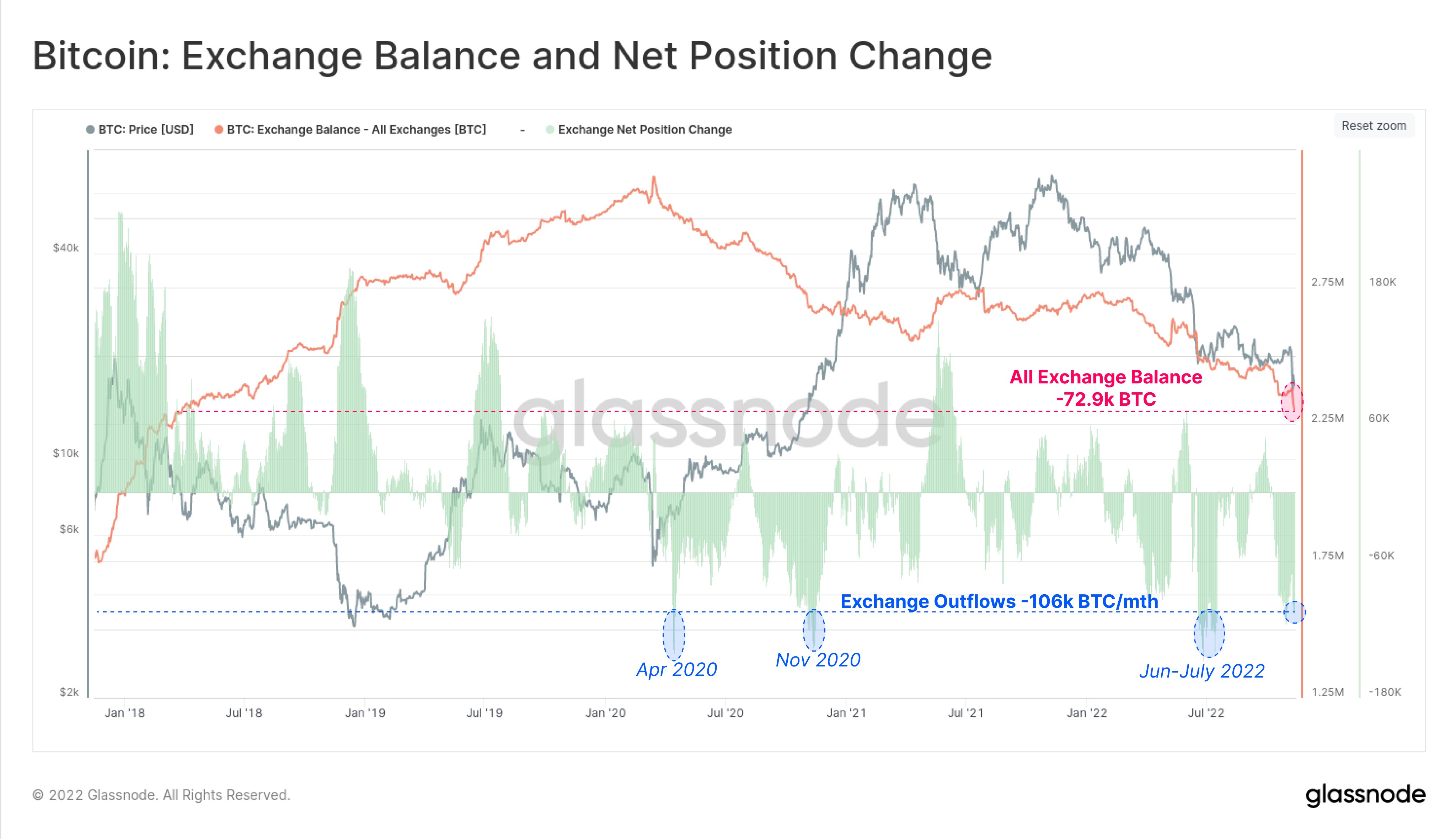

Leading analytics firm Glassnode says that Bitcoin ($BTC) holders are withdrawing from crypto exchanges at an astounding pace.

According to the insights platform, Bitcoin investors have taken it upon themselves to take custody of their $BTC troves after the implosion of crypto exchange FTX.

Glassnode says that crypto exchanges are now witnessing a massive exodus of Bitcoin at a rate of over $1.75 billion in $BTC per month.

“Following the collapse of FTX, Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106,000 $BTC/month.

This compares with only three other times:

– Apr 2020

– Nov 2020

– June-July 2022.”

With Bitcoin flying off of crypto exchanges, Glassnode notes that all wallet cohorts from shrimp to whales are seeing huge spikes in their $BTC balances.

