Solana has remained range-bound after nearly two weeks of consolidation below $90. The lack of direction reflects persistent uncertainty across the crypto market.

On-chain indicators hint at a gradual recovery. However, losses endured by investors continue to shape sentiment. While technical signals show improvement, the broader structure suggests that risks remain present.

Solana Metrics’ Mixed Signals

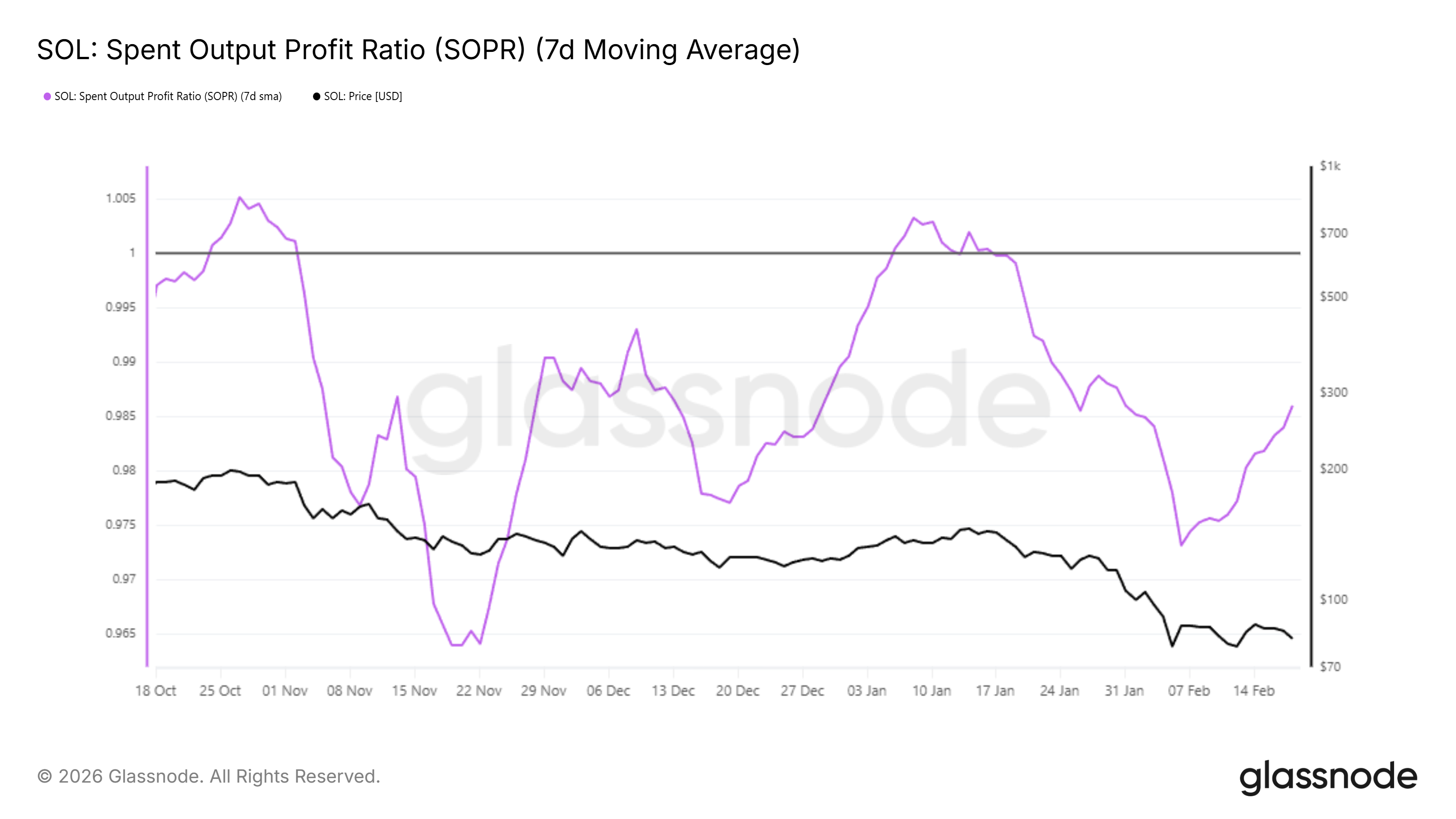

The Spent Output Profit Ratio, or SOPR, has recently ticked higher from the negative zone. A reading below 1 indicates that investors are selling at a loss. The recent uptick signals that realized losses are beginning to dissipate.

