Amid a resurging bullish trend on the crypto markets in the last several weeks, more users seem to have moved into trading Bitcoin, the biggest crypto by market capitalization. The total amount of bitcoin held on addresses that store between 100 and 10,000 BTC increased to 9.23 million for the first time.

Data acquired from Glassnode, a blockchain analytics platform, reveal that Bitcoin has experienced a significant surge in terms of the active addresses in the final week of July. The active BTC entities gained 30% from 250,000 to about 325,000 active users.

Based on Glassnode’s 7-day exponential moving average statistics of the active Bitcoin entities, it is the largest surge recorded after the total number of active Bitcoin entities plunged by 41% from 425,000 in January this year to below 245,000 addresses in early July.

The current Bitcoin activity level seems to correspond to the levels that were maintained in July 2021, when Bitcoin was seen trading near $11,300, as highlighted by Glassnode. Alongside a considerable uptick in the active number of Bitcoin users, investors seem to have been accumulating huge amounts of crypto in late July.

#Bitcoin has seen a resurgence in Active Entities over the past week, rising by 30% from 250k to 325k active entities per day.

This degree of activity was sustained in July 2021 when $BTC prices were around $11.3k in Q2-2020.

Live Chart: https://t.co/jsxqAS9wdk pic.twitter.com/TWtrtLvneh

— glassnode (@glassnode) July 30, 2021

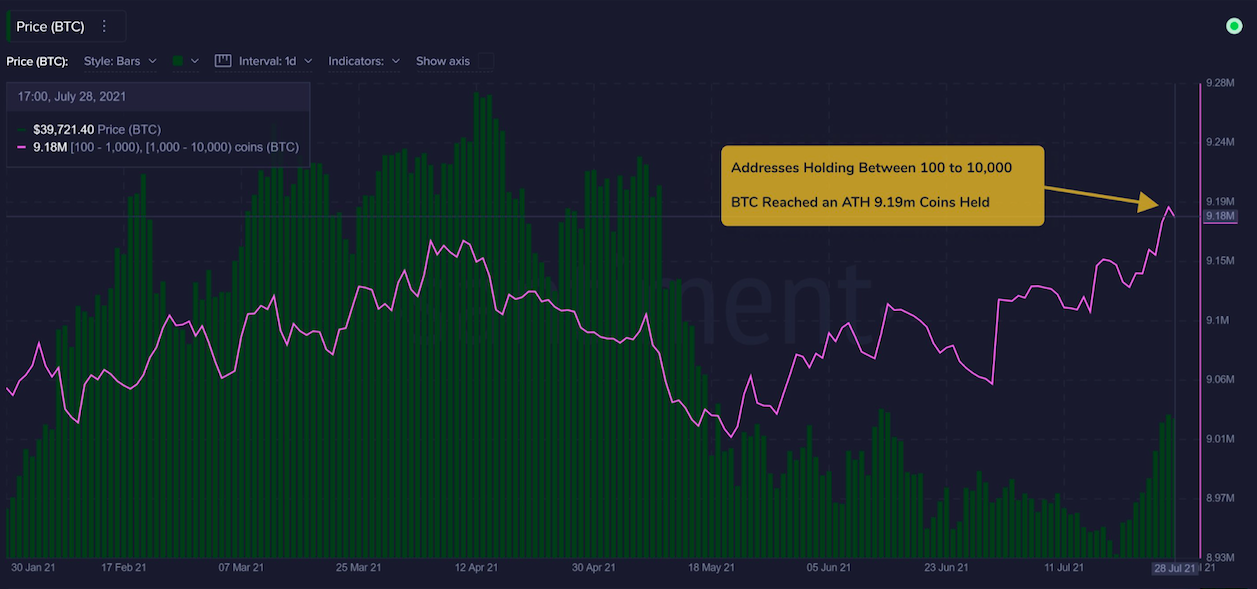

Based on data from Santiment analytics firm, the total amount of Bitcoin held on addresses that store 100-to-10,000 BTC hit 9.23 million Bitcoin ($364 billion) as of August 1, 2021. That amount is a new all-time high for this group of crypto investors. The previous all-time high happened on April 5, around a week before bitcoin exploded to reach its current all-time high above $64,000.

Santiment noted:

“In the last four weeks, these addresses have accumulated approximately 170,000 more BTC. This staggering pace was last matched in late December 2021, right before a massive bull run kicked off in 2021 where prices jumped from $29.0k to $40.8k in the year’s opening week.”

This growth in Bitcoin activity arises as the price of the crypto is slowly gaining momentum after Tesla CEO Elon Musk said that his other company, SpaceX owns bitcoin on July 22.

Musk also said that Tesla wanted to resume crypto payments for vehicle purchases, citing the growing percentage of renewable energy that is used for Bitcoin mining. The Tesla CEO is famous for contributing to BTC’s price crash earlier in the year, cutting BTC payments for Tesla in May as a result of the steep surge of fossil fuel usage for Bitcoin mining.

cryptovibes.com

cryptovibes.com