“The failure of FTX has created a very distinct change in Bitcoin holder behavior across all cohorts.

The balance change has been dramatic across all cohorts since November 6th:

Shrimp [<1 $BTC] = +33,700 $BTC

Crab [1-10 $BTC] = +48,700 $BTC

Sharks [10-1,000 $BTC] = +78,000 $BTC

Whales [>1,000 $BTC] = +3,600 $BTC.”

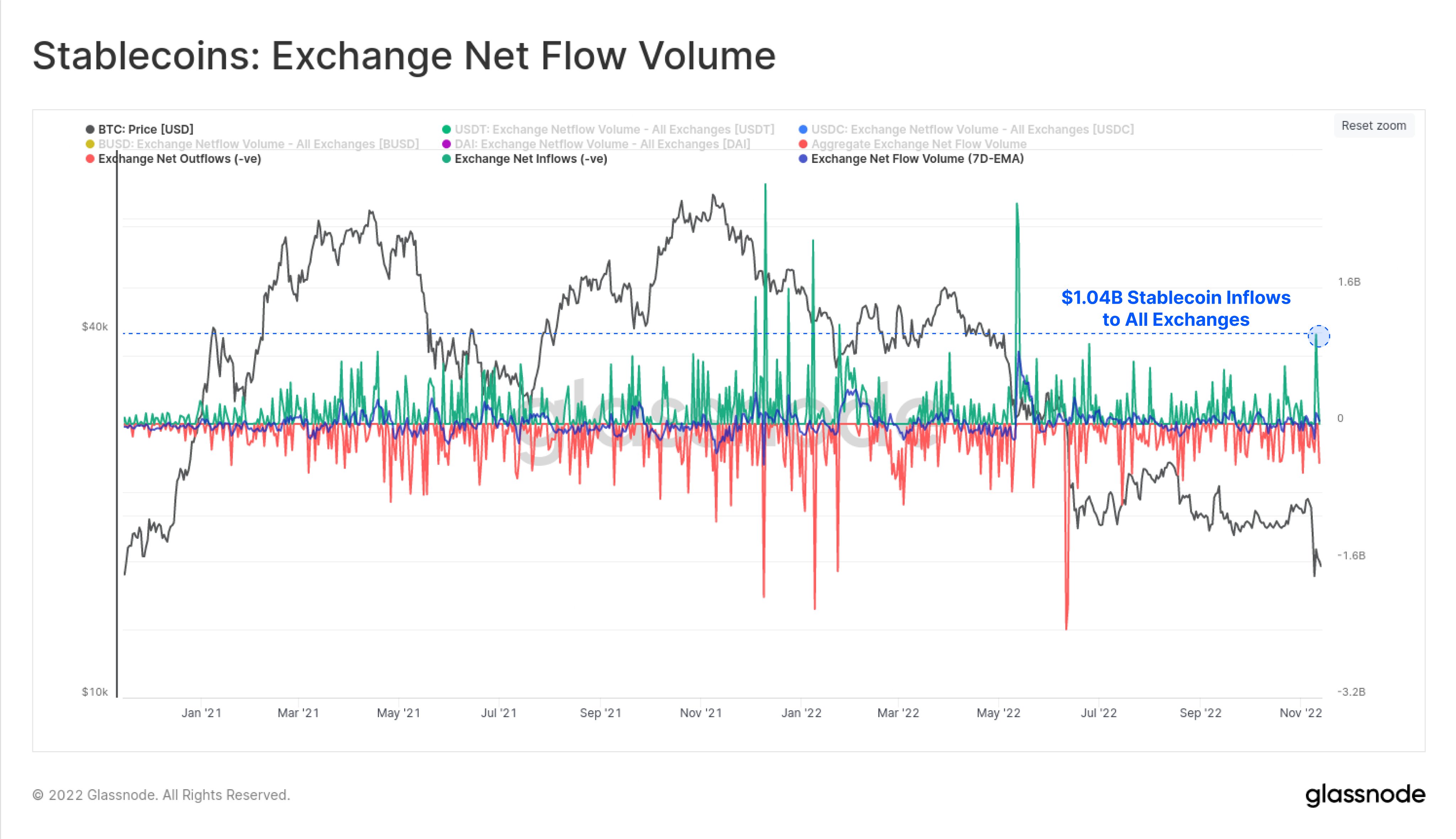

Looking at stablecoins, Glassnode highlights that traders flooded crypto exchanges with dollar-pegged crypto assets after the meltdown of FTX, suggesting that market participants are gearing up to buy the dip.

