With no end to the cryptocurrency price seesaw in sight, the war, inflation, and shifting monetary policy in the U.S. will likely continue to drive more volatility in the coming weeks and months, experts say. With LUNA crashing, speculations were ripe on Bitcoin soon being banned in places where it had already gained some form of acceptance.

Launched over ten years ago in 2009, Bitcoin is a virtual currency powered by blockchain technology. Satoshi Nakamoto created the coin to overcome the shortcomings of government-issued currencies without requiring a controlling authority. Bitcoin acts as a store of value and a payment method for any transaction process in the markets.

The round table discussion of 7 blockchain experts ended with their 2022 Bitcoin predictions. O.J. Jordan sees a peak of $120k this year, while Nikolai Shkilev predicts $100k. Hans Koning quickly pointed out that speculators for both extreme ends of the price fluctuations between $20k and $1 million exist, but the actual value will lie somewhere. Ultimately, many intriguing trends are evolving as we watch, and they are far more interesting to observe than the Bitcoin price.

Bitcoin’s price jumped back up above $30,000 last Thursday (19 May 2022), a near 3.5% increase. The leading crypto has been fluctuating near the $30,000 mark over the past week as both traditional financial markets and cryptocurrencies struggle to regain upward momentum. Will Bitcoin survive the onslaughts of criticism and regulations? Let’s do some critical thinking while we review historical Bitcoin price predictions.

Today’s Bitcoin price is $30,149.24 with a 24-hour trading volume of $22,170,531,432. Bitcoin is up 2.30% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $574,247,060,245 USD. It has a circulating supply of 19,046,818 BTC coins and a max. supply of 21,000,000 BTC coins.

Bitcoin Price Overview

According to expectations, BTC prices could rise and hit as much as millions. This rise could happen eventually as, only during February, the price change of one BTC increased by more than 70 percent leading to its all-time high. You might recall that the Bitcoin price reached a new all-time high of $50,000. Bitcoin is back above $60,000 as Coinbase gets ready to go public on the stock market. The all-time high price of $64,800 was reached on 14 April 2021.

According to analysts, the cryptocurrency industry saw a massive surge in investment and crypto for payments and trading this year.

Central banks from all over the world have been trying to push regulations for Bitcoin investment. The Bitcoin network has become quite popular with teens, youth, and adults, including women, as they indulge in Bitcoin trading.

This year has been crucial for Bitcoin and cryptocurrencies in general, wherein countries like El Salvador, China, and South Korea have played significant roles. Recently, we saw that the news of the China ban led to a massive drop in the price of Bitcoin. Bitcoin dropped from 53K USD to $42K, which scared everyone returning it.

Bitcoin Overview

| Coin | Symbol | Price | Marketcap | Change | Last 24h | Supply | Volume (24h) |

|---|---|---|---|---|---|---|---|

Bitcoin

BTC

|

BTC | $ 30,233.00 | $ 575.87 B | 2.35% | 19.05 M | $ 17.71 B |

Bitcoin Network & Signals

What is Bitcoin?

Launched over thirteen years ago in 2009, Bitcoin is a decentralized virtual currency powered by blockchain technology. Satoshi Nakamoto created the coin to overcome the shortcomings of government-issued currencies without requiring a controlling authority.

Bitcoin (BTC) was created out of the need for a cryptography-based e-payment system rather than the conventional trust-based system. The cryptocurrency acts as a store of value and a payment method for any transaction process in the crypto space. It is often dubbed “digital gold.”

Bitcoin’s cryptography is based on an algorithm (SHA-256) designed by the United States National Security Agency. This algorithm makes it impossible to crack the Bitcoin network.

Since the launch of Bitcoin in 2009, its value has risen dramatically, from less than 0.01 USD in May 2010 to over 65,000 USD in November 2021. Bitcoin is expected to attain newer feats in the coming years as more institutional investors and traders continue to turn to cryptocurrency.

What Influences Bitcoin’s Price?

Several factors are responsible for the price movement of cryptocurrencies. These price-determining factors include demand and supply, investor sentiments, availability, economic cycles, adoption rate, functionality, regulations, news, etc. Although Bitcoin is a mainstream digital currency, its price movement is also subject to these factors, as with other currencies.

24 February 2022 sell-off was sparked by Russia’s invasion of Ukraine, which also saw global stocks fall sharply. Bitcoin has been correlated with other risk assets like stocks for several months. More institutional investors get involved, and short-term investors who trade bitcoin like other risk equities have entered the market.

