Shiba Inu trades under pressure as price struggles below mid-band resistance, with subdued open interest signaling cautious sentiment.

Shiba Inu ($SHIB) is currently trading at $0.000006216, down by 4.7% over the past 24 hours, reflecting heightened short-term bearish pressure. The 24-hour daily range spans from $0.000006218 to $0.000006525, highlighting a relatively tight but clearly downward-trending session. Price action shows $SHIB initially attempted to stabilize near the upper end of its range before gradually sliding lower, now trading near the bottom of the daily band.

Further performance metrics show $SHIB is down 3.2% over 14 days, although it remains up 2.5% in the last 7 days, indicating some short-term bounce attempts within a broader weakening structure. Additionally, longer-term pressure remains evident with a 21.8% decline over 30 days. Traders will now be watching whether $SHIB can reclaim the upper boundary of its daily range.

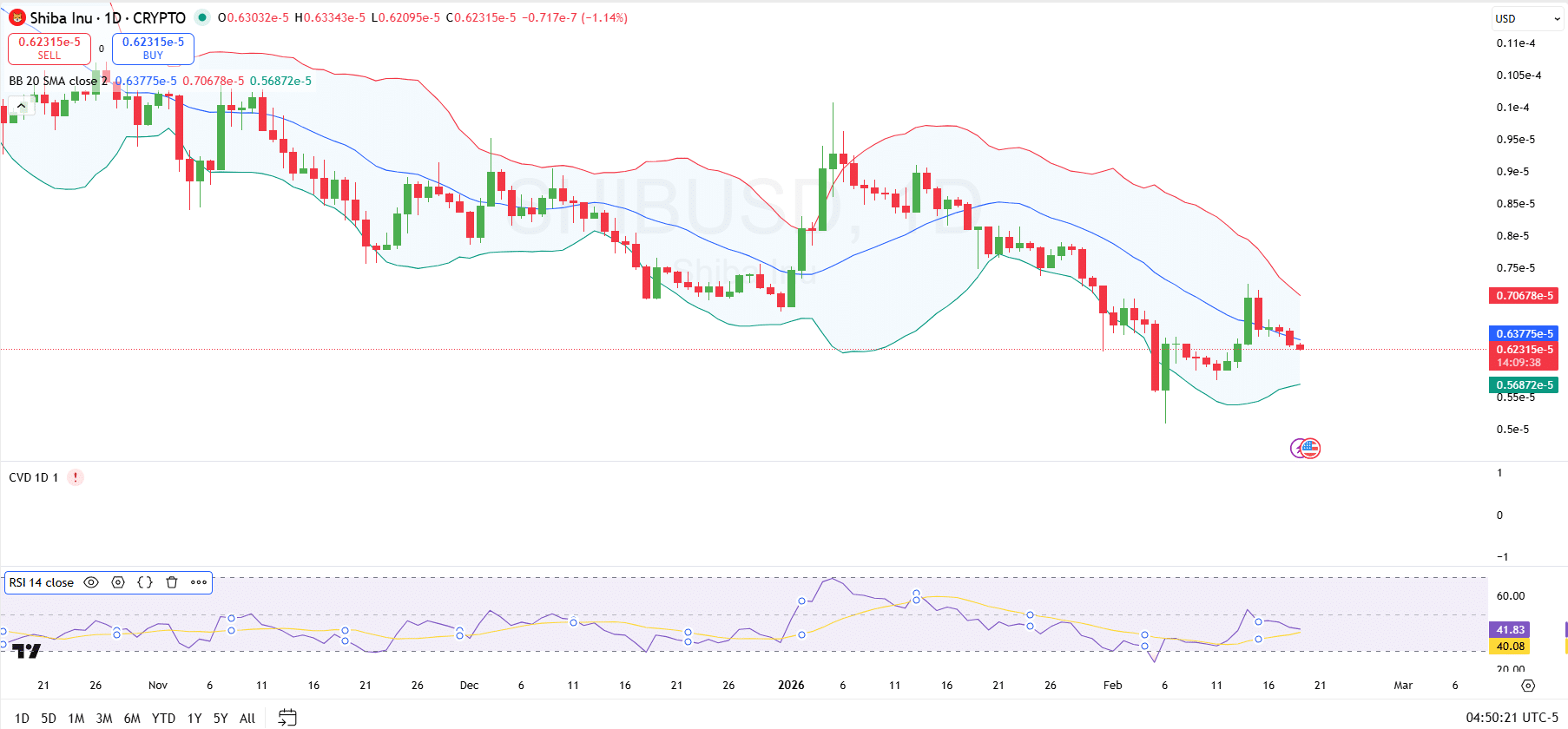

Shiba Inu Price Analysis

On the daily chart, Shiba Inu remains under broader bearish pressure, with price trading just below the middle Bollinger Band (around $0.00000638) and well beneath the upper band near $0.00000706. The lower Bollinger Band sits near $0.00000569, which now acts as immediate dynamic support.