Historically, a move above 1 during extended bearish periods marks the first wave of profit-taking. Such transitions often lead to renewed volatility. When profitability briefly returns, some Solana investors sell to exit positions, triggering short-term pullbacks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This pattern has appeared twice in the past three months. Each instance was followed by renewed selling pressure. If SOPR climbs above 1 again, a similar reaction could unfold. That dynamic may limit immediate recovery despite improving on-chain sentiment.

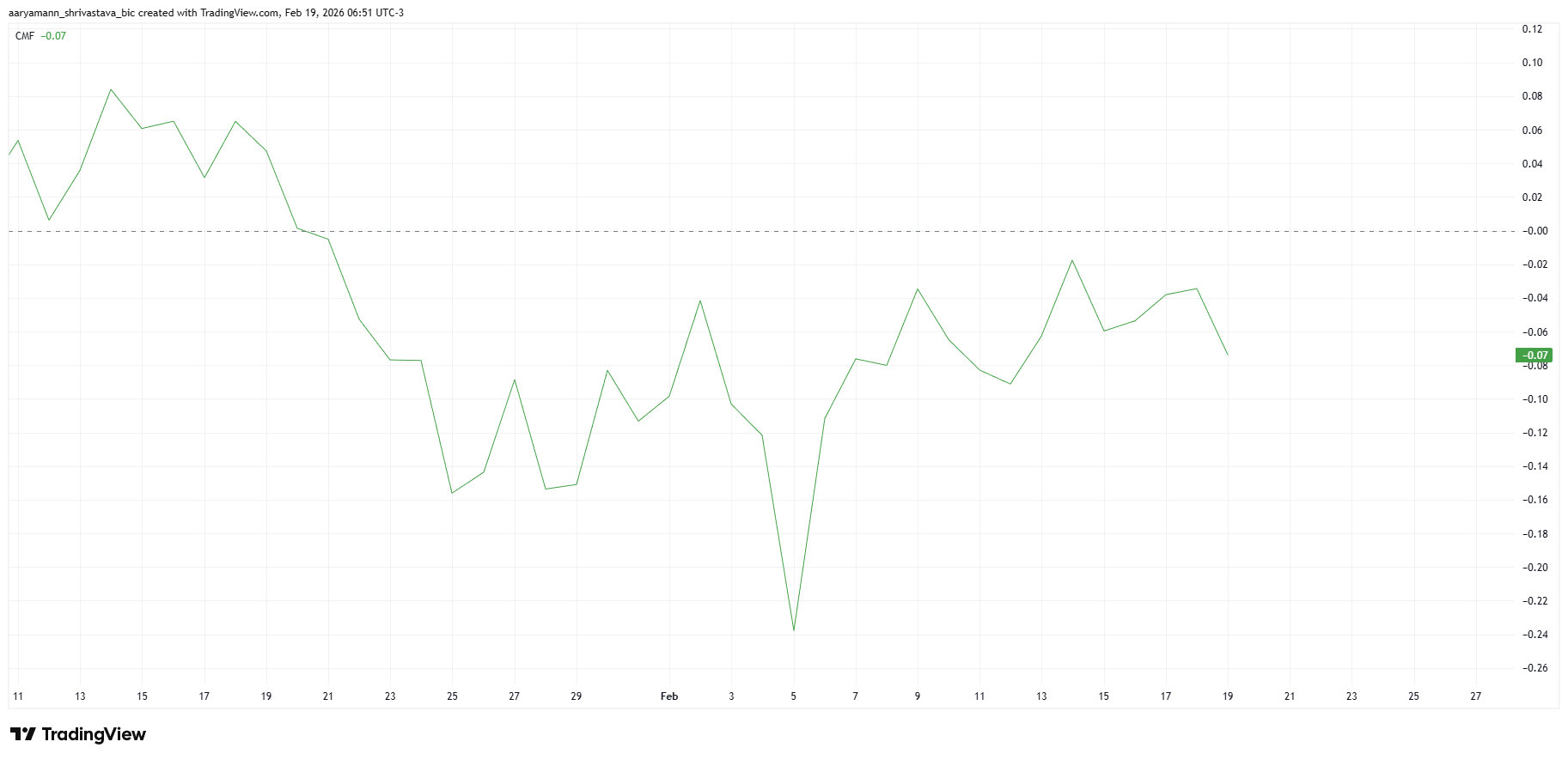

Technical indicators offer mixed signals. The Chaikin Money Flow is rising but remains in negative territory. This incline suggests that outflows are declining, yet capital has not returned decisively.