In 2021, the crypto industry saw a massive investment surge, with Bitcoin, Ethereum, and several altcoins hitting their all-time highs. Also, in the same year, Central banks from all over the world tried to push regulations for Bitcoin investment. There were severe clampdowns on cryptocurrency-related activities in some other countries, especially in China, with trading and mining outrightly prohibited. These pronouncements by the Chinese government dealt a blow to the market valuation of Bitcoin, and massive sell-offs became rampant due to fear of the unknown. In addition, the news of the Chinese ban led to an enormous drop in the price of Bitcoin, with the crypto losing over 50% of its value between April and August 2021.

In the clampdowns, El Salvador played a significant role in the continuous adoption of Bitcoin, as the country remains the only one to have declared the asset a legal tender. By October 2021, Bitcoin regained massive momentum by reaching $67,700 from $40,693, just after another round of crackdown in September by the Chinese government. Bitcoin hit its current all-time high at $68,789.63 on 11 November, after investors’ attention turned to the cryptocurrency again.

The cryptocurrency market, in general, has faced heightened uncertainties in the past month, with crypto investors selling off their assets. Consequently, Bitcoin dipped by about 50% from its current all-time high, affirming the effect of investor sentiments, news, demand, supply, etc.

Key Bitcoin moments to note

The development of Bitcoin is the first successful application of Blockchain technology for digital currency and payment infrastructure. As Bitcoin (BTC) enters its 13th year, it has garnered widespread adoption amidst stringent government regulations and uncertainty. Here are some of the critical bitcoin moments to note.

- European Endorsement

Although Bitcoin was birthed in the US, it was quickly embraced in Europe. In 2011, Bitcoin Central, a French-based cryptocurrency exchange, became the first platform to earn a license under EU regulations. Bitcoin Central subsequently provided customers with a maximum balance of 100,000 EUR and debit cards to access Bitcoin (BTC) balances. In 2014, Finland and Belgium declared a VAT exemption for crypto trades to encourage their adoption. Also, in 2017, Falcon, a Swiss-based private bank, became the first financial institution to sell BTC directly to customers.

- Time Magazine 2011

In April 2011, Bitcoin was featured in a Time Magazine article titled “Online Cash Bitcoin Could Challenge Governments, Bank.” This piece examined the potential of BTC, its use cases, the revolutionary concept of the Blockchain, and government barriers. In addition, the article, alongside others from Time Magazine, gave the cryptocurrency some mainstream media endorsement.

- University of Nicosia Accepts Bitcoin

In November 2013, the University of Nicosia started accepting BTC payments for tuition to ease the transmission of particular students. The CFO of the university, Dr. Vlachos Christos, was a proponent of cryptocurrencies. He wanted the institution to be one of the first to learn about blockchain technology. He also argued that the adoption of Bitcoin will aid the spread of financial services around the world while also creating a more efficient system.

- The Price Boom of 2013

In September 2013, Bitcoin’s (BTC) market value skyrocketed by over 780% due to progressive media coverage, crypto expansion in China, and the entrance of bullish investors. The rapid boom was soon cut short by negative publicity resulting from the collapse of a leading Chinese exchange (Mt.Gox), numerous cryptocurrency hackings, and the closure of illegal marketplaces. By April 2014, BTC had fallen below 400 USD, and by January of the following year, it had bottomed to less than $200.

Regardless, the Bitcoin boom of 2013 showcased the price potential of the coin, and by 2017 the optimism around the digital asset became evident as its price rose to about $20,000.

- Microsoft Adoption

2014 brought more mainstream adoption for Bitcoin as Microsoft jumped on the crypto bandwagon. By December 2014, the mega-corporation struck a partnership deal with BitPay and began accepting Bitcoin payments for digital purchases. Microsoft also offered the ‘Redeem Bitcoin’ feature that allowed customers to add BTC to their accounts.

- Banks and Institutional Adoption of 2015

Without a doubt, Bitcoin had enjoyed much success up to 2015. The perspective of banks, the government, and other financial institutions changed, and they began investing and researching the technology. In May of the same year, NASDAQ – an American stock exchange, began utilizing blockchain technology for transactions. JPMorganChase, Goldman Sachs, the BOA, and other banks soon followed suit in September 2015.

By March 2016, ICAP – a leading market broker – became the first institution to utilize Blockchain for data distribution. The coming months also saw Santander – a leading British bank – adopt the Blockchain to keep global payments records. The United States government was also not left behind. By 2017, they began investing in tech for healthcare data protection. Dubai also declared its intention to have all government transactions powered by the Blockchain.

- The 2017 Price Surge

2017 was a significant year for Bitcoin. The crypto started the year at just about 1000 USD and closed out at almost 20000 USD. This massive price leap saw the coin forcefully dash out of obscurity into the limelight.

