On Friday 27th August, around $2 billion worth of Bitcoin options are scheduled to expire, according to options data provider Skew. This has left analysts and investors questioning what this will mean for the crypto markets, especially after BTC briefly returned to $50,000 on August 23rd.

Bitcoin’s Latest Price Test

Friday will be an important turning point for Bitcoin, as approximately 25% of BTC open interest options are on track to expire. This makes up $2 billion worth of BTC, a number large enough to affect the entire market.

This is the most recent price test for Bitcoin. The majority of these options are calls, meaning they are contracts that allow a trader to buy an asset at an agreed-upon price at a certain date in the future. Traders make call options when they suspect the underlying asset to increase in price—a bullish tendency.

If Bitcoin manages to rise above $50,000 by that date, then around 12,000 calls will be filled, which would equate to a substantial amount of BTC being bought. There is also a small number of put options set to expire, which are contracts allowing traders to sell an asset if it reaches a certain price at a certain time. Put options are placed when a trader believes the asset will decrease in price.

While put options are bearish as they indicate people’s desire to leave the market, there are substantially more calls expiring on Friday, extinguishing some of the damage they could do. There are 2,500 put options set below $45,000 and just 35 set above $50,000.

For context, Bitcoin is currently at $48,800. If Bitcoin moves sideways and remains at this number by Friday, then around 6,500 calls will be triggered, as well as 1,300 puts. This means there are 5x more calls than puts, placing Bitcoin in a good position.

Options Data Suggests Bitcoin is in a Safe Place

Friday’s financial activity has the potential to significantly affect Bitcoin’s price, but considering the number of calls compared to the number of puts, it is fair to assume there will not be a significant disaster. This is more so a test to see how bullish Bitcoin is, rather than how bearish it is. The ratio of calls-to-puts makes this clear.

If Bitcoin successfully rises above $50,000, then there is no telling how high it will shoot. If those 12,000 calls expire on Friday, then the markets will see a substantial amount of BTC getting bought up nearly instantly, which could very easily trigger more buys from retail and institutional investors alike.

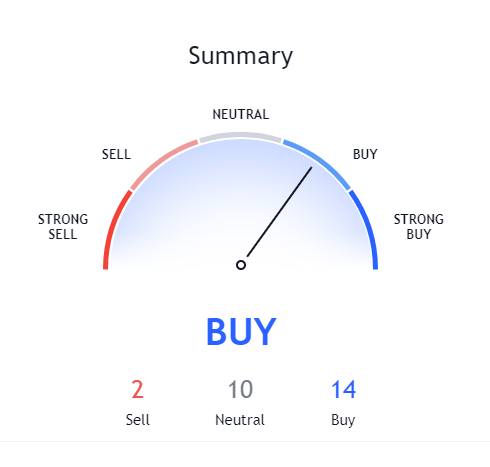

TradingView’s 1-day activity meter for BTC/USD reflects this by marking Bitcoin as a worthy asset to currently buy, rather than sell or stay neutral on. This is a positive sign for Friday.

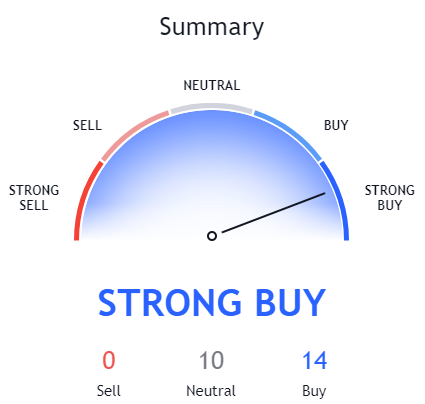

TradingView’s 1-month meter shows even better results. Over this span of time, Bitcoin is marked as a “strong buy”.

It is hard to say what exactly triggered so many options on this date, but one theory is that the Fed’s Jackson Hole symposium is scheduled for Thursday 26th. This is where institutional investors, central banks, and other prominent financial corporations congregate to discuss the current economic landscape.

Considering the recent wave of institutions using crypto to diversify their assets, it is fair to say Bitcoin will be discussed extensively here.

Even if Bitcoin does not return to $50,000, considering the number of calls set just below that point, this could still be good (or at least neutral) news. If Bitcoin does successfully hit this price, then it could have an effect on the crypto markets overall, potentially even reigniting a bull market.

What price do you think Bitcoin will be at by Friday 27th? Let us know in the comments below.

tokenist.com

tokenist.com