A move above the zero line would confirm sustained inflows. Until that shift occurs, Solana remains vulnerable to further weakness. Gradual improvement does not guarantee reversal, especially in an environment of cautious investor positioning.

Institutions Like Solana

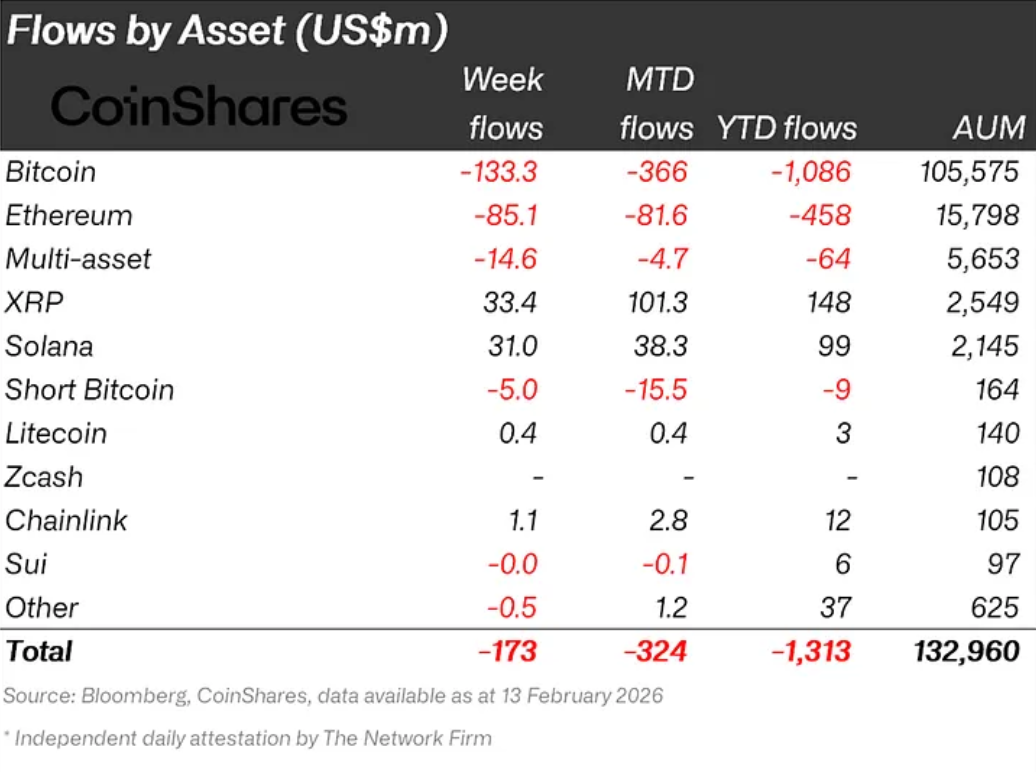

Institutional flows provide a contrasting signal. For the week ending February 13, Solana recorded $31 million in inflows. Among major tokens, only XRP saw comparable institutional support.

These inflows reflect continued interest from large wallets. Despite broader bearish conditions, institutions appear to view Solana as strategically valuable. Such support can cushion downside moves during periods of market stress.

Institutional accumulation has likely prevented deeper declines. Strong backing from larger players reinforces confidence in the network’s long-term prospects. This underlying demand remains a stabilizing factor even as retail sentiment fluctuates.

