On Sunday (April 18), Jeff Dorman, who is the Chief Investment Officer (CIO) at NYSE Arca (which is “the top U.S. exchange for the listing and trading of exchange-traded funds”), gave three reasons for this past weekend’s Bitcoin price crash.

Data by TradingView indicates that — on crypto exchange Bitstamp — when the past weekend started (i.e. 00:00 UTC on April 17), Bitcoin was trading at $61,436. It got as high as $62,523 at 09:00 UTC on April 17. Then, at 03:35 UTC on Sunday (April 18), the Bitcoin price fell as flow as $51,541. By the end of the weekend, the Bitcoin price had recovered to $56,260.

Yesterday, the Arca CIO provided this short intelligent analysis of what happened in the Bitcoin markets over the weekend.

market recap

— Jeff Dorman, CFA (@jdorman81) April 18, 2021

– incorrect analysis of $BTC hash rate decline

– incorrect analysis of how much $COIN insiders sold

– most likely false (or at best unsubstantiated) rumors of US Treasury charging financial companies over crypto money laundering

Result: Huge selloff/liquidations

Now, let’s take a look at each statement in this tweet.

First, there was much confusion about the drop in the BTC hash rate (because of a blackout in one region of China) that we found out about on Friday (April 16).

The hashrate of Bitcoin mining pools plummeted in 24 hours. Antpools fell by 24.5%, https://t.co/1YRYr58dLy fell by 18.9%, Poolin fell by 33%, Binance pools fell by 20%. The reason is that Northwest China is undergoing a complete blackout for safety inspections. pic.twitter.com/vaWgYsMEFH

— Wu Blockchain (@WuBlockchain) April 16, 2021

On-chain analyst Willy Woo thought that the Bitcoin hash rate had dropped by 50%.

However, not everyone was convinced that the BTC hash rate had dropped this much. For instance, here is Blockstream CEO Adam Back replying to Woo and telling him that the drop in hash rate was probably around 20%.

nit I think hashrate is closer to 20% down, just the extrapolated data from blocks has high variance and so low estimation accuracy. real-time pool shares shows the actual https://t.co/XhBsfvdsc3

— Adam Back (@adam3us) April 19, 2021

However, not everyone believes that there is any causing relationship or even a correlation between the Bitcoin hash rate and the Bitcoin price. One of those people is Adam Cochran, a partner at venture fund Cinneamhain Ventures.

1/15

— Adam Cochran (@adamscochran) April 18, 2021

You might have seen charts around claiming that there is some sort of link between the mining hash-rate and Bitcoin's price drop.

I've seen all sorts of words thrown around with this chart including 'causations' and 'correlations' by a lot of people who don't math. pic.twitter.com/Gfog3Sk8Wo

Second, there were various people claiming that high-level Coinbase executives had sold most of their Coinbase (NASDAQ: COIN) shares shortly after the start of trading of the shares on Nasdaq on April 14. For example, here is what gold bug and Bitcoin hater Peter Schiff said on April 18:

On the same day #Coinbase CEO @brian_armstrong was on @CNBC publicly pumping COIN, he was privately dumping 71% of his shares. Other insiders selling included the Pres., CAO, CPO, and CFO who dumped 63%, 86%, 97%, and 100% respectively. Union Square Venture fund also dumped 100%. pic.twitter.com/C0oqScTYbR

— Peter Schiff (@PeterSchiff) April 18, 2021

Earlier today (April 19), The Block’s research team shed some light on this topic, and showed that contrary to Schiff’s claim, the Coinbase CEO had sold less than 2% of his total holdings rather than 71%.

