Neo price analysis is bearish today, with the cryptocurrency slipping below the $11.47 resistance level to reach a low of $11.31. The next few hours may see upward price movement as the bears take a breather, but any rallies are likely to be short-lived as the overall trend remains bearish. The NEO/USD pair has been downtrend for the last 24-hours and is currently trading near the $11.35 mark.

The NEO/USD pair is bearish today as the price reaches a low of $11.31, after failing to sustain above the $11.47 resistance level. The bears are in control of the market and are likely to push prices lower in the next few hours. The most recent attempt at a corrective rally occurred last week, but this too was sold into, leading to the current decline. The price has now broken below the $11.47 support level and looks likely to continue falling.

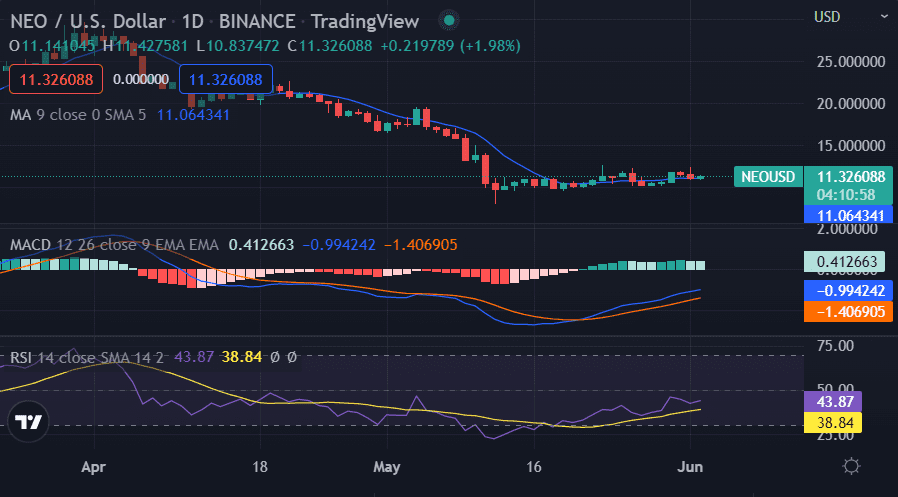

NEO price action on a daily price chart: Bears mount pressure as prices fall below $11.31

