Bitcoin has seen an increase in its dominance of crypto trading activity, as altcoin volume drops 50% from previous levels.

The crypto market is still trying to catch its breath after months of steady pressure that has dragged prices down since Q4 2025. Traders are looking for signs of relief, but the mood remains cautious. New data now shows a change in investors’ trading activity.

According to market data, activity has swung heavily toward Bitcoin, while interest in altcoins has cooled off sharply. Meanwhile, over the past three weeks, the Bitcoin dominance has declined by 2.23%, indicating that the higher volume could be translating to stronger selloffs.

Key Points

- As the crypto market grapples with the consistent bearish pressure, data shows trading activity has tilted more toward Bitcoin.

- Bitcoin accounted for 36.8% of total Binance trading volume on Feb. 7 and has maintained this lead, compared to 35.3% for altcoins and 27.8% for Ethereum.

- Altcoin trading volume fell from 59.2% in November to 33.6% by Feb. 13, marking nearly a 50% contraction.

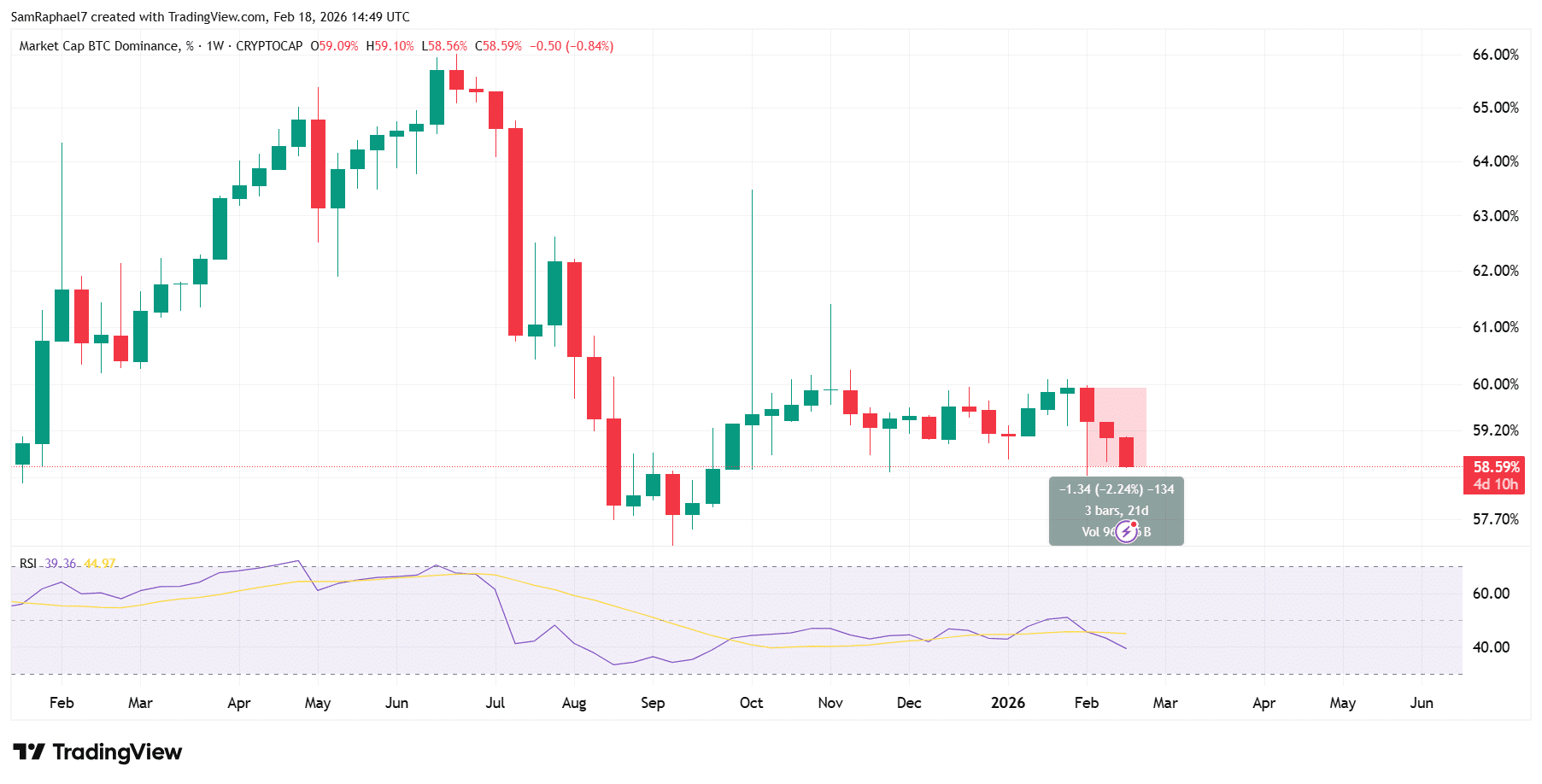

- However, over the past three weeks, the Bitcoin dominance has declined by 2.23%, dropping from 59.93% to 58.59% after rising throughout January.

- This suggests that the increased trading activity surrounding Bitcoin could be translating to greater selloffs, not higher accumulation.