“This week also saw one of the most dramatic one-day inflows of stablecoins across all exchanges on November 10th. Over $1.04 billion worth of stablecoins flowed into exchanges following the collapse of FTX.”

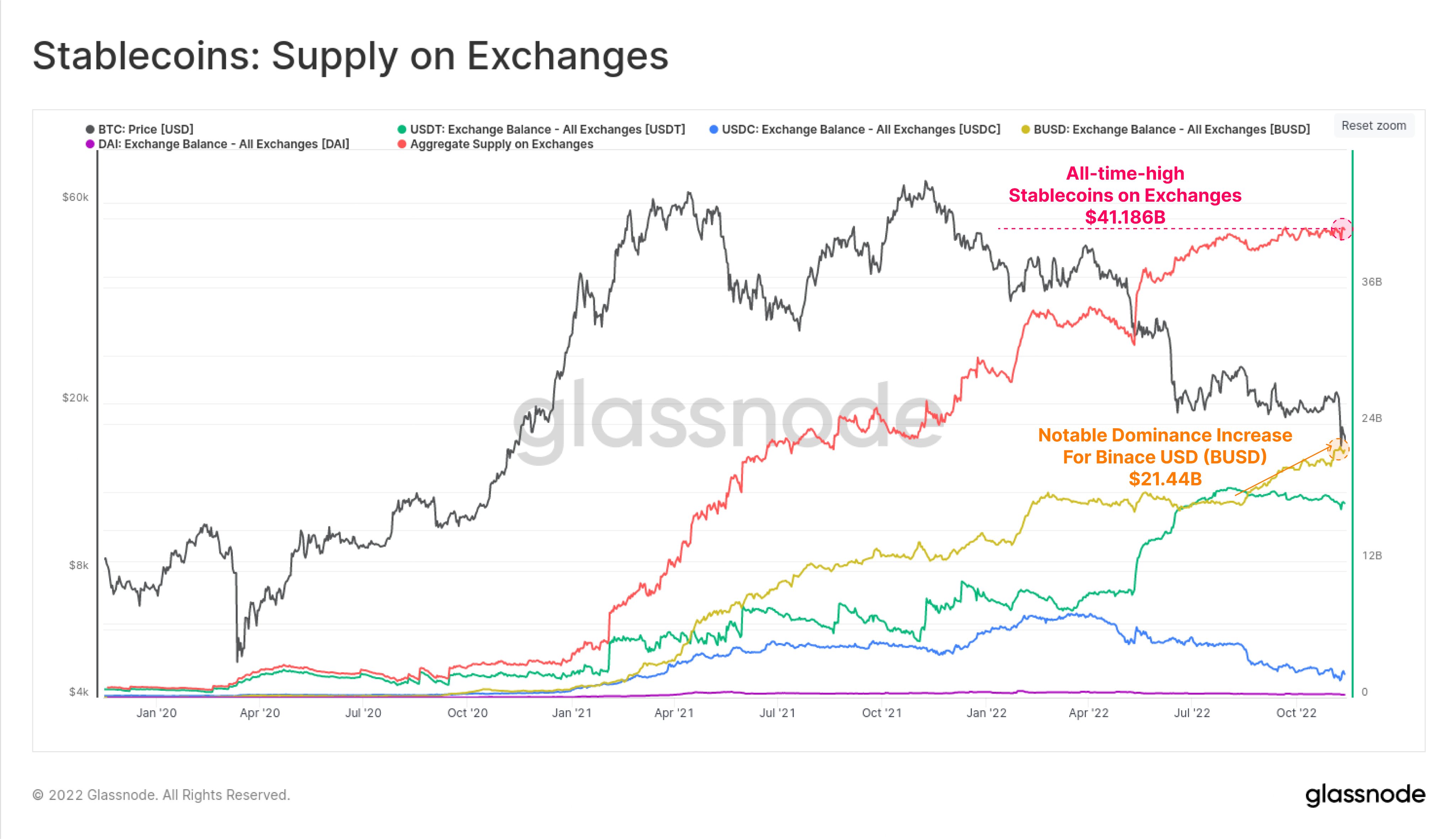

According to Glassnode, the abrupt change in trader behavior has pushed stablecoin reserves across crypto exchanges to a fresh all-time high of $41.18 billion.

Glassnode concludes,

“On net, there appears to be a transition in investor holdings.

– Stablecoins are flowing into exchanges

– Trustless assets like $BTC and ETH are flowing out

This leads to a net increase in stablecoin ‘buying power’ on exchanges of ~$4 billion per month.”

dailyhodl.com

dailyhodl.com