Bitcoin exchange users appear to get comfortable as “Do Nothing December” sees BTC price volatility plunge to record lows. It now seems like the Bitcoin exchange users have forgotten about the FTX scandal this Christmas season, based on market data.

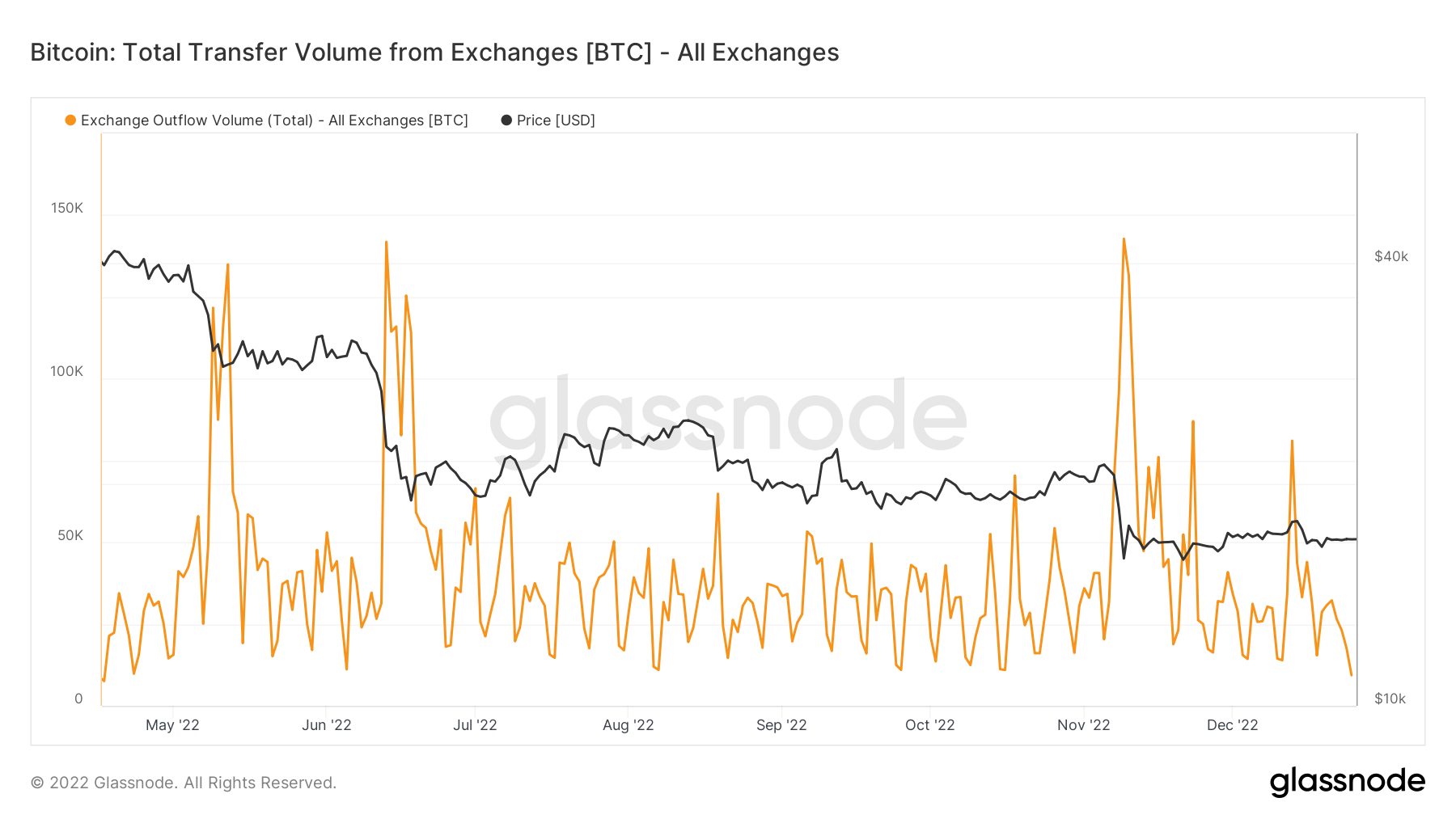

Looking at on-chain analytics firm Glassnode, exchange outflows appear to have hit their lowest levels in more than six months.

Still Not Your Coins Or Keys?

As Bitcoin volatility sets a new record low in what analysts and experts are calling “Do Nothing December,” exchange users’ habits are also quickly adjusting to the current climate.

