The bedrock of modern investing—the classic 60/40 stock-bond portfolio—may no longer be the safe haven investors once trusted.

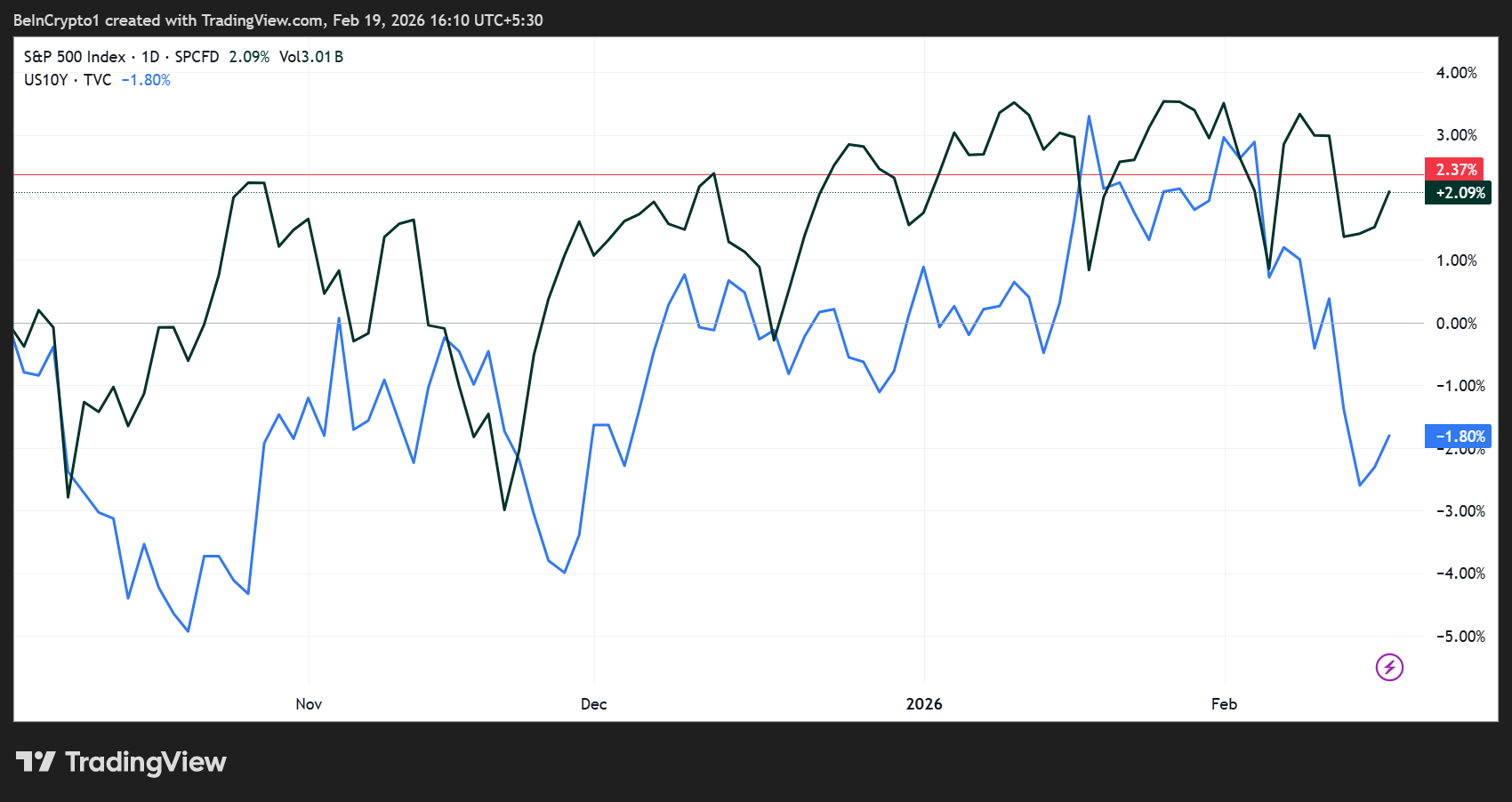

Since the pandemic began, stocks and bonds have increasingly moved in lockstep during market stress. This has eroded decades of conventional diversification and created a new playing field of risk for institutional and retail investors alike.

Why Stocks and Bonds No Longer Cushion Portfolios: The Rise of Gold and Silver

The International Monetary Fund (IMF) warns that this breakdown in traditional hedging strategies is reshaping financial markets.

