The Cardano price shows mixed signals as it faces resistance, with several potential scenarios potentially unfolding based on market momentum and trends.

Cardano ($ADA) is changing hands at $0.2841 today, with a decline of 0.91% over the past day. The price has experienced some volatility during the day, ranging between $0.278 and $0.287, reflecting a moderate daily range.

In terms of performance, Cardano’s 7-day performance has seen some improvement with an 8.61% gain. However, the trend has been downward over the past 30 days, showing a 24.35% loss, and a 38.65% drop over the past 90 days.

The trading volume over the past 24 hours has been $57.74 million in spot trading, while the futures market has seen a significantly higher volume of $593.37 million. This suggests that more aggressive trading is happening in the derivatives market, which could indicate anticipation of future price movements.

Moving forward, traders will be looking closely at the key price levels and market trends for potential movements in the near term.

Cardano Price Prediction

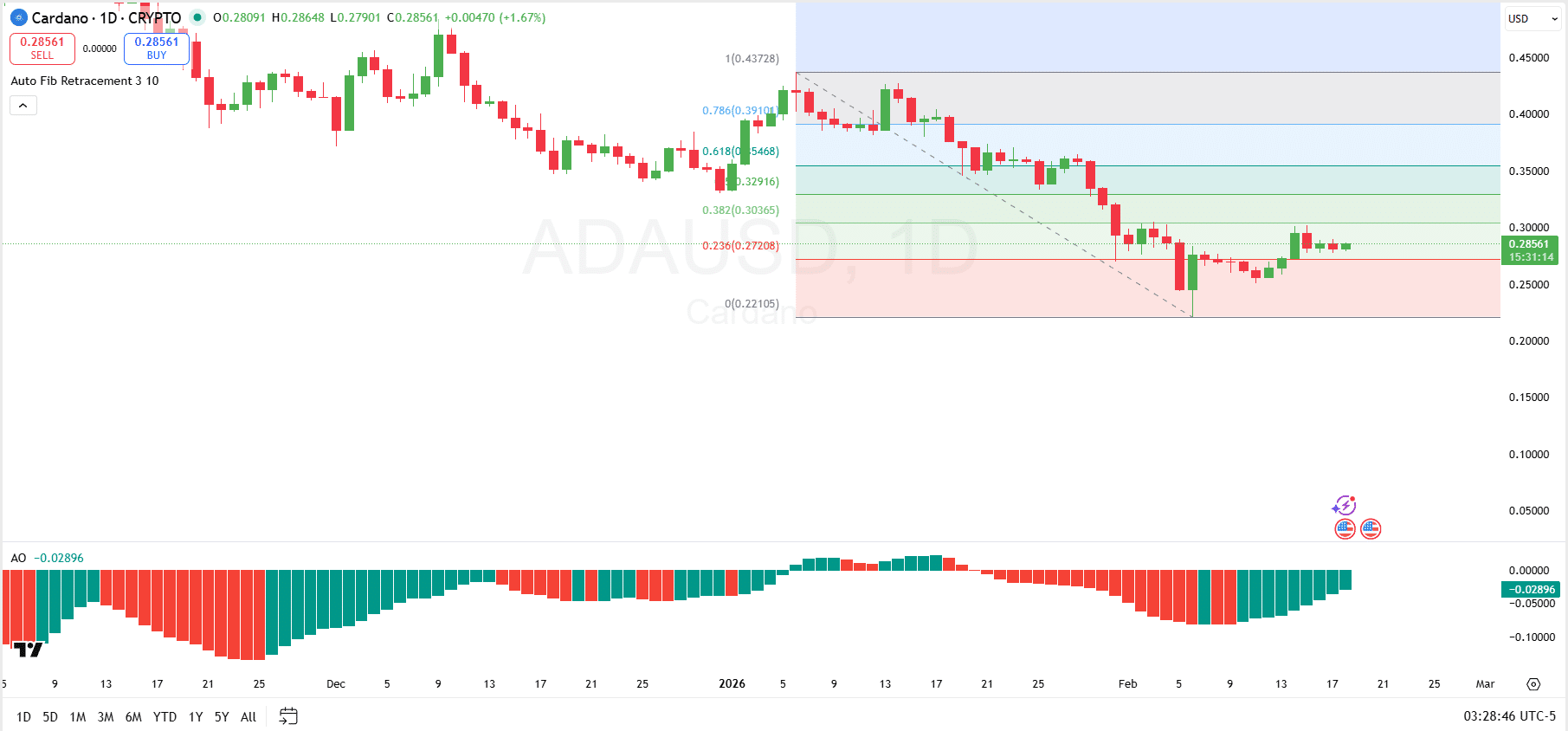

From a technical perspective, Cardano is currently facing resistance around the 0.382 Fibonacci level, which sits at $0.30365. This level marks a key area where $ADA has struggled to break through in the past few days. If Cardano manages to break this resistance, it could potentially continue its upward movement toward the next Fibonacci level at $0.32916, which is the 0.5 level.