After seeing an overwhelming increase in light of the FTX exchange collapse, BTC withdrawals from exchange wallets have fully reversed the spike that started nearly six weeks ago. Having reached a peak of 142,788 BTC on November 14, outflows from the trading platforms tracked by Glassnode have dropped more than ten times.

On December 25, the latest date for which numbers are available, total exchange outflows came in at just 9,352 BTC — a drop of 93.5%.

Apart from that, the last time that outflows were so low on a daily basis was seven months ago in May.

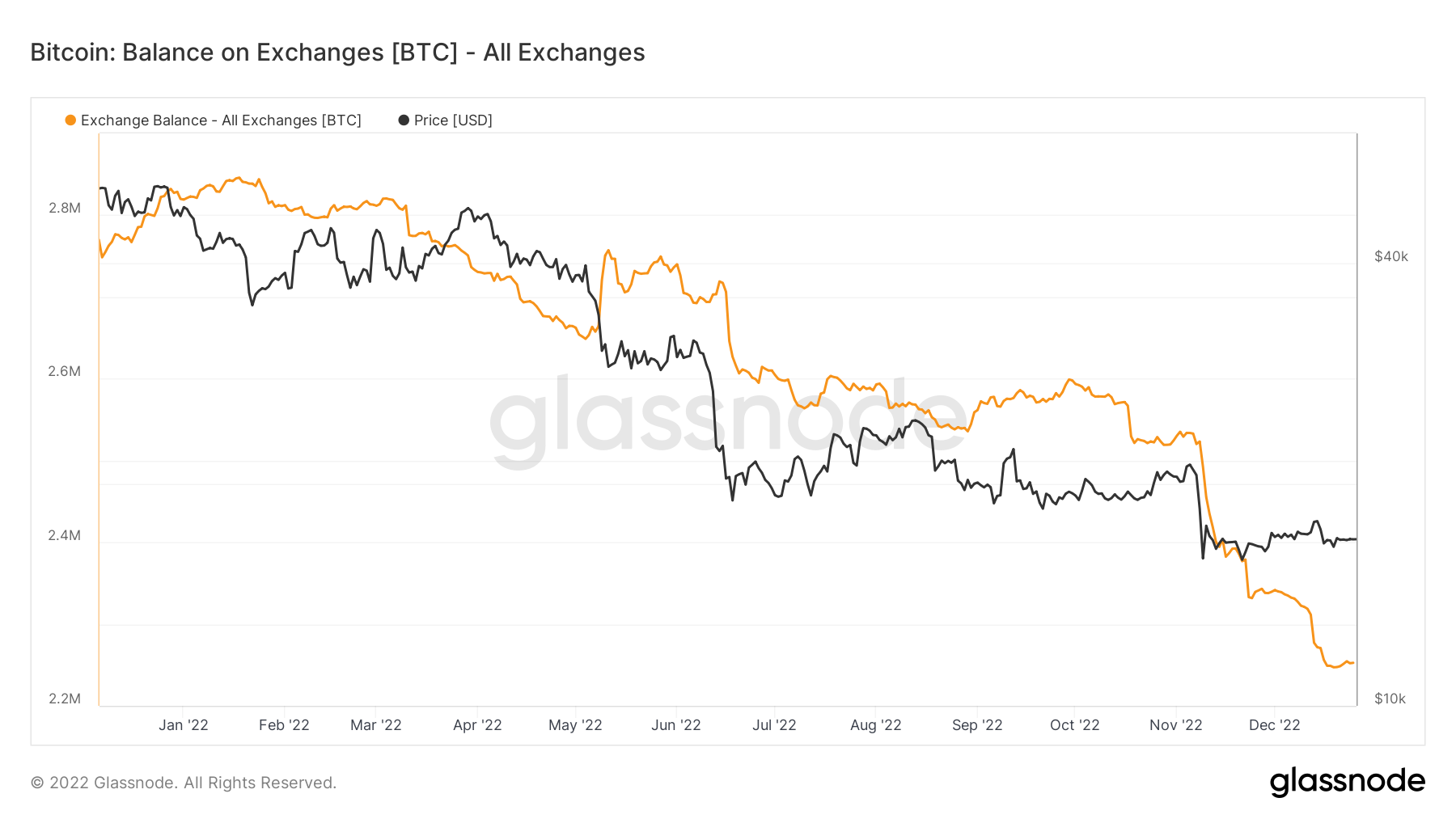

According to previous reports, in the immediate aftermath of FTX, exchange reserves dropped by more than $3 billion in one week.

Exchanges’ Bitcoin balance stood at 2.252 million BTC on Christmas Day, a plunge of almost 21% compared to the 2022 peak of 2.845 million BTC from January.