The boom led to new investors joining the moving train, and news outlets began spewing controversies and unverifiable facts under the euphoria of the recent phenomenon. Despite the boom, some investors were burned by the volatility of the cryptocurrency. However, the point was established – Bitcoin’s potentials are endless.

- Adoption by El Salvador

In June 2021, El Salvador became the first country to adopt BTC as a legal tender, while China once again caused a stir in the market by shutting off mines. The President of El Salvador, known for his passion for virtual currency, gave the green light to any store that wanted to accept payment in the form of cryptocurrencies. The increase in payments using Bitcoin as a store of value and the involvement of partners have all helped El Salvador. Analysts say that the demand for Bitcoin and its large-scale adoption will boost economies.

💥 New #Bitcoin ATM installed in El Salvador’s Bitcoin Beach 👍 pic.twitter.com/fSuRDtoNMv

— BITCOIN EXPERT INDIA By Pankaj Tanwar (@Btcexpertindia) March 6, 2022

Also, the establishment of Bitcoin mines in El Salvador was viewed internationally as a bold move owing to environmental concerns. But the President had a solution for that as well. He claimed the country would be harnessing volcanic energy to mine BTC. Bitfury founder George Kikvadze applauded the move by the President of El Salvador and claimed it could potentially be the most lucrative project for the entire country and Central America.

- Bitcoin and Social Media

In July 2021, Jack Dorsey provided hints about the platform’s potential Bitcoin integration. He also mentioned that the company was keen on integrating with Bitcoin payment systems to facilitate value transfer across the micro-blogging platform. The introduction of Twitter’s Tip Jar is just a peek into the future. Twitter is not the only social media platform keen on Bitcoin integrations; Meta’s Instagram also explores the technology.

- The Late 2021 Boom

The latter part of 2021 saw Bitcoin hit a new all-time high at over 68000 USD per coin after touching above 63000 USD some months before. This significant price movement of 2021 was primarily due to increased adoption and the activities of retail and institutional investors.

Bitcoin Challenges

Despite its success to date, Bitcoin has faced several criticisms, most especially its energy-hungry mining system. According to an energy consumption tracker developed by the University of Cambridge, Bitcoin mining was estimated to consume 100 TWh per year, about one-third of the UK’s total energy consumption in 2016.

In addition, BTC’s criminality potential has positioned it for more scrutiny, as it has facilitated numerous dark web dealings, such as the acquisition of illegal weapons, money laundering, etc.

The most significant and long-standing challenge of Bitcoin is scalability. Bitcoin’s underlying technology limits its performance in terms of transaction completion timeframe, with an insufficient capacity of 3-7 TPS. As more transactions are initiated on the network, processing delays will surface. Several proposals have been put forward to nip this concern in the bud, but a favorable long-term fix remains unclear.

Bitcoin Price Overview

For the first time since the July 2021 massive crypto sell-offs, Bitcoin has dipped below the USD 30,000 mark. With the current series of events in the market, especially the collapse of LUNA and TerraUST that dragged BTC along, traders and investors alike have been forced to dump their positions.

At the time of writing, Bitcoin is trading at $29,534.48, a loss in value of about 57% from its current ATH of $68,789.63. The 24-hour trading range of Bitcoin is $28.79k to $29.58k. Its 24-hour trading volume has slumped by 32%. It remains to be seen where the market goes from here and if this is the right time to invest in Bitcoin long–term or sell short for profits.

- BTC breached $40k and $42k,

On 9 March 2022, Bitcoin cleared some significant obstacles that investors were hopeful for when it rallied by 10.84%. Bitcoin was trading at $38,031 yesterday and is now trading at $42,155. In these 24 hours, BTC breached $40k and $42k, which have been vital support and resistance levels.

Although the Parabolic SAR’s white dots indicate a downtrend, they will soon change their position to move underneath the candle and indicate an uptrend. This is backed by the rising bullishness of the MACD indicator, which is preparing for a bullish crossover.

Bitcoin, the earliest utilization of blockchain technology, has received massive acceptance and paved the way for other projects like Ethereum. In addition, Bitcoin has provided investors with considerable gains to date, but what does the future hold? This piece provides an in-depth opinion on BTC, its price history, Bitcoin price analysis, key moments, prospects, and price predictions.

#Bitcoin is showing the power of decentralized money – Forbes

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) March 7, 2022

Technical Analysis of Bitcoin

Bitcoin has had a strongly bearish price movement in the past weeks and, at some point, consolidated between the $30k to $34k range. Currently, BTC looks weak, and unless it breaks past the $30,500 resistance, we might see further downsides in the coming days.

