- $XRP price reverted from $1.5 resistance amid renewed selling pressure within the formation of falling channel pattern.

- Crypto Sentiment Turns Bearish for Bitcoin and Ethereum, While $XRP Sees Surge in Optimism.

- Amid current market correction, the 20-and-50-day exponential moving average acts as dynamic resistance against $XRP buyers.

$XRP, the native cryptocurrency of the $XRP ledger, plunged 3.56% during Wednesday’s U.S. market hours to trade at $1.42. The selling pressure follows broader market weakness amid the geopolitical tension in the middle east. Despite the intraday sell-off, the social media sentiment surrounding $XRP witnessed a notable spike, indicating a bullish outlook towards this asset following recent partnership expansion announcements. Is altcoin poised for a bullish rebound?

$XRP Defies Market Slowdown With Rising Social Sentiment

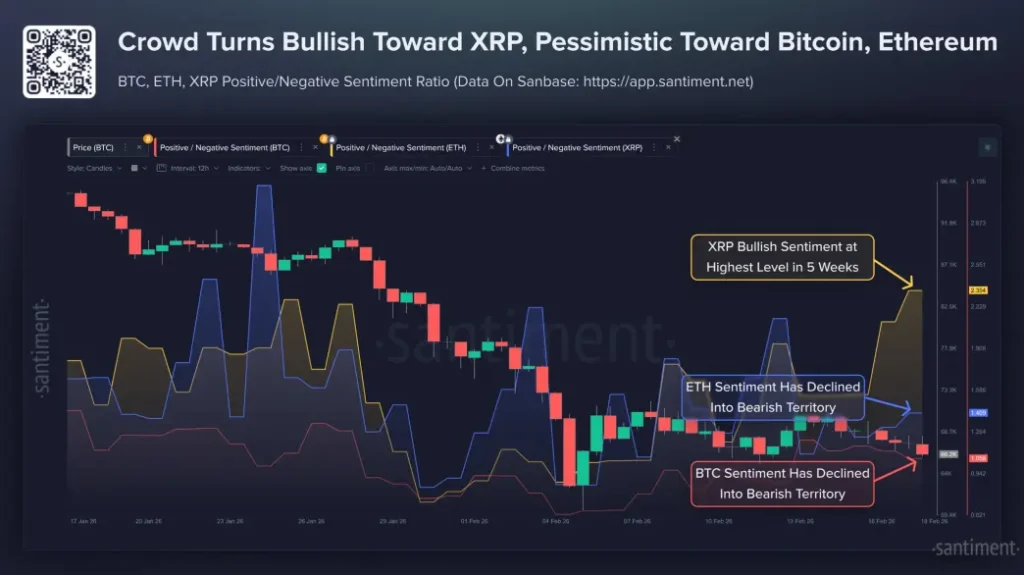

Social media chatter in the cryptocurrency space shows a contrasting divide in how traders feel in the current state of the market slowdown. Data tracked by Santiment has shown that discussions around Bitcoin and Ethereum have become significantly more negative in the past few days with critical postings far more prevalent than supportive ones and positive to negative ratios of crypto assets veering well into the pessimistic range.

Bitcoin commentary in particular shows a lot of frustration as prices are hanging around without much upward momentum, and Ethereum has done a similar thing in terms of moving towards bearish territory as measured by the social platforms.

$XRP, however, buckles this trend quite noticeably. Online mentions have shifted to the positive, best balanced in more than a month. This shift is coupled with Ripple’s string of new partnerships, such as with Aviva Investors to explore tokenizing traditional fund structures on $XRP Ledger, along with other expansions in custody and institutional infrastructure that seem to have fueled the renewed interest.

These patterns highlight the manner in which particular developments on a network can lead to divergent perceptions by those online at times of general caution. However, historical trend shows that cryptocurrency price has often moved in contrast to market sentiment, suggesting the $XRP price remains at a risk of prolonged correction.

$XRP Price Faces a Downside Risk of 28% if this Resistance Hold

Last weekend, the $XRP price showcased a decisive breakout attempt from the $1.5 resistance but failed to sustain higher levels. A long-wick rejection candle this barrier suggests intact sell-the-bounce sentiment among investors which is commonly spotted in an established downtrend.

The overhead supply has pushed the coin price 6.8% down to currently trade at $1.42. The downsloping trend of daily exponential moving averages (20, 50, 100, and 200) indicate the path to least resistance is down.

With sustained selling, the $XRP price could plunge another 28% and test the bottom trendline of a falling channel pattern at $1. Since July 2025, the coin price has been resonating actively within the pattern’s two parallel-walking trendlines as they offer dynamic resistance and support.

On the contrary, if buyers managed to defend the immediate support at $1.34, and $1.22, the coin price could rebound and rechallenge the channel resistance at $1.78. A bullish breakout from this barrier to drive a sustainable recovery in $XRP.

Also Read: Ethereum Solana $XRP Price Analysis as Altcoin Sell Pressure Hits 5-Year Extreme

cryptonewsz.com

cryptonewsz.com