BTC Supply Massively Stationary

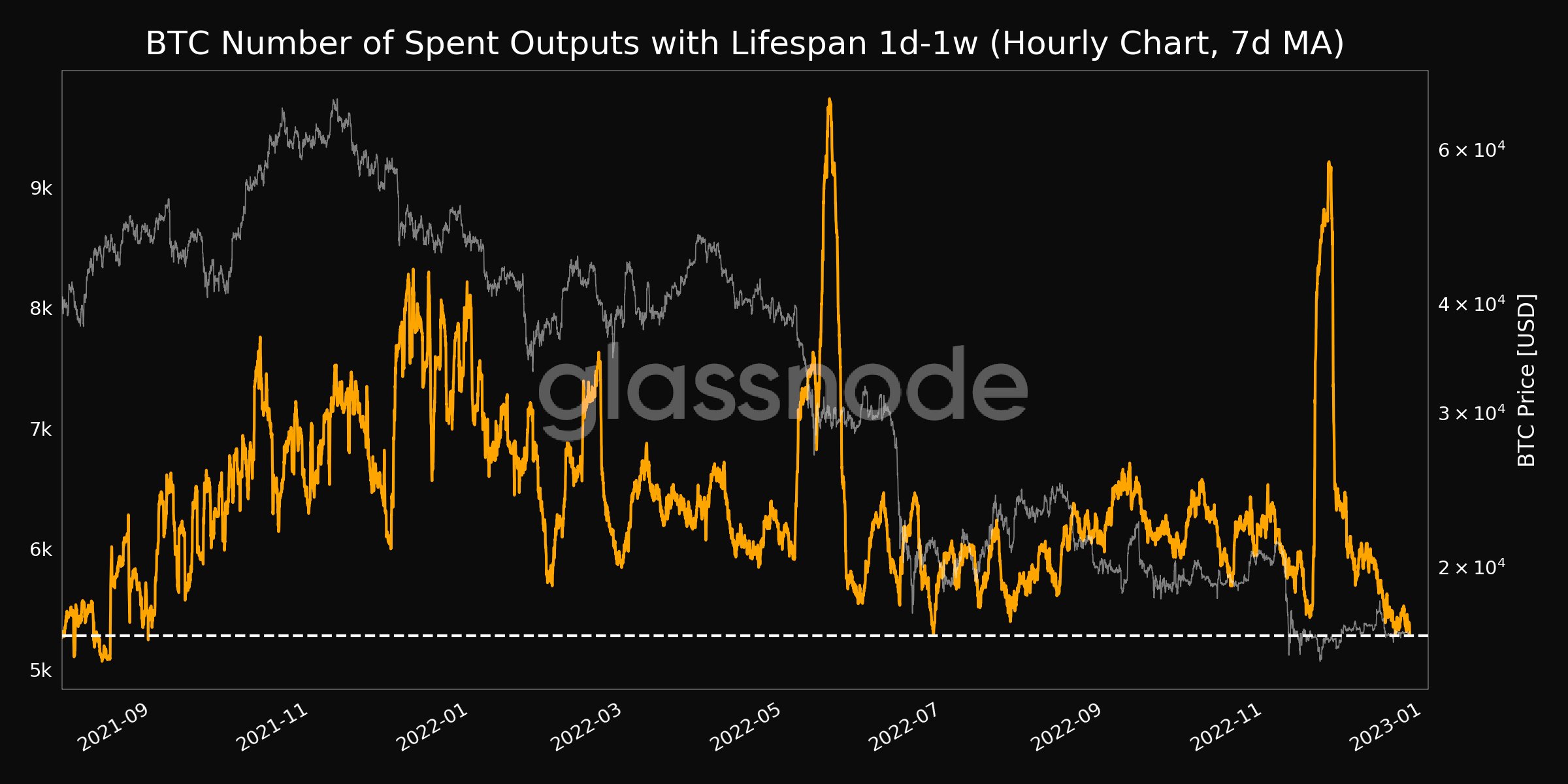

Record low volatility is in the meantime showing in on-chain data, with hodlers appearing reluctant or in little need of moving coins.

Glassnode confirms that the cumulative unspent transaction outputs (UTXOs) with a lifespan of one week to one month have plunged to their lowest in 15 months.

The popular HODL Waves metric, designed to group UTXOs by age, shows a surge in coins which last moved 1-2 years ago over the course of December.

These now account for more than 20% of the total BTC supply.

cryptovibes.com

cryptovibes.com