Bitcoin (BTC) price continues to battle at the $24,000 resistance and the price rejected there on Aug. 10, but the rejection was not enough to knock the price out of the 52-day-long ascending channel. The channel has a $22,500 support and this bullish formation suggests that BTC price will eventually hit the $29,000 level by early October.

Bitcoin derivatives data does show a lack of interest from leveraged longs (bulls), but at the same time, it does not price higher odds of a surprise crash. Curiously, the most recent Bitcoin downturn on Aug. 9 was accompanied by a negative performance from U.S.-listed stocks.

On Aug. 8, chip and video graphics card maker Nvidia Corp (NVDA) announced that its 2Q sales would present a 19% drop compared to the previous quarter. Moreover, the U.S. Senate passed a bill on Aug. 6 that could negatively impact corporate earnings. Despite freeing $430 billion to fund "climate, healthcare and tax," the provision would impose a 1% tax on the stock buyback by publicly traded companies.

The high correlation of traditional assets to cryptocurrencies remains a huge concern for some investors. Investors should not be getting ahead of themselves even if inflationary pressure cedes, because the U.S. FED monitors employment data very closely. The latest reading displayed a 3.5% unemployment typical of overly heated markets, forcing the monetary authority to keep raising interest rates and revoking stimulus debt purchase programs.

Reducing risk positions should be the norm until investors clearly indicate that the U.S. Central Bank is closer to easing the tighter monetary policies. That is precisely why crypto traders are following macroeconomic numbers so closely.

Currently, Bitcoin lacks the strength to break the $24,000 resistance, but traders should study derivatives to gauge professional investors' sentiment.

Bitcoin derivatives metrics are neutral-to-bearish

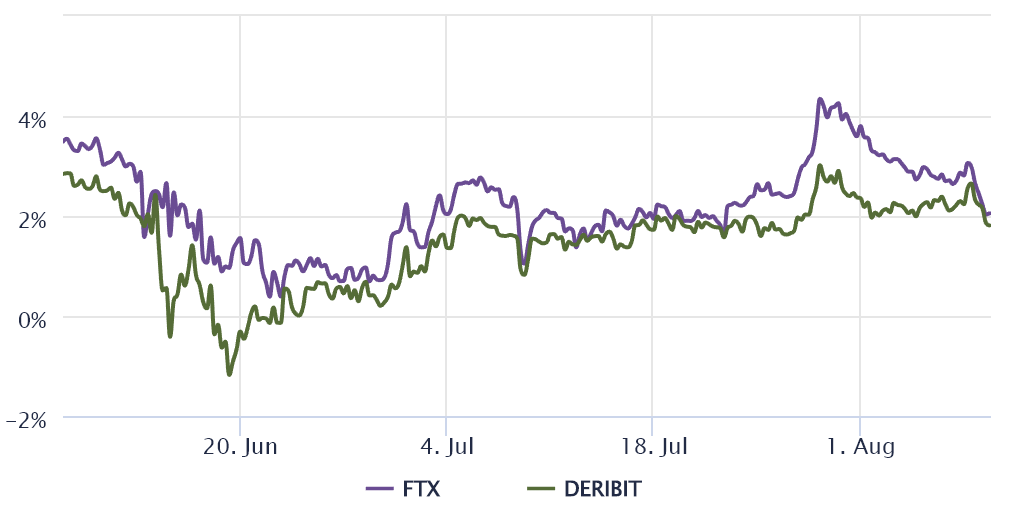

The Bitcoin futures annualized premium measures the difference between longer-term futures contracts and the current spot market levels. The indicator should run between 4% to 8% to compensate traders for "locking in" the money until the contract expiry. Thus, levels below 2% are extremely bearish, while the numbers above 10% indicate excessive optimism.

The above chart shows that this metric dipped below 4% on June 1, reflecting traders' lack of demand for leverage long (bull) positions. However, the present 2% reading is not particularly concerning, given that BTC is down 51% year-to-date.

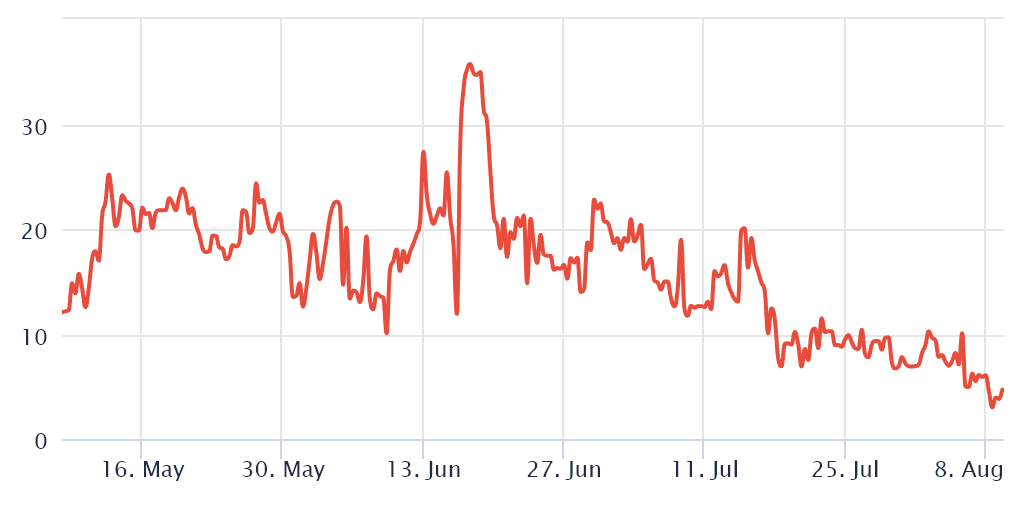

To exclude externalities specific to the futures instrument, traders must also analyze Bitcoin options markets. The 25% delta skew is a telling sign whenever arbitrage desks and market makers overcharge for upside or downside protection.

Related: Bitcoin price sees $24K, Ethereum hits 2-month high as US inflation shrinks

If those traders fear a Bitcoin price crash, the skew indicator will move above 12%. On the other hand, generalized excitement reflects a negative 12% skew.

Data shows that the skew indicator has been ranging between 3% and 5% since Aug. 5, which is deemed to be a neutral area. Options traders are no longer overcharging for downside protection, meaning they might lack excitement, but at least they have abandoned the "fear" sentiment seen in the last few months.

Considering Bitcoin's current ascending channel pattern, Bitcoin investors probably should not worry too much about the lack of buying demand according to futures market data.

Of course, there is healthy skepticism reflected in derivatives metrics, but the path to a $29,000 BTC price remains clear as long as inflation and employment statistics are under control.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision

cointelegraph.com

cointelegraph.com