After the cryptocurrency sector finally reclaimed the $1 trillion market capitalization, most of its projects are recording improvements across the board as well, including the TRON Protocol (TRX).

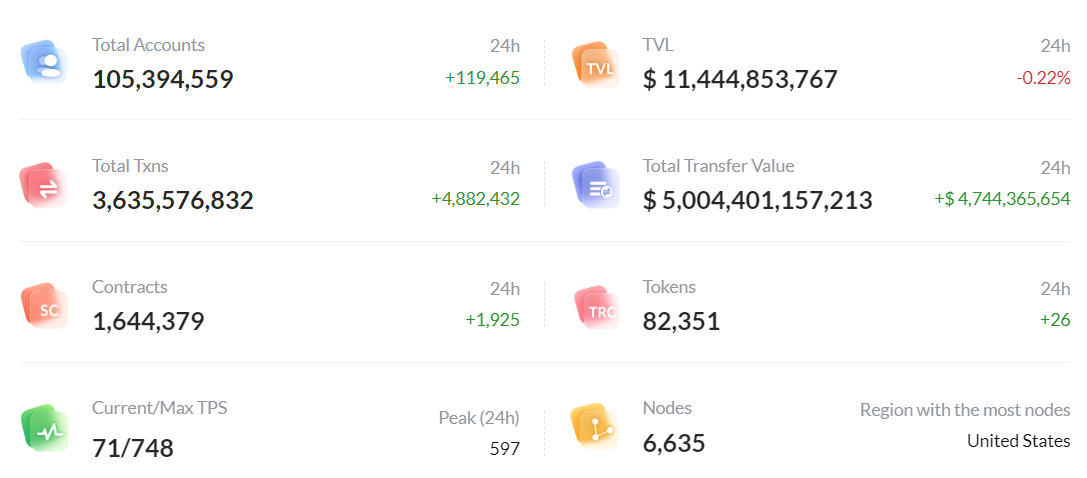

Specifically, TRON’s total transfer value has recently surpassed the $5 trillion mark, adding 105 million new accounts, and recording over 3.6 billion transactions on its blockchain, according to the data by TRONSCAN published on August 1.

On top of that, its total value locked (TVL) has surpassed $11 billion. As per a tweet by the TRON network explorer, these indicators make it “the 2nd largest public chain by stablecoin market cap & Top3 largest public chain by TVL.”

Expansion of the TRON ecosystem

One of the possible reasons to account for TRON’s growth is its announced partnership with WeFund, a multichain community crowdfunding incubator for blockchain and real-world projects, with the objective to gain more users in the DApp market and provide more use cases for TRON-based payments.

In early June, Finbold reported on TRON’s rapid advance which saw its TVL in decentralized finance (DeFi) increasing by 47% month-over-month (MoM) in May, making it the only blockchain to report positive results in the bearish market sentiment following the collapse of the Terraform Labs ecosystem.

By comparison, the TVL of Ethereum (ETH), the largest DeFi ecosystem, decreased by 35% MoM at the same time. Binance Coin (BNB), Polygon (MATIC), and Solana (SOL) also recorded losses ranging from 27% to 38%.

TRX price analysis

At press time, the price of TRON’s native cryptocurrency TRX stood at $0.06945, which is a 0.03% increase on the day, and a 6.06% gain across the previous seven days.

As things stand, TRX’s market cap is currently $6.42 billion, making it the 16th-largest crypto by this indicator, according to data retrieved from CoinMarketCap.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com