Global markets are reacting sharply to rising geopolitical tensions in the Middle East, as reports suggest the US could be moving closer to a direct military confrontation with Iran.

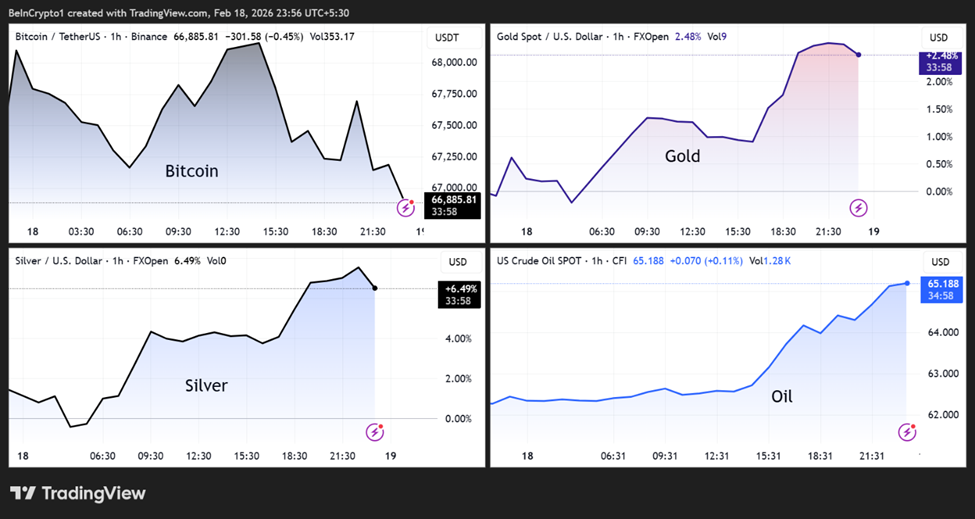

Safe-haven assets such as gold and silver are climbing, oil prices are rising on supply fears, and Bitcoin is slipping as traders rotate away from risk-sensitive assets.

Iran Military Buildup Fuels Market Anxiety

Recent intelligence and media reports indicate that any potential conflict would not be a limited strike. Rather, it would be a broader, weeks-long campaign if launched, raising concerns about prolonged volatility across commodities, equities, and crypto.

According to Axios analysis, evidence is mounting that a conflict could be imminent, with Israel reportedly preparing for a scenario of “war within days,” which could involve a “weeks-long ‘full-fledged’ war” and a joint US–Israeli campaign broader in scope than previous operations.

BREAKING: Axios reports that there is evidence that US war with Iran is "imminent" and Israel is preparing for a scenario of "war within days," which is expected to include:

— The Kobeissi Letter (@KobeissiLetter) February 18, 2026

1. Weeks-long "full-fledged" war unlike the Venezuela operation, sources say

2. Joint US-Israeli…

The same report noted that US forces in the region now include “2 aircraft carriers, 12 warships, hundreds of fighter jets, and multiple air defense systems.” This is in addition to more than 150 cargo flights transporting weapons and ammunition.

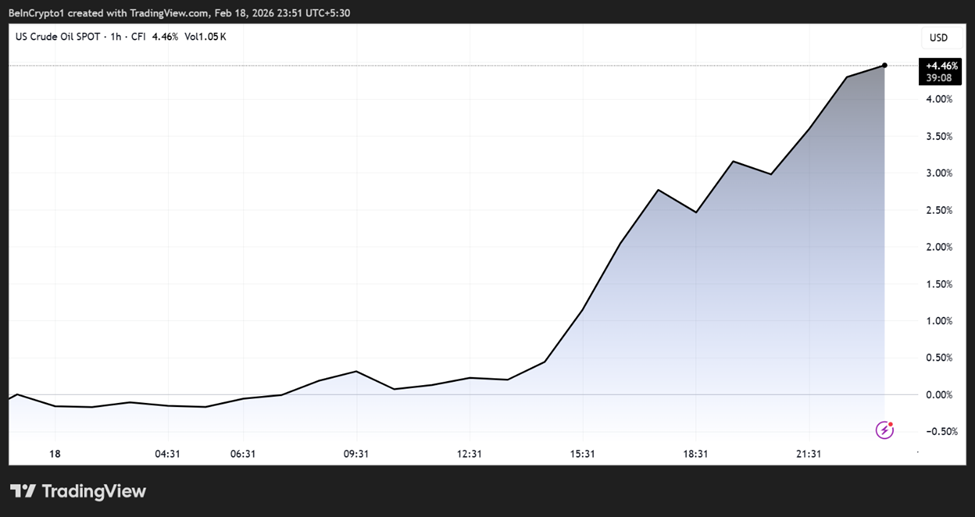

Oil prices reportedly surged above $64 per barrel following the news.

