# Benchmarks

Bitcoin (BTC) is up 15.9% in the last 7 days and is up 26.3% in the last 14 days

Ethereum (ETH) is up 18.8% in the last 7 days and is up ~35.0% in the last 14 days

# Exchange listings

## Coinbase

__- March 24th__

Listings for Mina (MINA)

In the last 7 days - MINA is up ~28.7%

__-March 18th__

Listings for Apecoin (APE)

In the last 7 days - Apecoin is up 348%

## FTX

__-March 25th__

Listing for Stargate Finance (STG)

In the last 7 days - up 151.4%

__-March 24th__

Listings for Fraxshares (FXS), Sperax (SPA),

In the last 7 days - FXS is down 0.1%, SPA is up 31.6%

__- March 21st__

Listings for C2X (CTX)

In the last 7 days - CTX IEOed on FTX on March 19th.

From an initial IEO listing price of US$0.075, CTX currently trades for US$3.41. This is a percentage increase of 4,447%.

## Binance

- Biswap (BSW) will list in the Binance Innovation zone will list on Binance Innovation zone

In the last 7 days - BSW is down ~24.9%

# Governance forum review

__Maker (MKR) Crypto Venture Capital giant proposes a whole new tokenomics structure for MakerDAO__

Summary

Two weeks ago crypto VC firm A16z posted a governance proposal in the MakerDAO governance forum suggesting a major reworking of the MakerDAO token model that will add new utility to the Maker (MKR) token.

MKR holders are currently the buyers of last resort for the DAI stablecoin ecosystem. They add a layer of safety to the DAI ecosystem. As part of this system, a small interest fee in MKR is due whenever a Dai collateralized Debt Position closes. A small portion of this fee is burned. This burn system keeps the ecosystem deflationary.

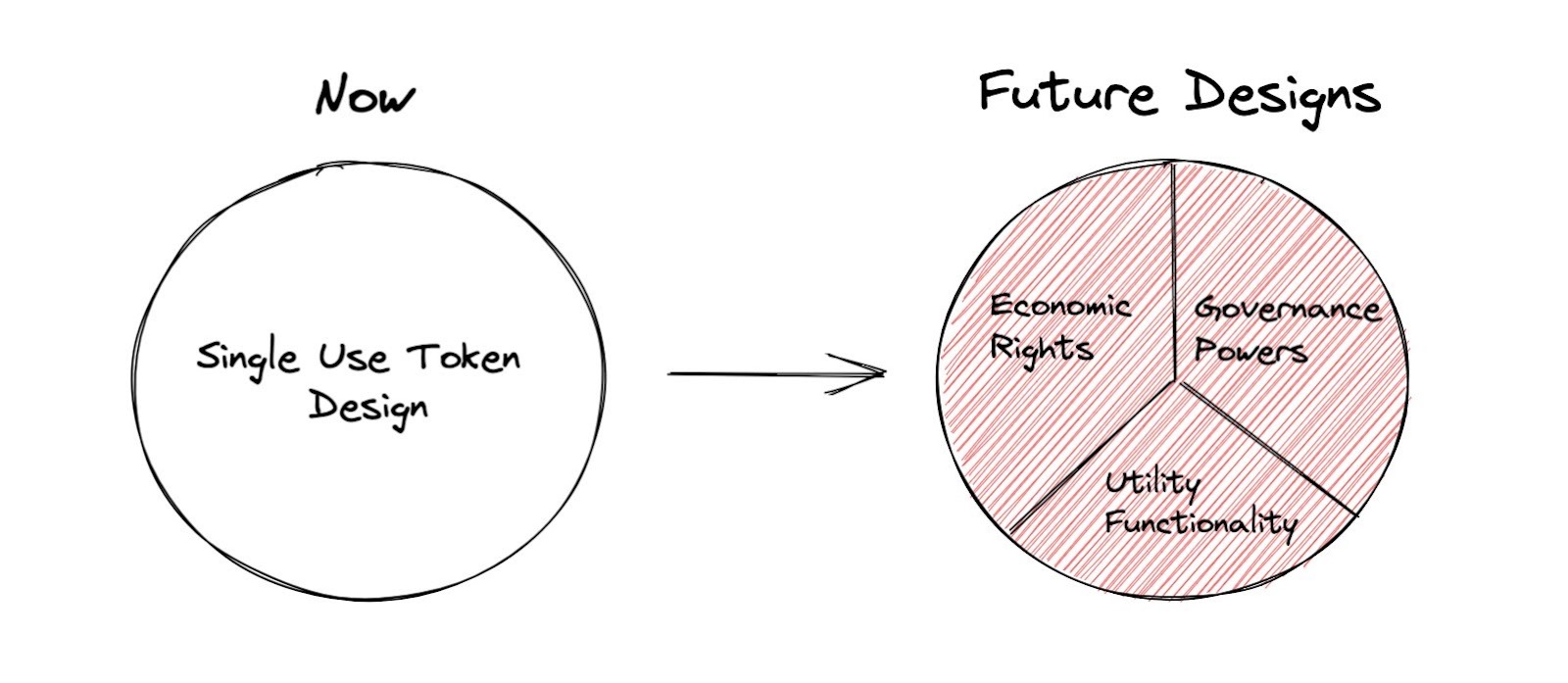

According to Porter Smith of A16z, MKR’s tokenomics, which originated in 2014, are dated. He says future token designs should incorporate economic, governance, and utility value to provide stronger value accrual and incentives for holders.

