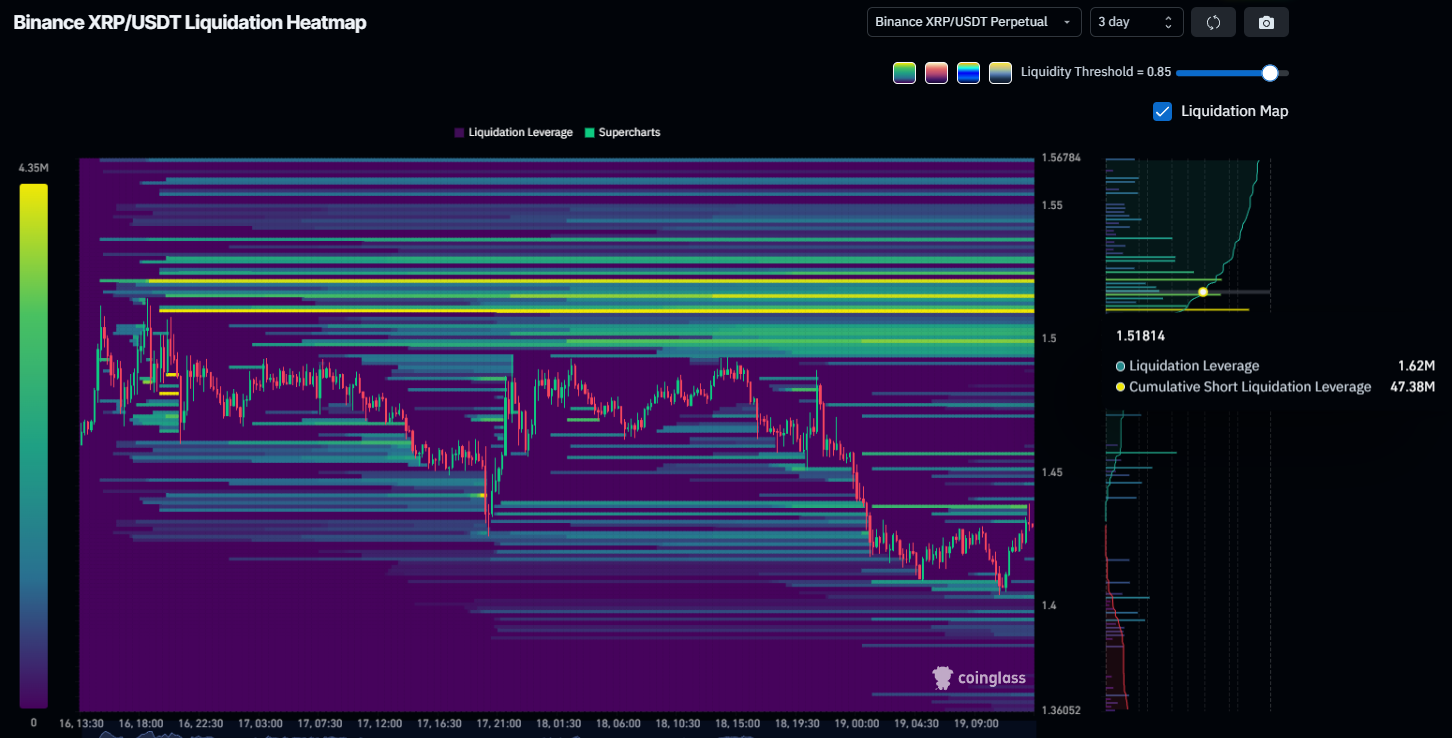

$XRP has entered a prolonged consolidation phase, trading sideways beneath a key resistance zone. The muted price action is not random. Derivatives data suggest a heavy concentration of short contracts is capping upside attempts.

This resistance wall has created tension in the market, highlighting the question of whether $XRP can trigger a short squeeze or remain suppressed below $1.50.

$XRP Is Facing a Wall

Futures market data and liquidation heatmaps highlight a critical level near $1.51. At that price, approximately $47 million in $XRP short positions face liquidation. This concentration has formed a visible barrier above current price action.

Traders holding short contracts are incentivized to defend this level. A sharp breakout could force rapid short covering, triggering a temporary price spike. However, such moves often exhaust buy-side liquidity quickly. Large players may sell into strength, turning the level into a short-term ceiling rather than sustained support.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

$XRP Liquidation Heatmap.">

$XRP Liquidation Heatmap.">

On-chain data reflects continued stress among $XRP holders. Net realized profit and loss metrics show that investors are still selling at a loss. On February 17 alone, roughly $117 million in realized losses were recorded.

This level of capitulation indicates persistent fear. When holders exit positions at a loss, it signals reduced confidence in near-term recovery. Sustained loss realization can limit bullish momentum until selling pressure subsides.