A further decline in Bitcoin’s price could be positive for traders selling short.

Here are some predictions for the Bitcoin price that we think could happen. These predictions are not investment advice, so please invest at your own risk.

Bitcoin Price Predictions 2022-2030

Wallet Investor

The short-term Bitcoin price prediction from Wallet Investor is bearish, with further price dips to about $20,834 expected in June 2022. However, their long-term price prognosis presents an optimistic outlook for BTC. By 2023, their BTC price prediction puts the coin’s value above $49,000. Their 5-year forecast is bullish, and the Bitcoin market price is expected to be trading at over $127,000.

TradingBeasts

TradingBeasts predicts that Bitcoin will see out 2022 with a maximum price of about $36,000, a minimum price of $25,000, and an average market value of $29500. A bearish signal is predicted for 2023 – they expect a price fall of about -15.33%.

Further price declines are expected in 2024, and BTC may be set to hit higher lows of $17,600. By the end of 2024, the team’s Bitcoin price prediction is set at a maximum value of $38,581, a minimum level of $26,235, and an average price of $30,865. Bitcoin is expected to recover in 2025, and the forecasted trading range is $27,151 to $52,163.

PricePrediction

According to the deep AI-assisted technical analysis on BTC from PricePrediction, the coin is expected to recapture the $40,000 mark to reach a maximum level of $41,180 by 2022. By 2024, they predict that Bitcoin will get a peak price of $64,734, a minimum fee of $53,038, and an average trading price of $54,570.

They also predict that the bullish run will continue in 2024 and 2025, with BTC expected to reach new all-time highs. The forecasted maximum prices within these periods are $91,629 and $137,071. By 2030, the PricePrediction team expects a possible price jump of over 3000%.

