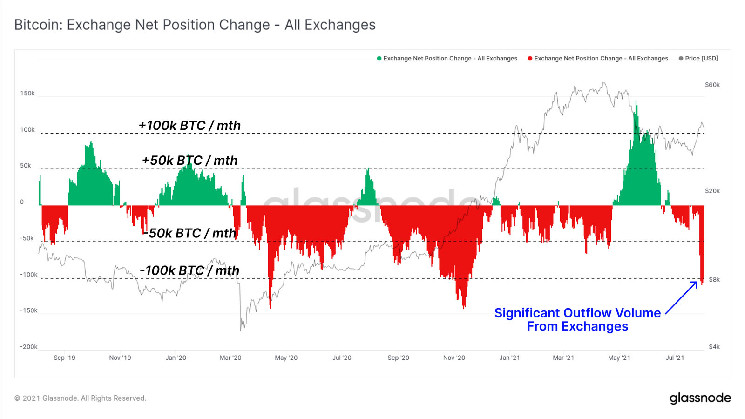

The latest market analysis conducted on the crypto markets confirms that Bitcoin outflows from centralized exchanges have exponentially surged to their highest level year-to-date, with roughly 40,000 BTC offloaded over the past seven days.

According to the Glassnode On-Chain report published on August 02, the growth rate for Bitcoin outflows rapidly accelerated to hit precedented highs above 100K BTC per month for the third time since 2019. On-chain data has estimated that only 13.2% of the initial circulating supply is currently held in crypto exchanges making a new record low for 2021. The report stated:

“This represents a near full retracement of the significant inflow volume observed during the May sell-off.”

The report further confirmed that Bitcoin outflows for the past four months have exponentially surged to roughly more than 150,000 BTC monthly following the violent “Black Thursday” that saw the entire crypto market tumbling more than 50% in less than two days.

The market crash appeared barely two days after the then United States President Donald Trump announced a travel ban between the U.S and Europe in March 2021 as the Covid-19 pandemic intensified.

Nonetheless, despite April’s aggressive market crash, Bitcoin had rebounded by 150% compared to the previous year, during its accumulation phase in March 2021.

The flagship cryptocurrency seemed to retest a similar market action in November 2021, where Bitcoin outflows surged to reach almost 150,000 BTC. At the time, Bitcoin rallied to break its then record high of $20,000 setting new all-time highs in the following months.

The Glassnode report notes divergent market trends between two giant crypto exchanges, Coinbase, and Binance, for most of this year. Coinbase has recorded significant outflows, while Binance has been the largest recipient of BTC in the same period.

In the same context, the report revealed that Binance reserves are now beginning to gradually reduce with 37,500 BTC (worth roughly 1.5 billion) offloaded from the exchange over the past week.

On the other hand, Coinbase balances remained relatively steady in June amid a continued panic sell-off. Despite the exchange receiving roughly 30,000 BTC in mid-July, more than 31,000 BTC has exited the firm over the past week.

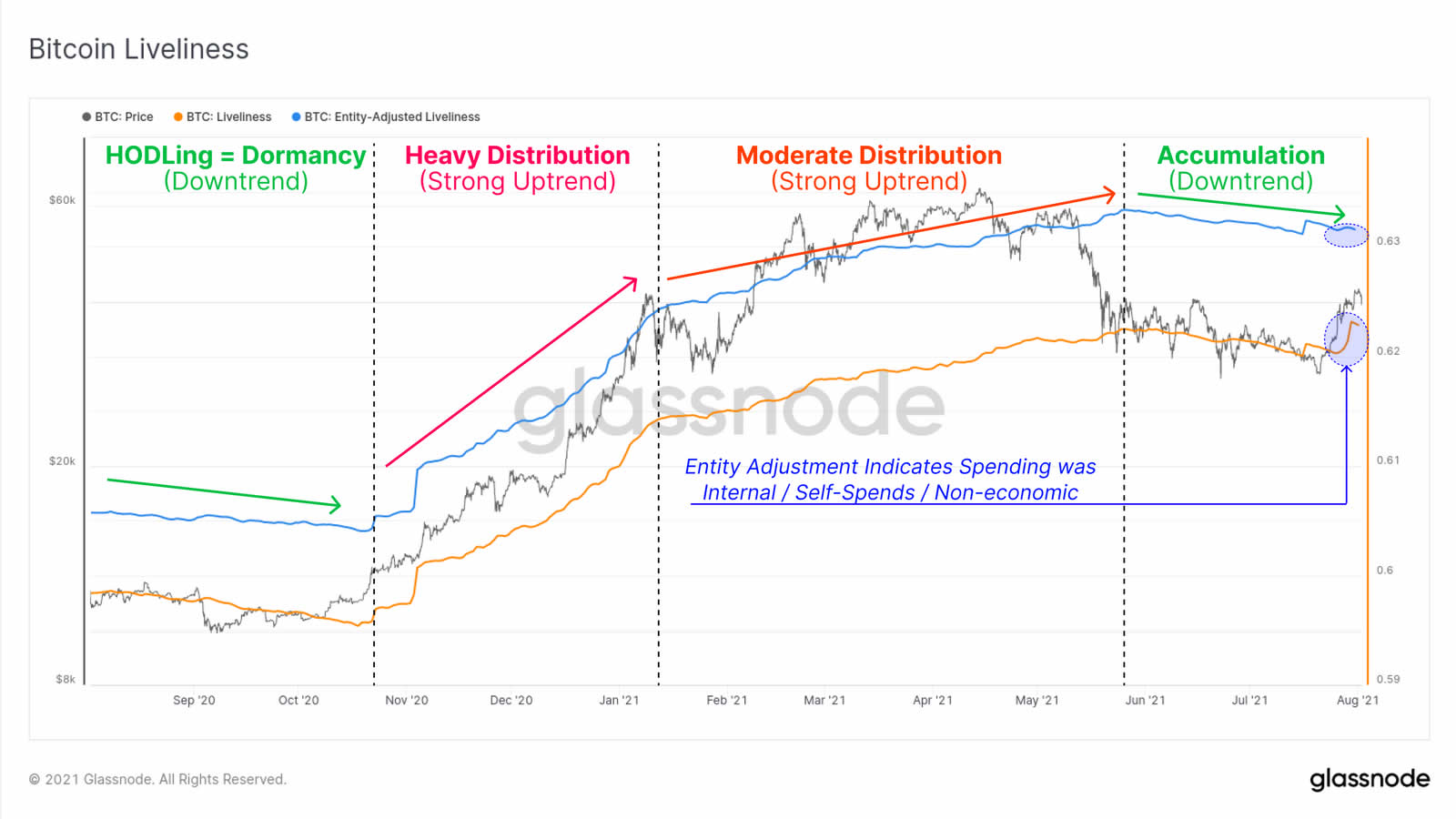

While issuing out a macro sentiment about the report, the On-Chain analytic provider dubbed the market action as “Liveliness Metric” to identify trends in accumulation.

The Liveliness Metric, which measures the ratio of the sum of coin days destroyed and the sum of all coin days ever created, confirmed that the market experienced a widespread accumulation trend amid May’s immediate panic sell-off. The report concluded by noting:

“It seems that HODLing and accumulation is the most likely dominant trend in the on-chain market.”

cryptovibes.com

cryptovibes.com