Separate commentary similarly described the US as being on the brink of a large-scale conflict, with stalled nuclear negotiations and a growing military presence increasing the risk of imminent action.

U.S. ON BRINK OF WAR WITH IRAN

— *Walter Bloomberg (@DeItaone) February 18, 2026

The Trump administration is moving closer to a large-scale conflict with Iran, with officials warning strikes could come within weeks.

Donald Trump has combined stalled nuclear talks with a major U.S. military buildup in the region, including… pic.twitter.com/2mcfo8ZSa6

The assessment suggested that strikes could come within weeks if diplomacy collapses, with Donald Trump’s advisers continuing talks but failing to close key gaps.

Oil and Precious Metals Rally

Commodity markets have been the most immediate beneficiaries of the rising geopolitical risk premium.

Oil, Gold and Silver all up thanks to news around Trump attacking Iran soon.

— Kirttan Shah (@KirtanShahCFP) February 18, 2026

Analysts tracking market moves reported that gold, silver, and oil all advanced as tensions escalated. Silver posted some of the strongest gains among major assets.

“The precious metals sector has so far been the primary beneficiary of heightened US attack concerns,” commented commodities strategist Ole Hansen, adding that gold is trading above $5,000 while silver and platinum have also recorded significant gains.

Oil markets are also reacting to the possibility of disruptions in the Strait of Hormuz, through which roughly one-fifth of global oil supply moves.

Even the perception of risk to this route tends to trigger sharp price swings, amplifying volatility across energy markets.

Bitcoin Slips as Risk Appetite Weakens

While traditional safe havens rallied, cryptocurrencies moved in the opposite direction. Bitcoin fell below the critical support of $67,014 and was trading for $66,384 as of this writing.

This divergence, where Bitcoin slumps while gold, silver, and oil advance, reflects a broader risk-off shift in investor sentiment.

$BTC) Price Performance">

$BTC) Price Performance">

The divergence highlights a recurring pattern in periods of geopolitical stress: capital often flows first into commodities and cash-like instruments before returning to higher-beta assets such as crypto.

Debate Over the Likelihood and Consequences of War

Despite the buildup, some analysts remain skeptical that a full-scale war will materialize. Nigerian tech entrepreneur Mark Essien argued that a prolonged conflict would be far more complex than previous campaigns.

Trump starting a bombing campaign against Iran would break my understanding of how his admin works. It does not really make sense. The U.S can obviously win, but then what? The next cadre of leaders is still variants of the same people. Iran invented the best weapon of the last… https://t.co/fGqBc9z1pw

— Mark Essien (@markessien) February 18, 2026

Based on this, Essien warns that Iran’s drone capabilities and potential insurgency could make the situation difficult to resolve quickly. Meanwhile, domestic opposition in the US is also visible.

“Americans do not want to go to war with Iran!!! They want to be able to afford their lives and get ahead,” wrote former congresswoman Marjorie Taylor Greene.

At the same time, geopolitical risks may be expanding beyond a bilateral confrontation. Reports cited by defense analysts suggest that China could be providing Iran with intelligence and navigation support, potentially complicating the regional strategic balance.

🚨 BREAKING: Reports suggest China is assisting Iran with advanced intelligence and surveillance capabilities, including satellite imagery, navigation support, and potentially real-time tracking of U.S. military movements.

— Defence Journal (@Defence_Journl) February 18, 2026

China may be providing access to its BeiDou navigation… pic.twitter.com/KvdF962O5U

With peace talks continuing but showing little sign of a breakthrough, markets are preparing for prolonged uncertainty. Traders are increasingly pricing in the possibility that any military action would be larger, longer, and more disruptive than recent conflicts.

It explains why commodities are reflecting fear, cryptos are reflecting caution, and global investors are watching diplomatic developments closely.

Whether diplomacy prevails or tensions escalate further may determine the direction of oil and gold, as well as the next major trend across global financial markets.

The post Weeks-Long War With Iran Could Start Within Days: Bitcoin Under Pressure, But Gold, Silver, Oil Prices Surge appeared first on BeInCrypto.

beincrypto.com

beincrypto.com