Bitcoin was higher, in an indecisive-looking market swinging between about $18,300 and $19,300. Prices have failed to push higher after surging to a new all-time high of $19,920 earlier this week.

“Expect additional short-term volatility,” Katie Stockton, a technical analyst for Fairlead Strategies, told CoinDesk’s Daniel Cawrey.

In traditional markets, European stocks slipped and U.S. stock futures pointed to a lower open as lawmakers discussed new economic-stimulus measures and traders awaited new data on U.S. jobs growth during November. Gold strengthened 0.7% to $1,827 an ounce.

The 10-year U.S. breakeven rate, representing inflation expectations as implied by bond markets, rose to 1.81% on Tuesday, the highest since July 2019.

Market Moves

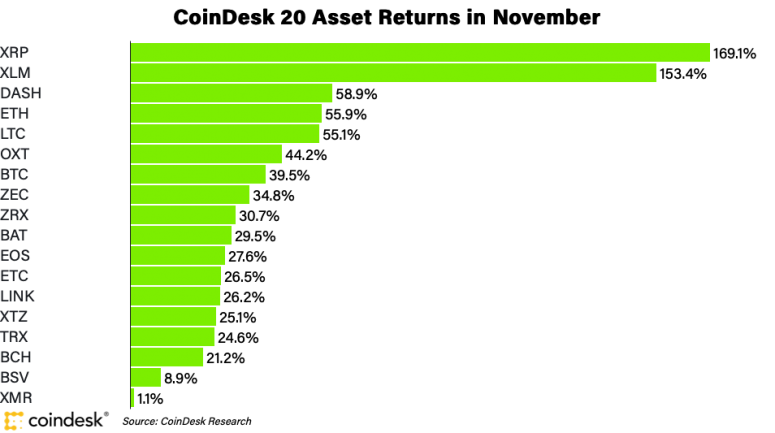

As bitcoin dominated headlines in November with its rally toward an all-time high, one of the most prominent alternative cryptocurrencies, XRP, quietly jumped 169% during the month to top the performance rankings among digital assets in the CoinDesk 20.

The move left XRP, the payments token used in Ripple’s global payments network, up 225% in 2020, versus the older and larger bitcoin’s 165% gain. XRP has a market capitalization of $21.4 billion, a fraction of bitcoin’s roughly $350 billion.

The frenzy may be driven by a looming airdrop of free “spark” tokens to anyone who holds XRP, some digital-markets analysts told CoinDesk last month.

There’s also the possibility that some first-time cryptocurrency buyers are unaware that it’s possible to buy a fraction of a bitcoin (BTC, +0.35%) – divisible up to the eighth decimal, instead of a whole token. For the novice investor, XRP, currently changing hands at 62.3 cents, looks a lot cheaper on a price table than bitcoin’s $19,087.

“As the digital asset space has seen renewed interest in the second half of 2020, a new wave of investors are looking for ways to get exposure,” said Brian Mosoff, CEO of the publicly traded Canadian investment fund Ether Capital. “Ripple appears to offer exposure in their portfolio, and a quick Google search may result in some users believing XRP is cheap and likely to become a product banks utilize for cross-border settlement.”

Stellar (XLM, +1.21%), another payments token founded by Ripple co-founder Jed McCaleb, was the second-best performer in November among the CoinDesk 20, gaining 153%. It’s up 313% on the year.

For comparison, bitcoin rallied 40% in November while ether, the native cryptocurrency of the Ethereum (ETH, +1.43%) blockchain, rose 56%.

– Bradley Keoun

coindesk.com

coindesk.com