Table of Coinbase execs % of holdings sold last week, by share count https://t.co/yYsZXB9R9W pic.twitter.com/VaY4OjaP4C

— Ryan Todd (@_RJTodd) April 19, 2021

Third, around 02:42 UTC on Sunday (April 18), one Twitter account posted the following tweet that created much fear in the crypto markets:

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

Despite the tweet not coming from a well-known news outlet and essentially being not more than an unsubstantiated rumor, it was widely shared and created much fear in the crypto markets. Within one hour of the time this tweet was posted, the Bitcoin price on Bitstamp had dropped from a high of $59,231 (at 02:35 UTC on April 18) to a low of $51,541 one hour later.

One of Crypto Twitter’s favorite lawyers, Jake Chervinsky, who is the General Counsel at Compound, had this to say about this rumor yesterday:

I don't find this credible. The tweet itself is fishy: Treasury doesn't charge money laundering (DOJ does) & a case against several FIs at once would be unusual. Also, criminal investigations are kept strictly confidential & rarely leak. I'm not convinced by unnamed "sources." https://t.co/71opA5cUby

— Jake Chervinsky (@jchervinsky) April 18, 2021

And today, he said:

As much as crypto has grown & matured in recent years, the market's sensitivity to a single all-caps tweet making an unfounded & unsound allegation shows we still have far to go.

— Jake Chervinsky (@jchervinsky) April 19, 2021

I don't know if that tweet caused the sell-off, but it's gotten way too much attention regardless.

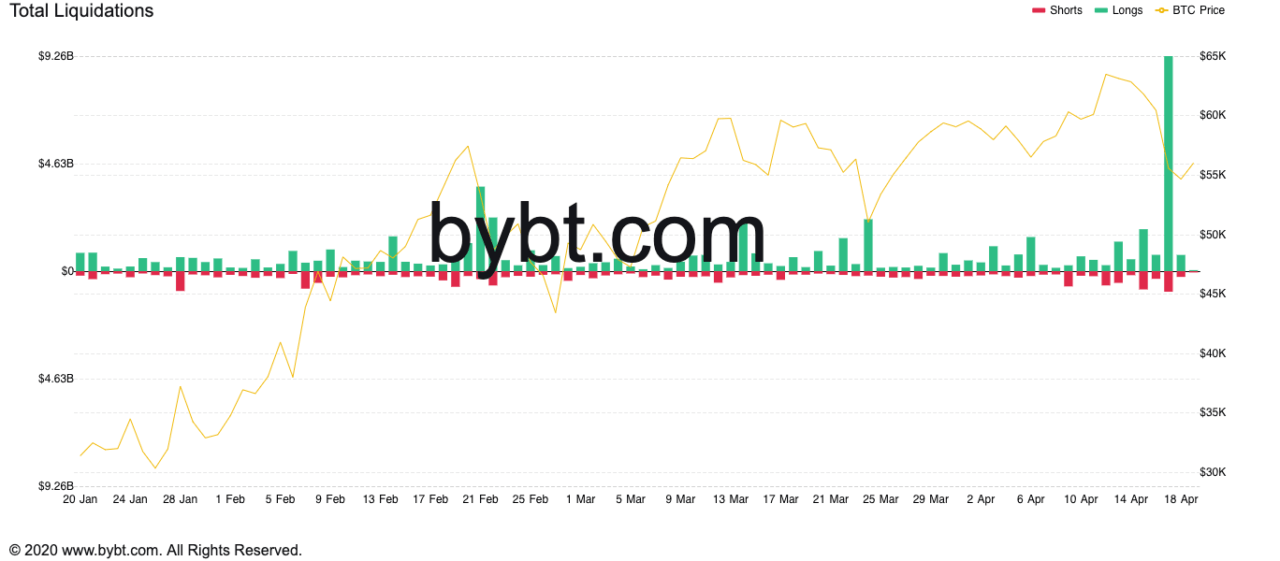

And finally, as Dorman points out, the weekend sell-off caused a huge amount of (long) liquidations, which is confirmed by data from Bybt.

Featured Image by “vjkombajn” via Pixabay.com

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

cryptoglobe.com

cryptoglobe.com