The year 2021 was game-changing for the cryptocurrency market, not only in the sense that its capitalization had reached $3 trillion. This was also the time when the majority of new users have entered the space, as a recent study has revealed.

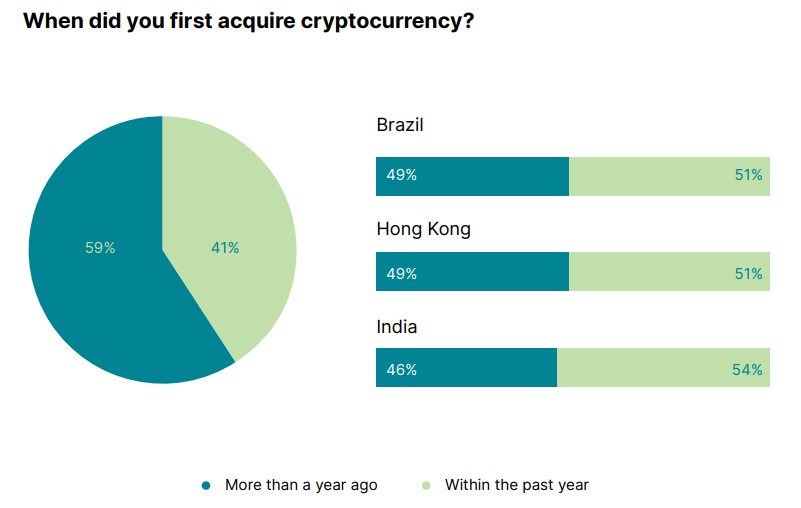

According to the 2022 Global State of Crypto report, released on April 4 by the crypto exchange Gemini, 41% of crypto owners around the world purchased their first cryptocurrency in 2021. This percentage was taken from close to 30,000 respondents surveyed in 20 countries.

The same percentage of participants said they did not currently own crypto but were either interested in learning more or planned to acquire digital assets in the next year – described in the report as ‘crypto-curious’.

It’s worth noting that the report has also divulged signs of reducing the crypto gender gap, as 47% of the crypto-curious group were women. Interestingly, women in developing countries represented over half of all crypto owners, while only a third of female crypto owners in 2021 were in developed nations and regions.

Crypto adoption driven by inflation, hindered by legal and educational barriers

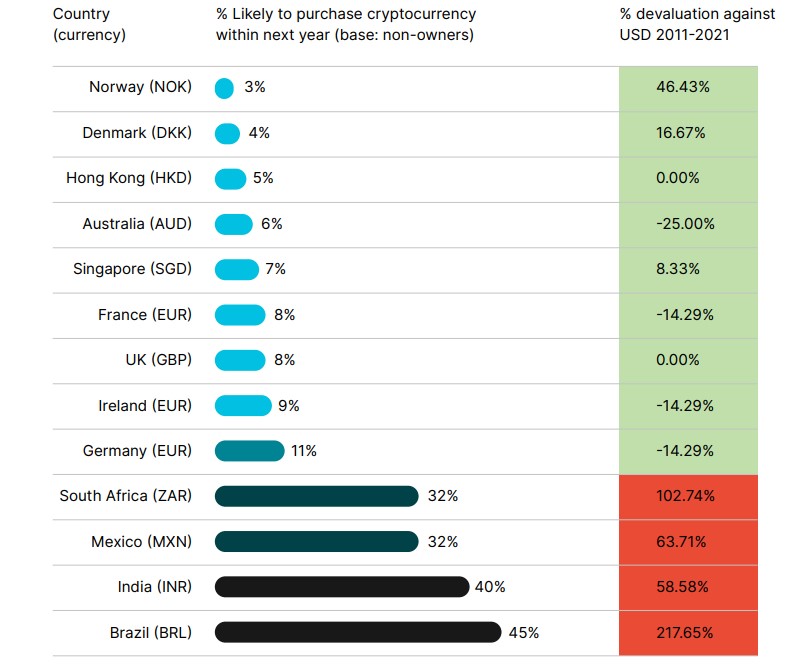

The respondents in countries going through 50% of more devaluation of domestic currency against the USD over the last decade were over five times more likely to plan to buy crypto in 2022 than those with less than 50% devaluation.

This is especially evident in Brazil, whose domestic currency was experiencing more than 200% devaluation against the USD and where 41% of respondents said they were crypto owners. Interestingly, 40% of cryptocurrency owners in the United States consider the asset a hedge against inflation.

Gemini’s study has also uncovered the main reasons still keeping the non-owners of crypto away – namely legal uncertainties, tax complexities, and the lack of education.

More specifically, legal uncertainties were cited the most by the respondents in the Asia Pacific region (39%), while tax complexities were the problem for 30% of interviewees in the Middle East.

Finally, the respondents were almost twice as likely to say that more educational resources on crypto would assist them in getting on board (40%) in decentralized finance (DeFi), compared to friends’ recommendations (22%).

finbold.com

finbold.com