$SOL Price Continues Moving Sideways

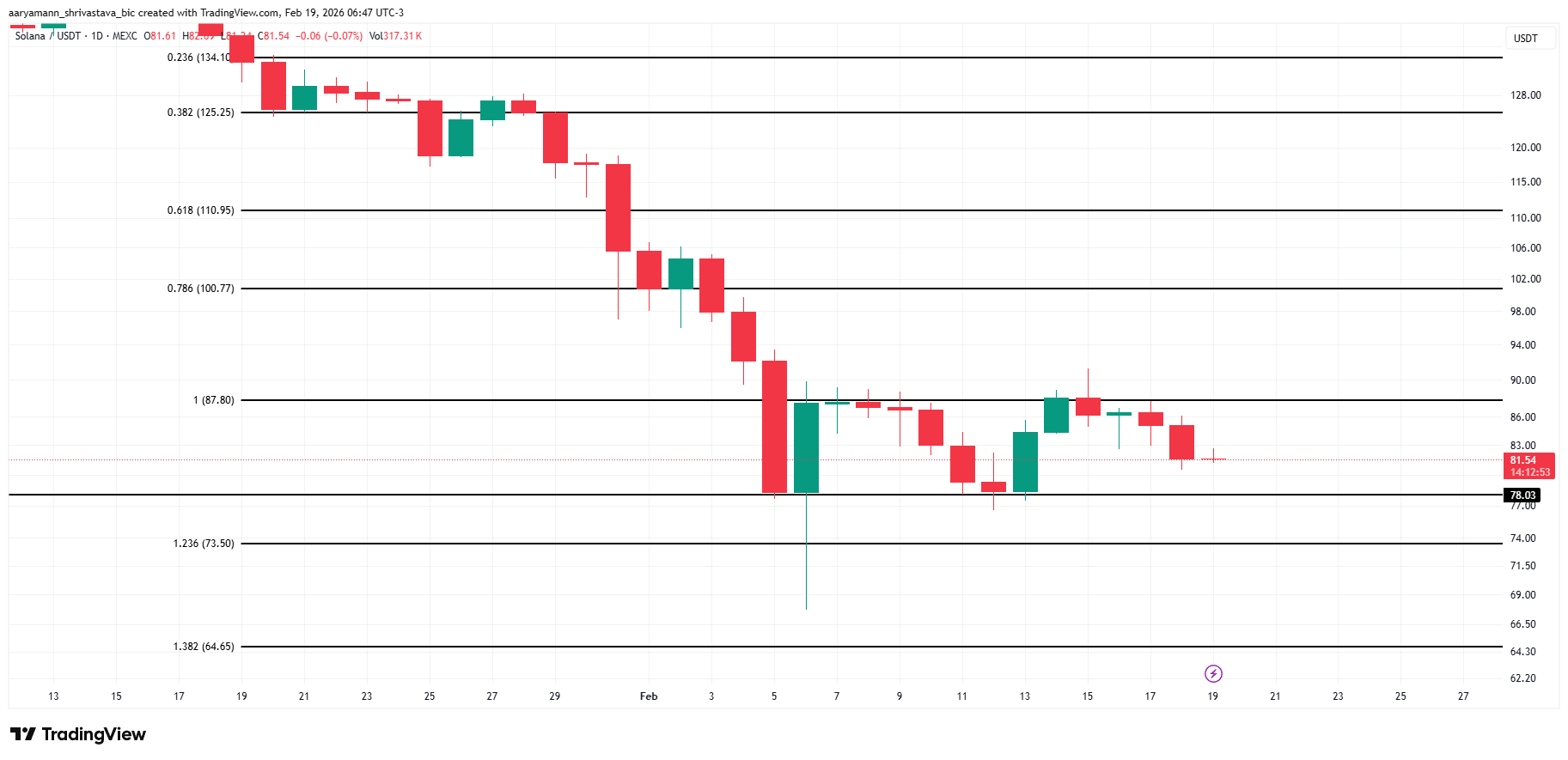

Solana price is trading at $81 at the time of writing. The token remains range-bound between $78 support and $87 resistance. This consolidation has persisted for over two weeks, signaling indecision among market participants.

Without clear recovery catalysts, sideways movement may continue. If bearish pressure intensifies, $SOL could slip below $78. A breakdown may expose the next support near $73, extending short-term downside risk.

Conversely, a bounce from $78 could shift momentum. A decisive move above $87 would signal breakout potential. Sustained buying pressure could then push Solana toward $100. If $SOL clears that psychological barrier, price may advance toward $110, invalidating the prevailing bearish outlook.

The post Solana Stays Stuck Below $90 as On-Chain Recovery Signals Clash With Loss Selling appeared first on BeInCrypto.

beincrypto.com

beincrypto.com