Bitcoin Seeing Increased Trading Activity

According to Darkfost, a CryptoQuant verified author, Bitcoin now trades in the $72,000 to $65,000 range after a sharp drop. At the time of writing, the crypto firstborn changes hands at $67,305, well within the range.

Inside this zone, whales, long-term holders, and institutional investors show increased trading appetite. He explained that during heavy corrections or the final stretch of bear markets, investors often pull money out of altcoins and move it into Bitcoin.

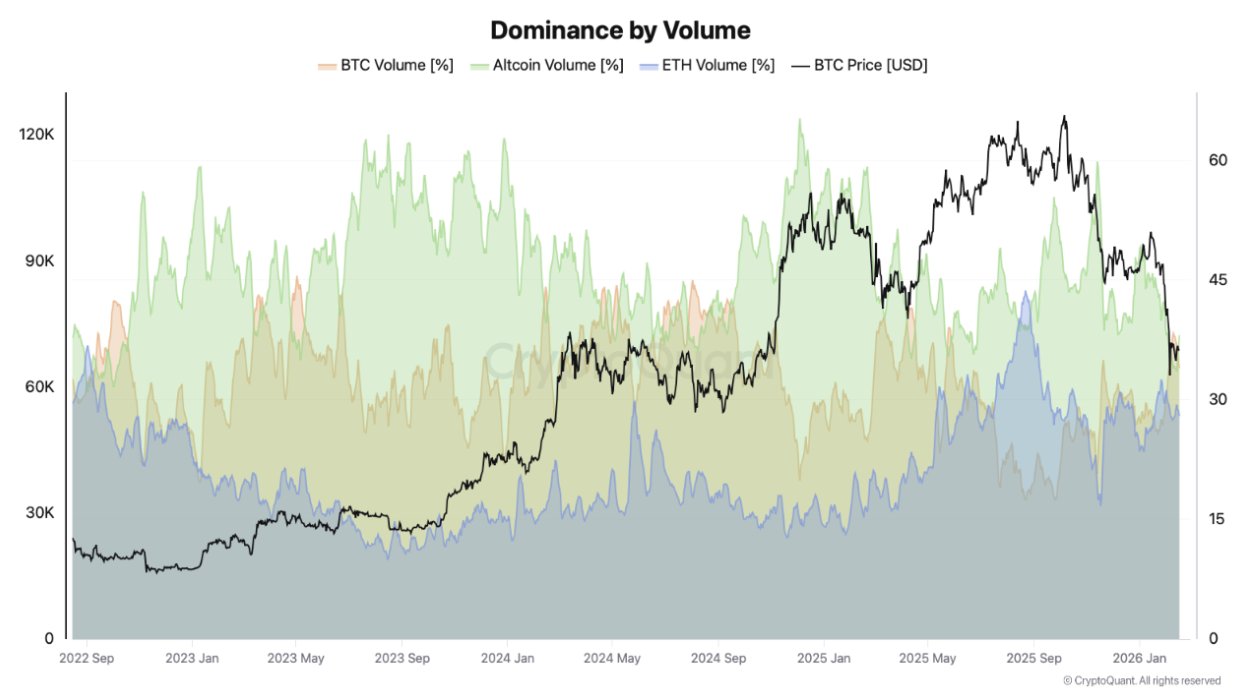

To show this trend, Darkfost highlighted trading volumes on Binance across three groups: $BTC, ETH, and other altcoins. He pointed out that Binance regularly records some of the highest volumes in the market, which makes it a strong reference point for tracking investor behavior.

Altcoin Volume Shrinks by 50%

When Bitcoin climbed back above $60,000, the balance of trading activity changed. On Feb. 7, Bitcoin reclaimed the largest share of Binance trading volume, making up 36.8% of total exchange activity. This lead has continued up to now. Within the same period, altcoins accounted for 35.3%, while Ethereum represented 27.8%.

Altcoins felt the impact during the change. In November, they made up 59.2% of Binance trading volume. By Feb. 13, that figure had dropped to 33.6%, showing an almost 50% contraction in activity.

Darkfost noted that similar patterns showed up in earlier correction periods, including April 2025, August 2024, and October 2022, near the close of the bear market. He added that Bitcoin’s share of trading volume often rises when uncertainty and stress hit the market. During such moments, investors tend to lean toward $BTC.

Market Data Shows Bitcoin Suffering Heavier Selloffs

While Darkfost’s analysis points to capital rotating into Bitcoin, market data suggests that the situation may be different.

Specifically, the Bitcoin dominance has actually declined during this period. In the first week of February, Bitcoin dominance stood at 59.93%. At the time of writing, it sits at 58.59%, marking a 2.23% drop over three weeks. This decline followed a steady rise throughout January.

In addition, at the start of February, Bitcoin’s market cap stood at $1.54 trillion. It has since fallen nearly 13% to $1.34 trillion. Meanwhile, the altcoin market cap (TOTAL2) dropped from $1.03 trillion to $951 billion during the same period, a smaller decline of 5.18%.

These figures show that Bitcoin has taken heavier losses than the broader altcoin market, even though it controls a larger share of exchange trading volume. This suggests the surge in Bitcoin activity may reflect stronger selling rather than aggressive buying.

thecryptobasic.com

thecryptobasic.com