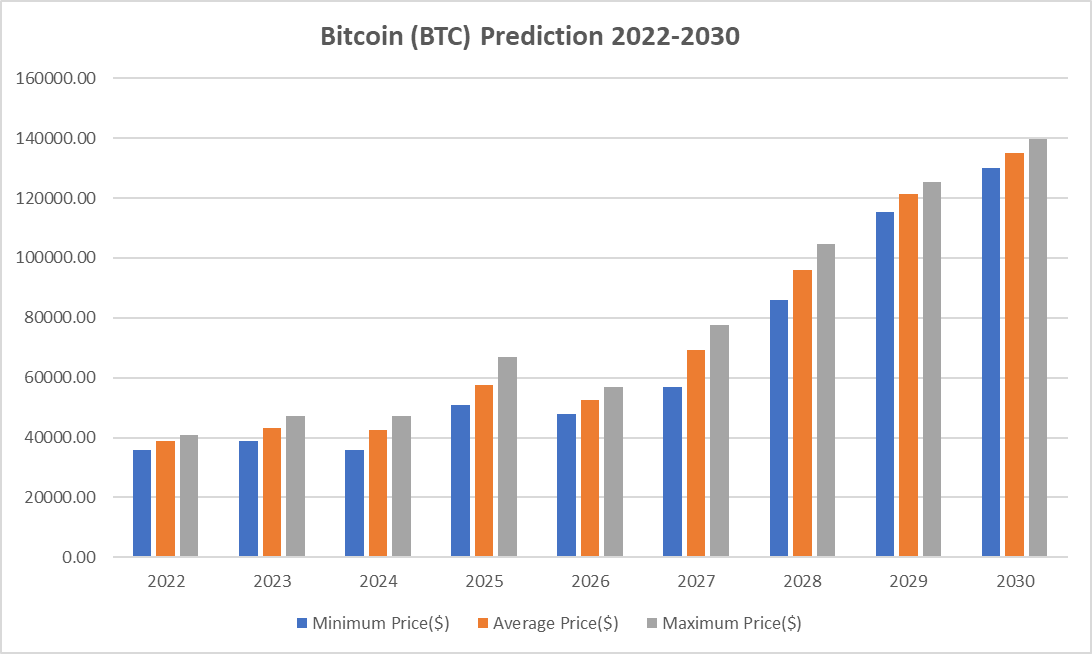

Cryptopolitan

| Year | A minimum price ($) | Average price ($) | Maximum price ($) |

| 2022 | 35800.67 | 38720.36 | 40818.81 |

| 2023 | 38957.25 | 43225.19 | 47096.15 |

| 2024 | 35809.75 | 42685.88 | 47302.39 |

| 2025 | 50741.64 | 57459.64 | 66989.09 |

| 2026 | 47945.62 | 52678.34 | 56768.87 |

| 2027 | 56716.69 | 69354.41 | 77646.29 |

| 2028 | 85794.53 | 95852.48 | 104586.82 |

| 2029 | 115231.57 | 121276.09 | 125353.79 |

| 2030 | 129980.26 | 135124.48 | 139778.80 |

Bitcoin Price Prediction 2022

The crypto market is currently experiencing massive sell-offs, with over $700 billion wiped off in market capitalization over the last few weeks. The signals do not look good in the short term, but we expect price recoveries across the market in the coming months. As per our Bitcoin price prediction for 2022, the crypto could rise to about $40k by 2022. The expected minimum price by December 2022 is $35.2k. Also, the year-end average trading price of BTC is $38.6k.

Bitcoin Price Prediction 2023

As per our Bitcoin price prediction for 2023, the average trading price in January is $42.7k, and its expected maximum price is just about $45.5k. A BTC trading range of $38k to $50 is scheduled for the remainder of the year.

Bitcoin Price Prediction 2024

Slight pullbacks are expected in 2024, and Bitcoin could fall below its highs and lows from 2023, as seen on the price prediction table.

Bitcoin Price Forecast 2025

We expect significant recoveries in the market in 2025, and Bitcoin is expected to follow suit, with a maximum trading price of $66,989.09 and an average price of $57459.64. As per our Bitcoin price prediction 2025, the coin is expected to be trading around the $50,000 mark.

Bitcoin Price Prediction 2026 and Beyond

By 2026, we expect a trading range of $47k to $57k. 2027 could see Bitcoin doing over 160% of its current market price. By 2030, we expect one unit of BTC to be trading for as high as $139,778.80.

With increasing adoption, favorable regulations, and more institutional investments in Bitcoin cryptocurrency, newer heights are inevitable.

Bitcoin Price Prediction by Industry Experts

According to a tweet from Kevin Svenson, a crypto market analyst, he exuded caution on a swift rebound in the market price of BTC. He went on to refer to the market downturn of 2018. Bitcoin’s recovery to its ATHs in the short term could be an unrealistic ask.

Things take time

— Kevin Svenson (@KevinSvenson_) May 19, 2022

Success takes time

Markets take their time

To believe that #Bitcoin will see an instant recovery to ATHs anytime soon is to be unrealistic. Think about the amount of time #BTC holders spent waiting from 2018 -> 2021 to get returns

Prepare for something similar

In a Bitcoin newsletter from Jan Wüstenfeld, the economist and Bitcoin analyst expects the correlation between stocks and BTC to continue driving the crypto’s price.

Issue #4 of Bitcoin Market Intelligence is out! 🧠

— Jan Wüstenfeld (@JanWues) May 17, 2022

This time I write about #bitcoin price correlation, how Luna has affected $BTC, who has and who hasn't been selling and more… https://t.co/y6dFRdCJl0

Although the stablecoin luna experienced a significant dip in value last week, long-term bitcoin holders are not panicking. The correlation between the price of bitcoin and the performance of financial markets, particularly tech stocks, has remained in place and could continue to rise. Given Federal Reserve’s decision to combat inflation by reducing balance sheets and driving up interest rates may cause sideways movement or further downside for financial markets and bitcoin.

Conclusion

Bitcoin has continued to flow into exchanges, indicating that the bearish market could persist in the short term as BTC holders continue to sell off their assets. BTC on exchanges rather than wallets means that holders can initiate liquidation anytime and quickly. This current market status is typical of the 2017-18 scenario; however, the market is more mature now, and recoveries might be in the offing soon as investors reignite interest in cryptos as a haven.

While Bitcoin (BTC) price predictions are overwhelmingly positive in the long term, and investors could rake in profits in the future, it is essential to conduct your research and seek investment advisors’ advice before investing in any digital asset. If you must invest, do so wisely—using only what you can afford to lose.

FAQs about Bitcoin

What will Bitcoin be worth in 2030?

Bitcoin has experienced a wide array of exciting developments, and there are always new developments on the horizon. Based on our Bitcoin forecast, BTC could hit $140k by 2030.

How many Bitcoin tokens are left?

There are a total of 21 million Bitcoin to be ever created. 18.7 have already come out of the massive mining farms that perform hashing algorithms that help Bitcoins blockchain network and related companies to do their work.

Therefore, most Bitcoin has already come into existence (around 90 percent), and one would think what would need to change to get more Bitcoin after the total maximum is exceeded. The answer is – you will have to acquire them through crypto exchanges.

cryptopolitan.com

cryptopolitan.com