- Chainlink price analysis shows a bullish trend

- LINK prices are facing resistance at $14.30

- Support for LINK prices is present at $13.0

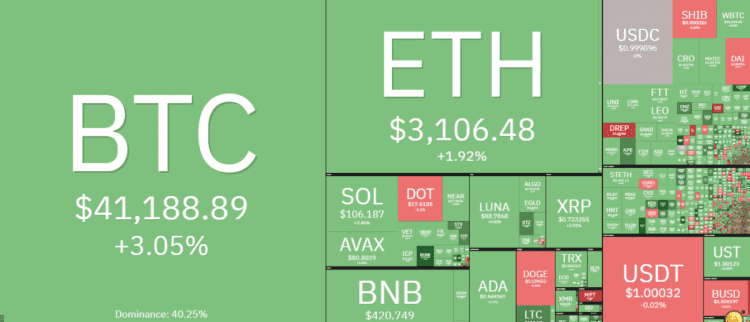

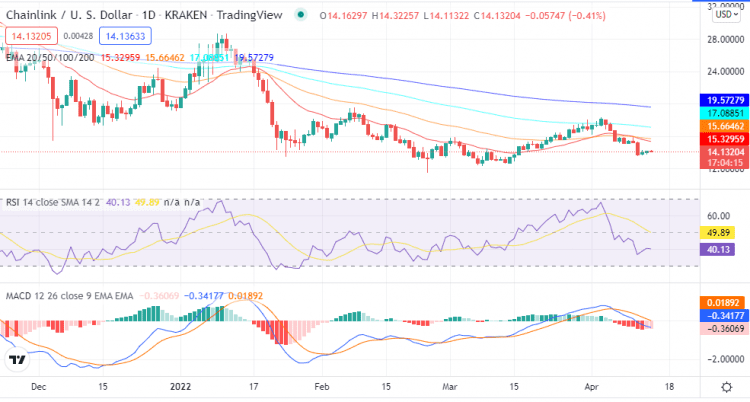

Chainlink price analysis for today shows a positive market sentiment that has been witnessed after LINK prices opened the daily trading chart trading at $13.04 and closed at $14.19. There has been a slight dip in prices as well, which has found support near the $13.0 level. After this, there was an uptrend witnessed that helped LINK prices push past the resistance near $14.30 and close at $14.29.

LINK prices have been trading sideways for the last few days before the bulls took control and pushed prices above the $14.0 level. The bulls are now facing resistance near the $14.30 level, which is likely to act as a strong barrier. If they can push past this level, we can expect Chainlink prices to continue their uptrend towards the $15.0 level.

Chainlink price movement in the last 24 hours: Bulls mount pressure

In the last 24 hours, LINK prices had seen a slight dip that found support near the $13.0 level before an uptrend was witnessed that pushed prices towards the $14.30 resistance level. The bulls could not push past this level, and prices have currently corrected lower. The market is currently trading near the $14.0 level, and if the bulls can take control, we may see Chainlink prices push past the $14.30 level once again.

The technical indicators are currently giving a mixed signal. The MACD is showing signs of bullish momentum while the RSI is below the 50 levels, which shows that the market is currently indecisive. The EMA ribbons are currently converging, which shows that a breakout is likely to occur in the near future.

Chainlink price analysis: What to expect?

Chainlink prices have been trading sideways for the past few days as the bulls and bear battle for control. However, the bulls have taken control in the last 24 hours and pushed prices towards the $14.30 resistance level. If they can push past this level, we can expect Chainlink prices to continue their uptrend towards the $15.0 level. On the other hand, if the bears take control, prices may retrace towards the $13.0 support level.

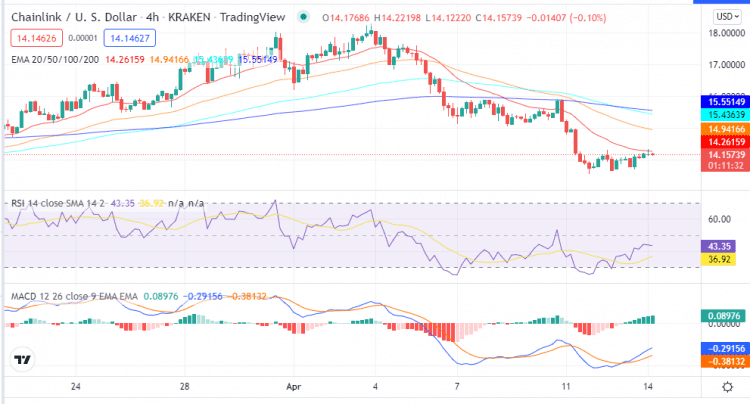

Chainlink price action on a 4-hour price chart: LINK /USD prices trade in a symmetrical triangle pattern

On the 4-hour chart, we can see that LINK prices have been trading in a symmetrical triangle pattern for the past few days. The bulls have taken control in the last 24 hours and pushed prices towards the $14.30 resistance level. If they can push past this level, we can expect Chainlink prices to continue their uptrend towards the $15.0 level. On the other hand, if the bears take control, prices may retrace towards the $13.0 support level.

The technical indicators are currently giving a mixed signal as the RSI line is currently just below the 50 levels, which shows that the market is currently indecisive. The MACD line is above the signal line, which shows that the bulls have the upper hand in the market. The EMA ribbons are currently converging, which shows that a breakout is likely to occur in the near future.

Chainlink price analysis conclusion

Chainlink (LINK) price analysis shows that the bulls are in control as prices push towards the $14.30 resistance level. However, the bears are expected to put up a fight near this level. If the bulls can take control, we may see Chainlink prices push past the $15.0 level. On the other hand, if the bears take control, prices may retrace towards the $13.0 support level.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com