The current swap systems, DEXs and DeFi on Ethereum are dying. They will have no choice but to be redesigned on L2 systems.

In May 2020, Ethereum fully demonstrated its market utility as a decentralized, zero trust and censorship-resistant platform for the execution of smart contracts and as a basis for decentralized applications.

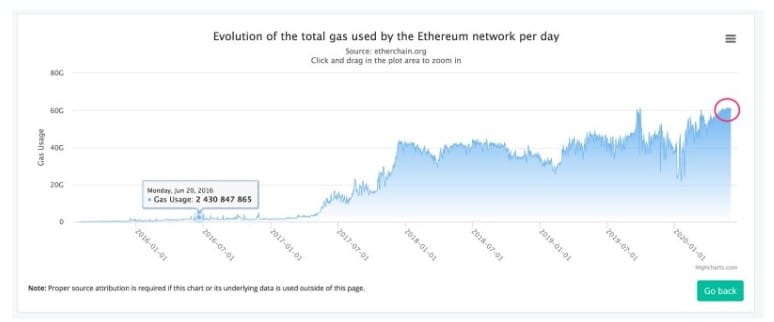

The success of Ethereum is proven and measurable by the amount of gas used by users, which has not only reached historical highs, but is maintained consistently.

There is a good reason why the daily gas spent does not rise above 60,000,000,000 gas x day: the current limit on the amount of gas that can be spent per block is around 10,000,000,000 gasxblock, which is kept by miners.

The Price of Success (in gas)

Ethereum is currently waiting for the next hard fork (Berlin), which foresees a market mechanism for determining the price of 1 gas unit in wei, the elementary unit of the most famous: 1 ether = 1,000,000,000,000,000,000 wei (1018), without entering into technicalities it is known that all transactions on ethereum have a cost expressed in gas determined by a price list that has been calculated (and sometimes is changed from fork to fork) based on the total computational weight.

In other words, the more a decentralized application (dApp) calls a complex smart contract, or a series of increasingly complex and heavy smart contracts, the total cost of the transaction (or concatenated transactions) expressed in gas to the end-user is higher.

For example:

- Transferring ether from one account to another costs 21,000 gas

- Transferring an ERC20 token from one account to another: about 50,000 gas

- Swapping on UniSwap between two ERC20 tokens: about 88,000 gas

- Swapping with kyber swap between two ERC20 tokens: about 650,000 gas

The cost expressed in gas rises considerably as the complexity of the transaction, as well as calls to various smart contracts, increases, a very common situation for almost all ethereum-based decentralized exchanges and DeFi protocols.

The Price of Success (in wei and dollars)

But how much does a wei gas unit cost?

It depends on the market, in other words, it depends on the price at which the miners are willing to agree to include a transaction in a block, basically it depends on what the demand for transactions is and how much the person requesting its inclusion in the ethereum blockchain is willing to pay.

It goes without saying that besides the miners’ willingness to include transactions starting from a certain weixgas price when the network limit is reached, i.e. when the demand for transactions expressed in total gas per block exceeds the current limit (today: 10,000,000 gas x block), a market selection mechanism takes place so that only those who are willing to pay more pass through. Basically, to run a dApp or even just transfer ether and tokens it is necessary to pay more.

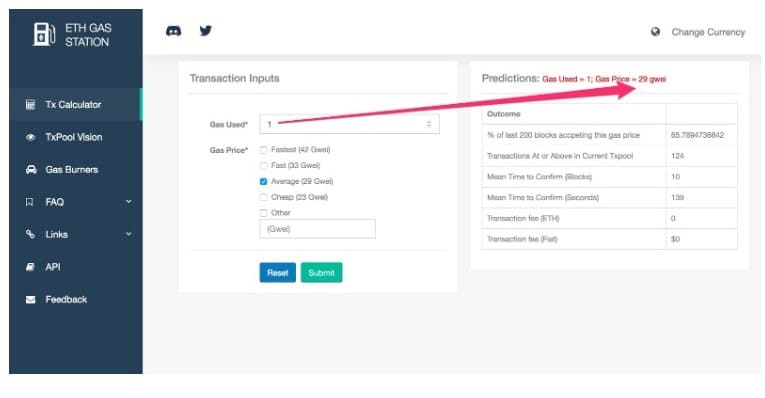

At the time of writing, the recommended price of a gas unit to be included quickly enough is 29 gwei (29 billion wei), data taken from the ETH gas Station website.

Which for example implies that:

- Transferring ether from one account to another costs 21,000gas x 29gwei = 609,000 gwei

- Transferring an ERC20 token from one account to another: about 50,000gas x 29gwei= 1,450,000 gwei

- Swapping on UniSwap between two ERC20 tokens: about 88,000gas x 29gwei = 2,559,000 gwei

- Swapping with Kyber Swap between two ERC20 tokens about 650,000gas x 29gwei= 18,850,000 gwei

And in American dollars (USD)?

It depends on the price of ether, remember that wei and gwei are sub-units of ether.

In this example, considering that the price of ether is $249 at the time of writing:

- Transferring ether from one account to another costs $0.15.

- Transferring an ERC20 token from one account to another costs about $0.36

- Swapping on UniSwap between two ERC20 tokens costs $0.64

- Swapping on kyber swap between two ERC20 tokens: about $4.69!!!

And we are talking about absolutely basic and commonplace operations.

It’s very common to see some dApps that require more than 200,000 gas per operation, or more than $1.45 per operation, it’s not very rare to find operations that cost 500,000 gas.

How was it possible that a huge ecosystem of dApps and wallets developed around such expensive operations for the user?

Because in the past it has never happened that for an extended period of time and predictably for an indefinite time in the future there has been such a massive use of ethereum and such a high transaction cost, for years the ecosystem has been accustomed to a 1 Gwei gas cost, 29 times less than today.

In fact, the vast majority of dApps and wallets using Ethereum have been designed and conceived to have an acceptable market price with a very low gas price, assuming that this would remain very low.

The impact of scaling systems, L2 (including zkProof)

This article will not cover second-level scaling systems (including zkProof systems that use a relayer), just know that these systems exist and have one feature in common: they allow the exchange of ether and tokens or smart contract activation on Ethereum by moving the network or computational load elsewhere, where it costs less.

The net result of L2 systems on ethereum is not only that of a potential decrease of the current network load, that could be only a temporary effect, the point is that the cost of ethereum transactions is either indifferent or relatively indifferent for L2 systems.

These systems can withstand the market, i.e. offer low or very low-cost transactions to users while still paying a lot to the ethereum network, even a multiple of today’s prices.

Already today, realities such as the Loopring exchange using zkProofs are displacing the traditional DEX market (and potentially Swaps) that use traditional methods to activate smart contracts. Loopring users will continue to pay a few thousandths or at most cents per transaction or iteration with this exchange even if the cost of gas should skyrocket.

Conclusion: Is Ethereum dead?

The more L2 systems reach the market to make transactions on Ethereum (or at least use its security) the less room there will be for everyone else.

Soon it may take tens of dollars per transaction to use a decentralized exchange, swap or a DeFi system, the latter being traditionally the most complex and computationally heavy.

en.cryptonomist.ch

en.cryptonomist.ch