$XRP Realized Profit/Loss">

$XRP Realized Profit/Loss">

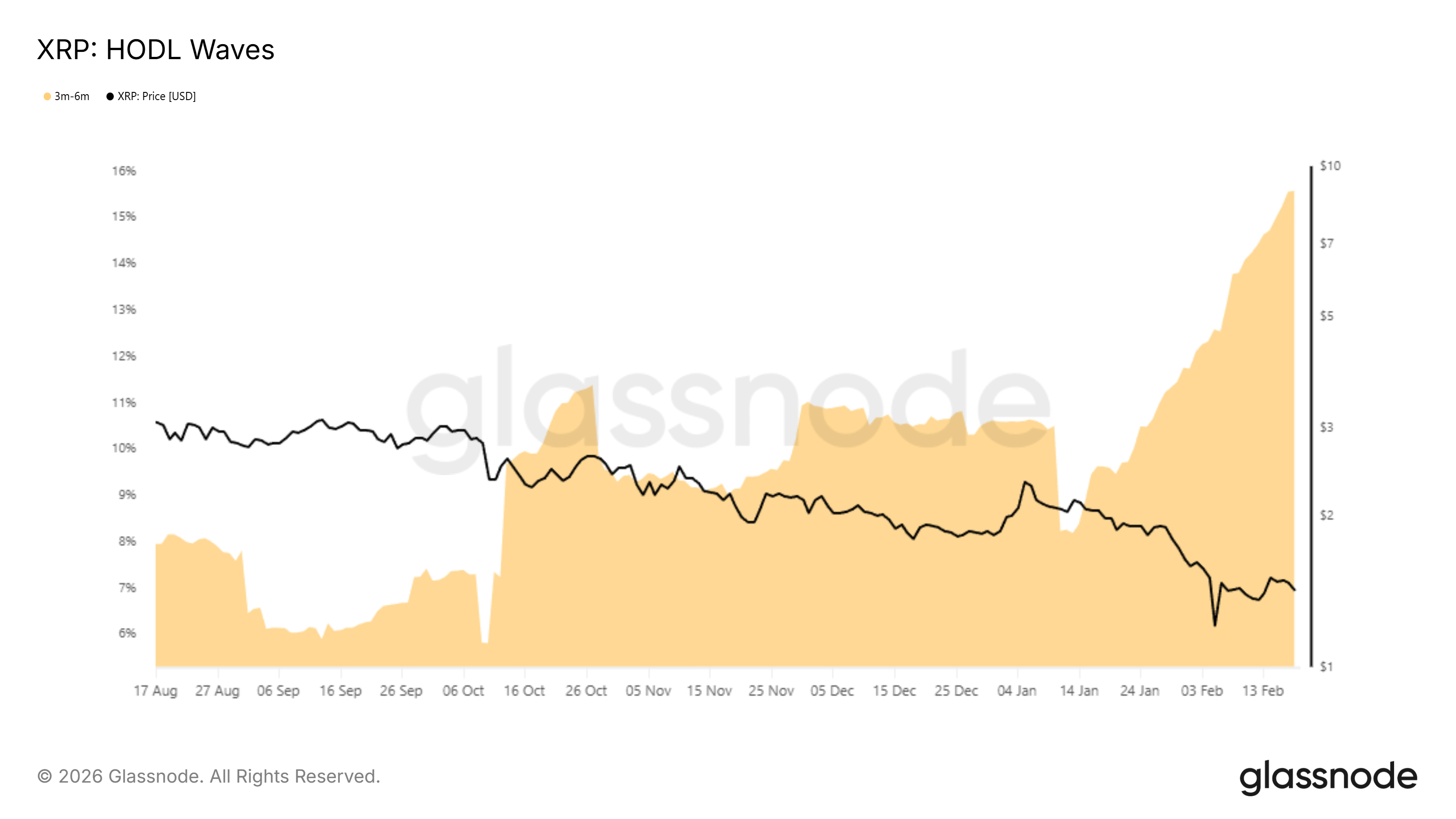

$XRP Holders Mature

Despite ongoing distribution, another cohort is showing resilience. Many $XRP holders remain underwater but are choosing to HODL rather than liquidate. This behavior suggests conviction among mid-term investors.

The three-month to six-month holding group has expanded notably. Their share of total $XRP supply increased from 8% to 15%. As these wallets mature, their reluctance to sell may counterbalance panic-driven distribution and stabilize price action.