“Diversification has become more difficult in recent years. Stocks and bonds increasingly sell off together, weakening a core hedge that investors relied on for decades. This shift raises new risks for investors and financial stability,” the IMF said in a post detailing its analysis.

Historically, bonds offered a buffer against falling equity prices. When stock markets dipped, investors would flock to Treasuries, stabilizing portfolios and dampening losses.

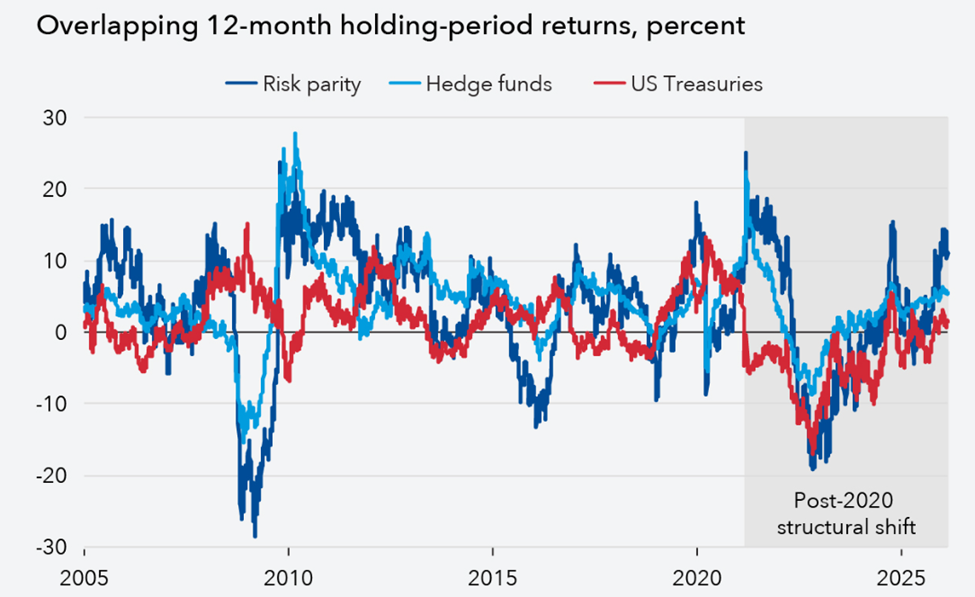

That inverse relationship enabled pension funds, insurers, and risk-parity strategies to operate under predictable volatility assumptions.

However, that relationship began to unravel in late 2019, accelerating with the onset of the pandemic. Today, sharp market selloffs see stocks and bonds declining simultaneously, compounding losses and amplifying volatility.

The implications are profound. Hedge funds and risk parity strategies that rely on historical correlations may now face forced deleveraging during crises.

Even traditionally conservative institutions (think pension funds and insurance companies) are increasingly exposed to unexpected swings, raising systemic risks.

Gold, Silver, and Alternative Assets Emerge as Portfolios’ New Lifelines

As conventional hedges falter, investors are pivoting toward non-sovereign assets. Gold has more than doubled since early 2024, while silver, platinum, and palladium have surged in recent quarters. Currencies such as the Swiss franc are also attracting attention as alternative safe havens.

“The IMF admits the diversification benefits of bonds have evaporated! Investors must adjust accordingly! Buy scarce assets!” Jeroen Blokland, a market strategist, remarked.

Underlying the shift is a complex web of economic pressures. Expanding bond supply to finance widening fiscal deficits, elevated term premiums, and slower central bank balance-sheet runoff have all eroded the protective qualities of sovereign debt.

Inflation above target in many advanced economies has further weakened bonds’ appeal as a hedge.

The IMF emphasizes that the solution is not simply buying alternatives. Policymakers must restore confidence in fiscal and monetary frameworks.

Central banks can intervene to stabilize bond markets during crises. However, such emergency measures carry limits.

Without credible fiscal discipline and sustained price stability, sovereign bonds cannot reliably anchor portfolios in turbulent times.

This means rethinking risk entirely. Diversification strategies must now account for rising correlations between traditional assets, and portfolios increasingly need exposure to commodities and private assets—albeit with their own risks.

The era of automatic hedges is over. Gold, silver, and other non-sovereign stores of value are no longer just diversifiers. They are emerging as critical stabilizers in an increasingly unpredictable market.

The post IMF Warns Classic Portfolio Diversification Collapses as Gold and Silver Stabilize Markets appeared first on BeInCrypto.

beincrypto.com

beincrypto.com