A breakdown below this area could expose deeper support around the recent swing low near $0.0000051, while a move back above the middle band would be the first sign of short-term recovery strength.

In terms of resistance, the middle Bollinger Band represents the first key hurdle for bulls. If $SHIB reclaims and sustains above that level, the next upside target would likely be the upper band near $0.0000070. However, repeated failures near the mid-band suggest sellers are still active on rallies. The overall band structure is currently contracting, indicating volatility is cooling.

Looking at momentum, the RSI (14) is hovering around 41–42, below the neutral 50 level. This places $SHIB in weak-to-neutral territory, reflecting lingering bearish momentum but not oversold conditions. For a stronger bullish case, RSI would need to push above 50 and hold, signaling a shift in momentum.

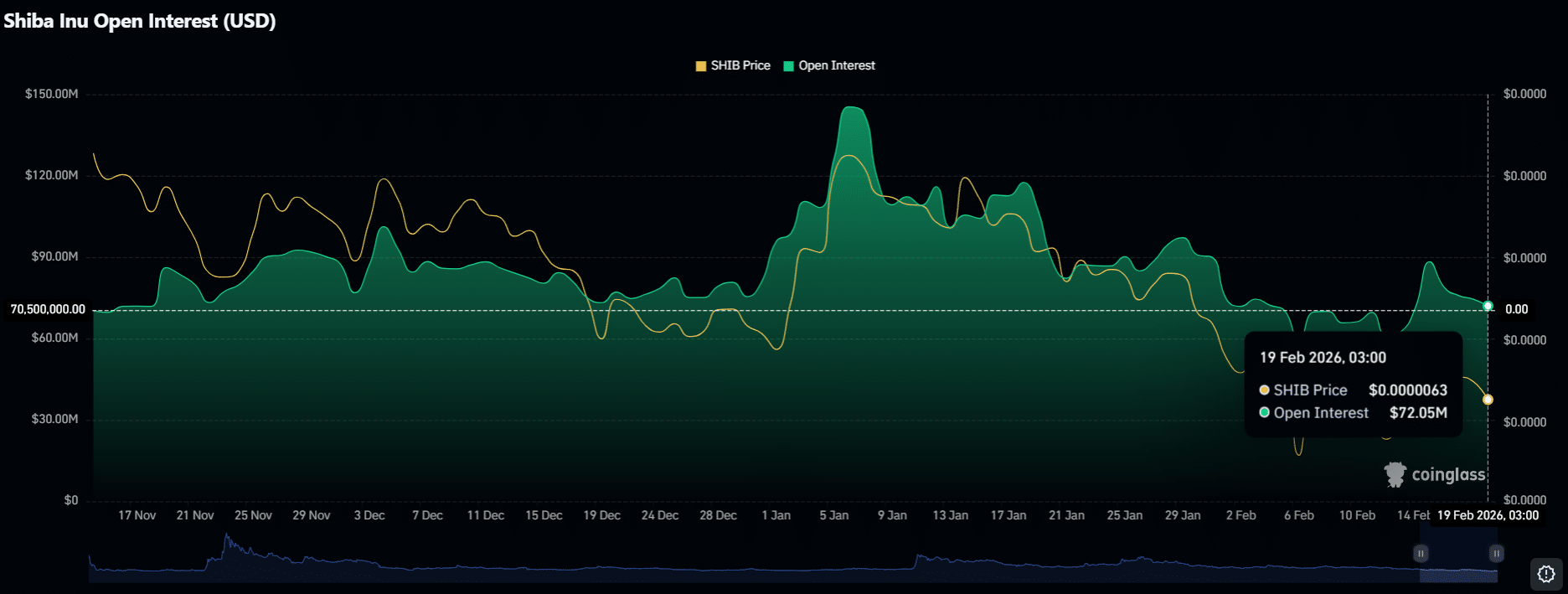

Shiba Inu Open Interest

Shiba Inu’s open interest data shows derivatives positioning has remained relatively subdued compared to earlier spikes, reflecting cautious sentiment among leveraged traders. As of Feb. 19, open interest sits around $72 million, notably lower than the early January peak when it surged above $140 million alongside a notable price rally.

The decline in open interest through late January and early February coincided with weakening price action, indicating long liquidations and reduced risk appetite. While there has been a minor rebound in positioning over the past few sessions, it remains modest relative to previous highs. This implies that traders are not aggressively building new leveraged exposure yet, keeping overall momentum muted.

For a stronger bullish case to develop, a sustained rise in open interest alongside upward price movement would be a key signal, pointing to fresh capital entering the market.

thecryptobasic.com

thecryptobasic.com