Amid the recent downturn, Cardano now sits at a critical juncture similar to its 2023 bottom, with two clear price paths before it.

Each path leads to two different price directions, and its near-term reaction would determine which one it would take. One is headed toward steeper dips, and the other is a recovery path to higher prices.

Key Points

- Amid the recent downturn, Cardano now sits at a critical juncture similar to its 2023 bottom, with two clear price paths set before it.

- For context, the 11th-largest cryptocurrency by market cap pumped by over 500% from its June 2023 lows of $0.220 to its cycle top of $1.32 in December 2024.

- After relinquishing all those gains, Cardano now sits at a level that aligns with the $0.27-$0.35 price range, with crucial support at $0.25. How $ADA reacts will determine its next course of action.

- If it holds this zone between $0.27 and $0.35 through mid-2026, it stands a chance of rebounding to between $0.40 and $0.50.

- If it doesn’t hold this price range, Cardano could drop further to below $0.20 by late 2026, representing an over 27% correction.

- On-chain data from Coinglass shows that Cardano has seen good spot buying activity in the past few days.

Cardano at a Crossroads It Hasn’t Seen for Years

For context, the 11th-largest cryptocurrency by market cap pumped by over 500% from its June 2023 lows of $0.220 to its cycle top of $1.32 in December 2024. The explosive move saw it rally to a distribution zone marked red in an accompanying chart before dumping as hard as it pumped.

Currently, $ADA has given up all its gains from this run, dropping to $0.2206 on February 6 before rebounding slightly to $0.274. It now sits around the same level as 2023, an area that is crucial for its next price direction.

Notably, this level aligns with the $0.27-$0.35 price range, with crucial support at $0.25. How Cardano handles this will determine whether it repeats its 2023 price action or drops to lows not seen in over five years.

What Could Happen from Here

From a bullish perspective, Cardano could rebound from here if it does what it did in the previous cycle lows. Specifically, if it holds this zone between $0.27 and $0.35 through mid-2026, it stands a chance of rebounding to higher prices.

While nothing explosive is on the horizon at the moment, given the current price momentum, a sustainable trend above this support level could pave the way for reclaiming the $0.40-$0.50 resistance range. This would represent a 46% to 82% growth from the current market price of $0.274.

However, if it doesn’t hold this price range, it could signal a price capitulation. Cardano could drop further to below $0.20 by late 2026, representing an over 27% correction. $ADA last saw such a low in January 2021, over four years ago.

What On-Chain Data Suggests for Cardano

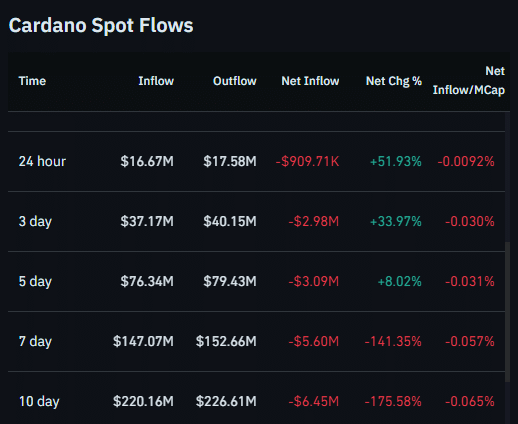

On-chain data from Coinglass shows that Cardano has seen good spot buying activity in the past few days. The spot flows show higher outflows than inflows on higher timeframes, signaling accumulation over further distribution.

In the past 24 hours, exchanges have seen inflows of $16.67 million in $ADA and outflows of $17.58 million, as users withdraw their tokens, likely to hold. This trend becomes more pronounced in the 7- and 10-day timeframes, with wallets withdrawing $152.66 million and $226.61 million, compared with inflows of $147 million and $220 million, respectively.

If this trend continues, $ADA could gain the needed buying pressure to push higher from current support levels.

thecryptobasic.com

thecryptobasic.com