Opinion

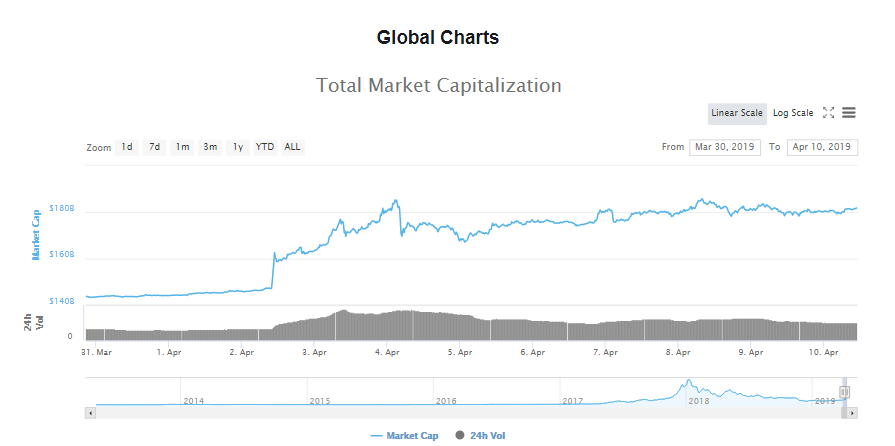

The recent spike in Bitcoin’s price caused a lot of frenzy in the cryptospace as it was much-needed in the face of the coin’s sideways price movement. This pump contributed to a huge influx of volume and money, causing the market cap of the cryptocurrency ecosystem to pump from $147 billion to $185 billion, which is a 25% increase. However, the market cap volume corrected itself and was at $181 billion, at press time.

Source: CoinMarketCap

Bitcoin pumped from $4,094 on 2 April, 2019 to $5,348 on 4 April, an increase of ~32% in 48 hours. The same effect was seen on the global market cap of cryptocurrencies as the 24-hour volume eventually increased from a mere $33.7 billion to $89.3 billion from 2-3 April, 2019.

Source: CoinMarketCap

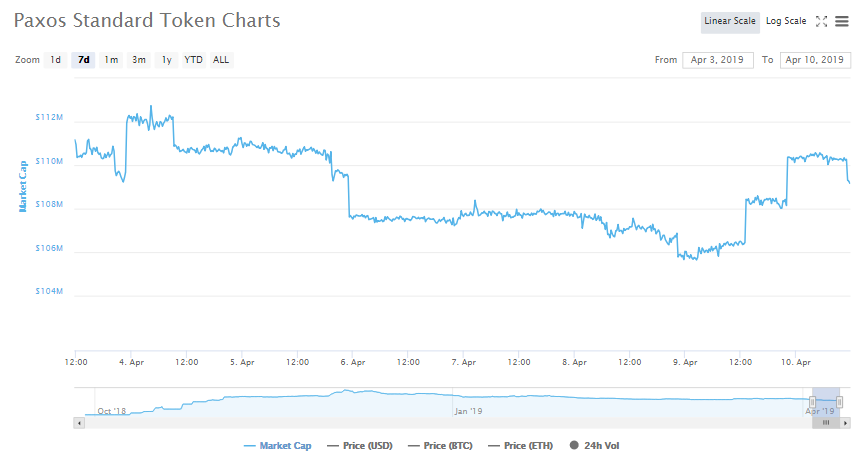

Interesting speculation of the after effects of Bitcoin’s pump can be seen in the market cap volume of stablecoins, especially, Tether [USDT], Paxos [PAX], and Circle’s USD Coin [USDC]. The attached charts show the increase in volume for stablecoins, surging massively from 8 April, 2019 to press time. The market cap of Tether, as seen in the above chart, rose from $2 billion to $2.2 billion, an addition of $200 million worth of Tether.

Source: CoinMarketCap

Further, the circulating supply of USDT increased from $2.02 billion to $2.195 billion, an addition of approximately 200 million USDT into the market.

Source: CoinMarketCap

The same trend was observed for Paxos and USD Coin as Paxos’ market cap increased from $105 million to $110 million, while that of USD Coin rose from $259 million to $266 million. The circulating supply of Paxos and USDC rose by approximately the same i.e., 5 million.

Although just a speculation, the sudden increase in stablecoin volume could be connected to the spike in Bitcoin’s price. Almost every altcoin pumps when Bitcoin pumps, going on to show the correlation and the dominance of Bitcoin over other altcoins. The sudden spike could be the cause of a lot of retail traders taking profits, and that is where stablecoins come into the picture.

The cryptocurrency community is speculating that this spike in stablecoins was caused by traders cashing out profits by converting their holdings into stablecoins and eventually, into fiat. Moreover, cashing out cryptocurrency profits for users on Coinbase via Circle’s USDC is more convenient since the exchange doesn’t charge any fees.

Additionally, some people speculated that this spike was caused by the influx of stablecoins into the crypto market, signifying the entry of more users into the cryptospace. Moreover, Diar’s volume 3, Issue 10, reports that institutional trading volume for Bitcoin grew in recent times.

Source: Diar

The research stated,

“Institutional products have now moved into growth for the 4th month in a row hitting new highs against US-based exchanges as a % of total trading volume. Currently, this is almost 8% more than when Bitcoin hit its price peak in December 2018.”

A Reddit user, Toyake, commented,

“One is legitimate, the other is a ticking time bomb. It should be telling that usdt is still able to pump out hundreds of millions of usdt while other stablecoins can’t even scrape together 10m. That’s the difference between fraud and legitimate stablecoins.”

ambcrypto.com

ambcrypto.com