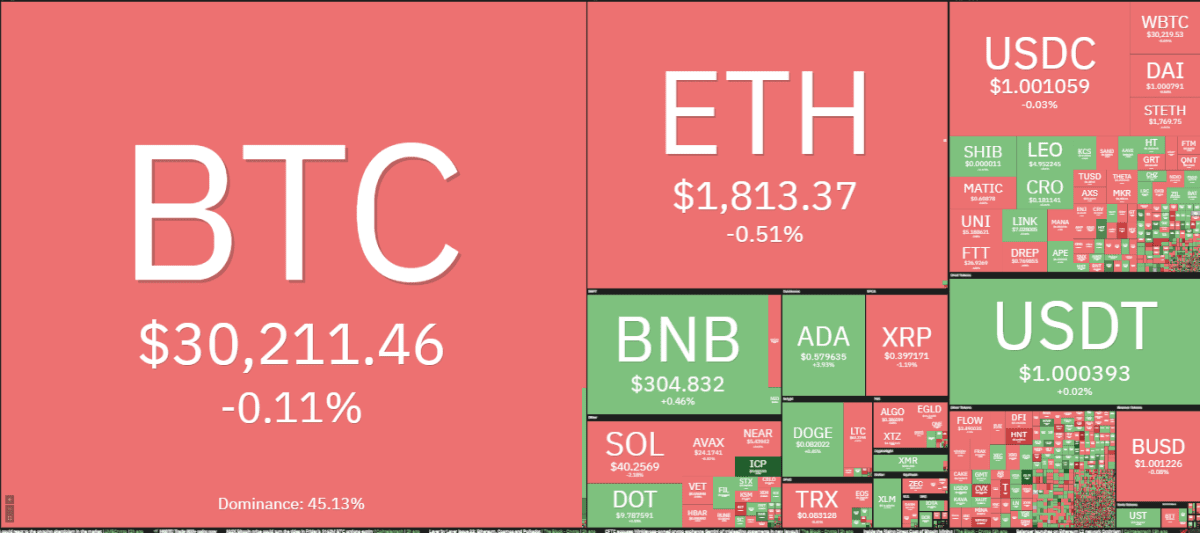

On a 1-day timeframe, the Neo price analysis is showing bearish today after prices slipped below the $11.47 resistance level to reach a low of $11.31. The bears have been in control of the market for the last 24-hours and are likely to push prices lower in the next few hours. The 24-hour market cap for the NEO/USD pair is currently at $813.6 million and the trading volume is at $536.4 million. The bulls may take control of the market if prices manage to sustain above the $11.47 resistance level. A breakout above this level could lead to a move higher towards the $12.00 resistance level. However, any rallies are likely to be short-lived as the overall trend remains bearish.

The Moving Average Convergence Divergence (MACD) on the 1-day timeframe is bearish as the signal line (blue) is above the MACD line (red). This indicates that the bears are in control of the market. The Relative Strength Index (RSI) is currently at 46.7 and is neutral, indicating that neither the bulls nor the bears are in control of the market at this time. The MA 50 and the MA 200 are both bearish as they are both below the current market price. This indicates that the bears are in control of the market.

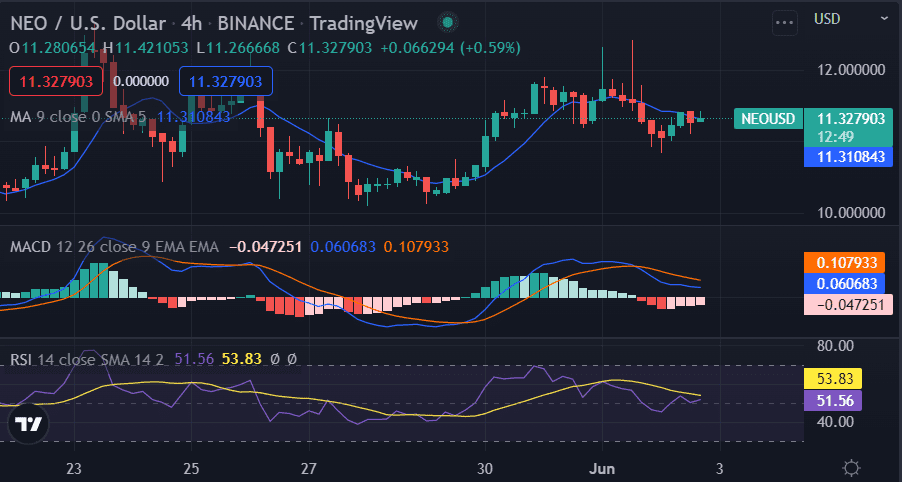

NEO/USD 4-hour price analysis: Resistance at $11.47 is currently limiting upward momentum

The 4-hour timeframe for the Neo price analysis shows that the bears have been in control of the market for the last few hours. The price is currently trading below the $11.47 resistance level and looks likely to continue falling. The NEO/USD price appears to be crossing under the curve of the Moving Average, signifying a bearish movement.

The market trend has recently entered bearish territory in the last couple of hours. Since the market volatility appears to be following a downward direction, the trend will likely have less room to move towards either extreme. It seems the bearish era might stay for a long time. However, that depends on whether the price will break the support or not. The MACD indicator is bearish on the 4-hour as the signal line (blue) is above the red line. This indicates that the bears are in control of the market. The RSI is below the 50 levels and is currently at 42.2, indicating that the bears are in control of the market.

Neo price analysis conclusion

The conclusion of the NEO price analysis shows that the recognition made of the current behavior of the cryptocurrency indicates that it is following an uncertain downward trend with the possibility of maintaining its energy and keeping the market. NEO/USD climbed with fatigue at the end of last week’s trading and has since been in a state of decline.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com