$XRP HODL Waves">

$XRP HODL Waves">

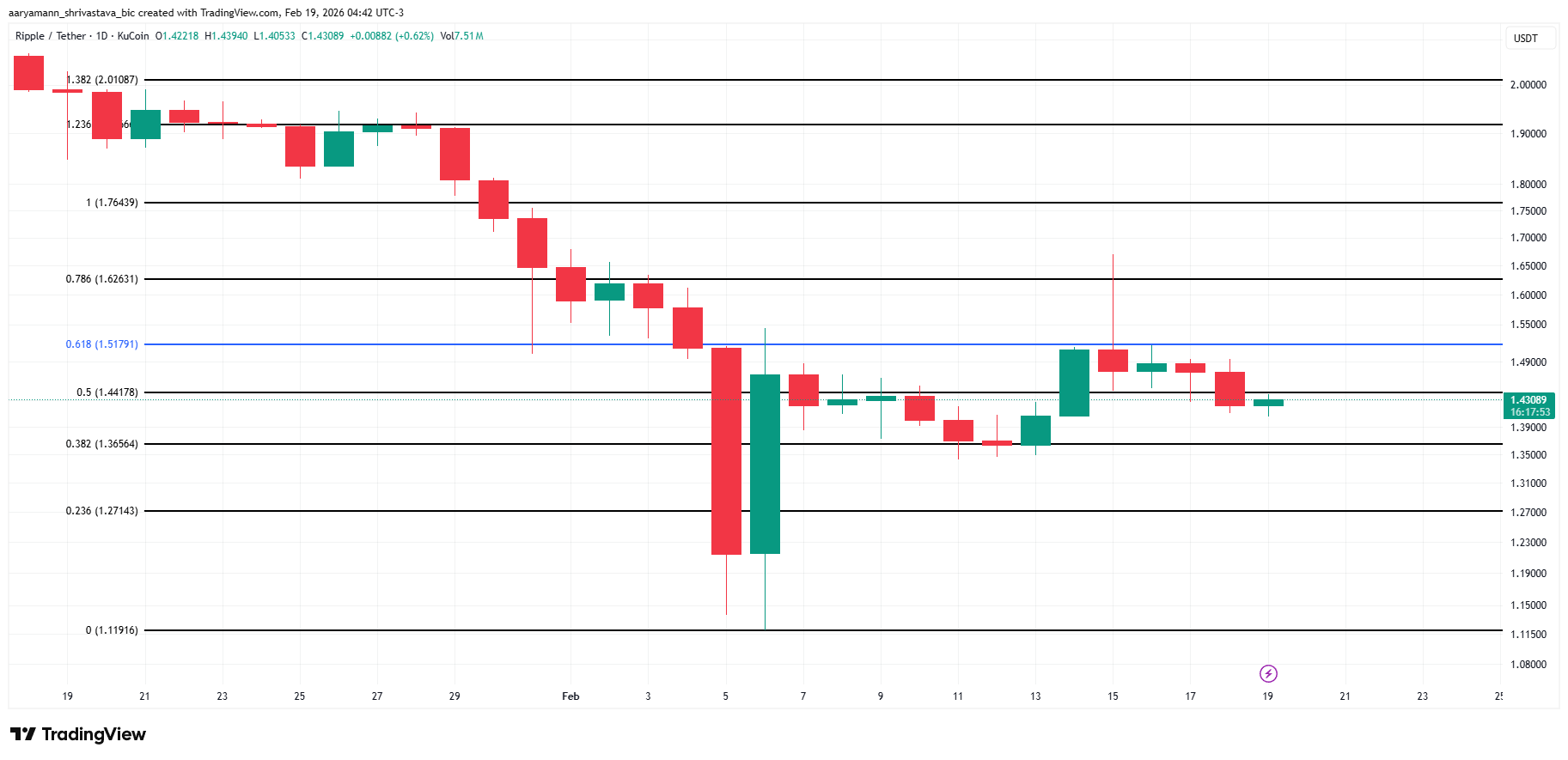

$XRP Price To Likely Consolidate

$XRP is trading at $1.43 at the time of writing. The token remains below the $1.51 resistance, which aligns with the 61.8% Fibonacci retracement level. Reclaiming this barrier as support would signal technical improvement and potentially ignite recovery.

For now, consolidation appears more likely. The $1.44 and $1.27 levels represent key support zones. Continued rejection near $1.51 may keep $XRP range-bound between these thresholds. Selling pressure from loss-making investors could reinforce this sideways structure.

$XRP Price Analysis">

$XRP Price Analysis">

However, sentiment can shift quickly in crypto markets. If short sellers lose control and $1.51 flips into support, upside potential expands. A breakout could push $XRP above $1.62 and attract momentum buyers. Such a move would invalidate the immediate bearish thesis and alter the short-term market structure.

The post $XRP Is Coiled Under $1.51—And $47 Million in Shorts Are on the Line appeared first on BeInCrypto.

beincrypto.com

beincrypto.com