Smith suggests one way to create economic rights for MKR is building a primary and secondary insurance pool system. The primary insurance pool is based on stablecoins, while there is a secondary pool that contains the platform’s native token. When the primary insurance pool is full, owners of tokens in the secondary insurance pool receive a reward or yield in stablecoins.

In the event of a shortfall, the tokens in the secondary pool are used to recapitalize the primary pool. This mechanism offers MKR holders a passive income for offering insurance to the protocol and is likely to create more demand to hold the token.

Another initiative suggested by Smith is utility drivers. An example is a discount for stakers of MKR, when participating in Maker debt auctions. Another is the reverse APEcoin model, where instead of NFT holders getting rights to new native tokens, native token holders gain rights to new NFTs.

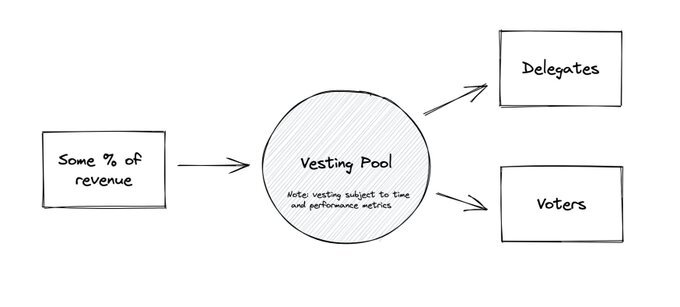

Smith then covers governance and suggests a dynamic governance model where different contributors to governance (delegators and voters) earn different percentages of protocol revenues and are rewarded for contributing to the protocol and locking their tokens to the protocol by vesting.

__Smith and A16z’s proposal doesn’t pitch any one specific change to the MKR token but instead encourages the MKR community to think about ways to maximize the value of the MKR token and offers a few different avenues to do this.__

Smith writes “Tokens offer a blank canvas that can combine economic, governance, and utility functionality, and one that will actively change over the coming months. We’re at the very beginning of discovering features that can be embedded to create new functionality.”

The A16z proposal to find new ways to create value and profit for MKR holders is timely. If the proposal gains traction, it is likely that the price of the MKR will rise as its tokenomics are updated.

There is some possibility, however, that some of these changes may push the MKR into having features that resemble a security which could make it difficult to trade the token in some countries.

MKR is up ~24.7% in the last two weeks.

# Other notable events in the cryptocurrency space

__-The Apecoin launch.__ On March 17th ApeCoin, a native token for the mega-popular Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht (MAYC) NFT collections was launched. In just under a week, it rose to become a top-100 digital asset by market capitalization. The token was initially launched as an airdrop to BAYC and MAYC NFT holders, although a large allocation has been set aside for Yuga Labs, the creators of the BAYC, and some of its VC partners. Apecoin will be backed by the newly formed Apecoin DAO, continuing the recent social token boom, where tokens offer holders access to a DAO or a community.

BAYC and MAYC make up two of the five most popular NFT collections of all-time by total sales volume. The token signals a new paradigm for the project. It is now set to expand beyond simply being an NFT art collection. With its new token it is now a DAO and can expand to new incentives and profit opportunities for Bored Ape stakeholders.

__Cardano’s bumper run.__ The native token of the Cardano blockchain, ADA, has been outperforming the rest of the large-cap crypto market. The asset is up ~31.8% in the last 7 days. There has been a massive surge in the value of assets locked onto the platform. While the chain’s DeFi ecosystem is still only 29th largest on DeFi Llama, its growth in 2022 has been undeniably impressive. Since the beginning of the year the Decentralized Finance TVL on Cardano is up ~38,951% and currently sits at US$322 million. This momentum appears to have built up to its recent price surge. Other factors that may have created some of this price momentum include rumors of an ADA token burn and the addition of ADA staking to the Coinbase custody staking service.

__-The Terra/Luna ecosystem props up the price of BTC.__ The Terra foundation’s continual BTC purchase is what many investment firms, like Singapore’s QCP Capital, suggest is driving crypto momentum in the last week. A proposal from the Terra foundation explains that US$2.5 billion will be used to create a pool of Wrapped Cosmos Bitcoin.

The tokens can then be used to recapitalize UST when it loses its peg. Over the last week the foundation has been buying over US$100 million worth of BTC a day to capitalize the protection fund. A bitcoin address believed to be owned by the fund currently owns 27,784.96 BTC or ~US$1.35 billion and has been topped up with new BTC every day. The aggressive strategy is making it more difficult for Bears to protect price levels and is weakening their resistance.

__-Risk appetite returns to Altcoin investors.__ Is crypto a divergent asset class? Across crypto markets, the risk appetite of investors appears to be returning, perhaps driven by the strength in BTC markets. Altcoins like Dogecoin (DOGE), Solana (SOL), Polkadot (DOT), and Near (NEAR) are up ~27%, ~27%, ~22%, and ~23% respectively in the last week. Crypto in general has performed strongly since Russia invaded Ukraine in February. This may signal that digital assets have divergent characteristics with more appeal than other asset classes during wartime. Russia has used crypto as a way to evade sanctions, while Ukrainians have used crypto as a way to smoothly and efficiently receive remittance/charity payments.

bravenewcoin.com

bravenewcoin.com