This would open the door for further upside, with a broader target of $0.35468 at the 0.618 Fibonacci retracement level. However, $ADA has not yet decisively broken the $0.30365 resistance, and failure to do so could lead to further consolidation or even a potential decline.

On the downside, Cardano has found support at the 0.236 Fibonacci level, which corresponds to a price of $0.27208. This support level previously acted as short-term resistance but has now flipped into support. If $ADA were to break below this support level, it could test lower levels near the $0.22105 level.

Looking at the Awesome Oscillator, which shows a negative reading of -0.02896, the indicator is confirming bearish momentum in the market. The AO’s red bars turned green, suggesting that selling pressure is fading. For further bullish confirmation, the AO would need to surge to positive readings.

$ADA Open Interest Still Declining

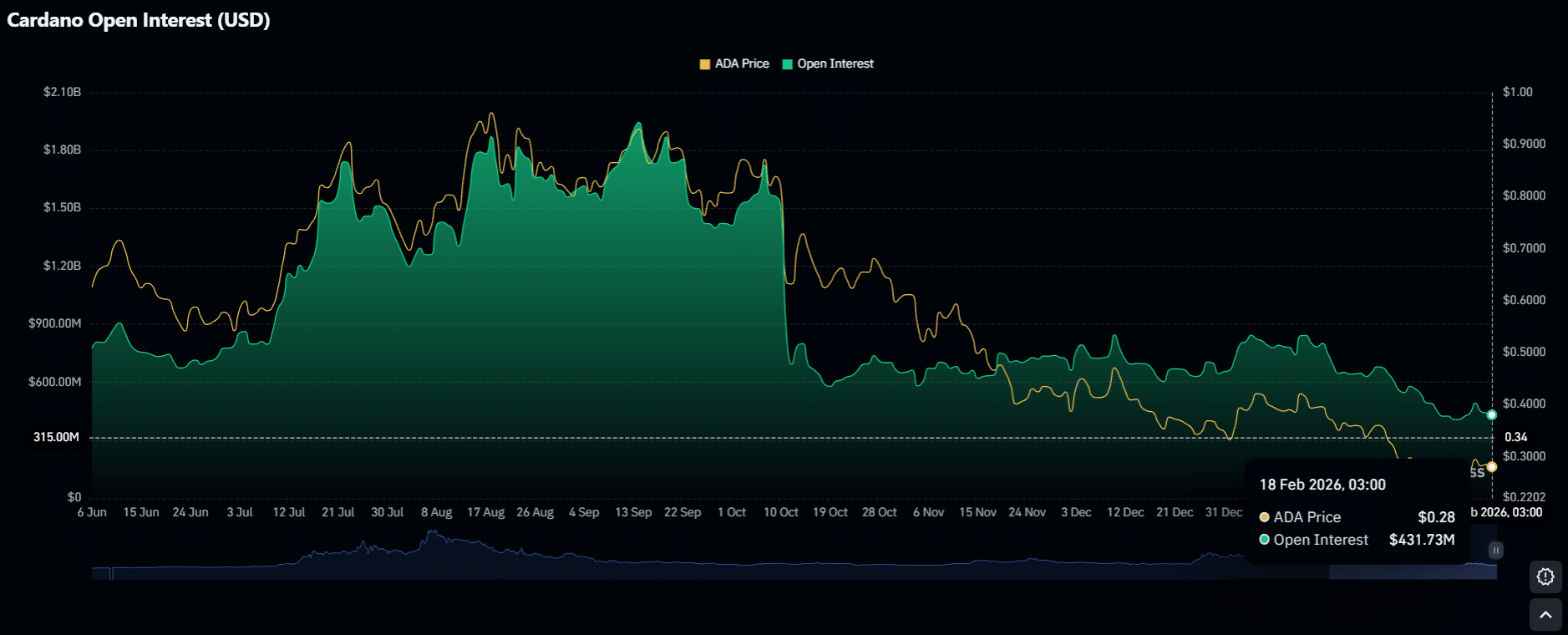

Per data from Coinglass, Cardano’s open interest has been showing a declining trend over the past weeks. Open interest peaked from mid-July to mid-October 2025, but has since steadily dropped, mirroring the decreasing $ADA price. Currently, the open interest stands at $431.73 million, which is a significant decrease from its previous highs of over $1.95 billion.

As open interest continues to drop, it suggests a weaker market sentiment, potentially causing further volatility unless there is a reversal in market activity. This is a critical indicator to watch, as Cardano’s potential to stabilize or rise significantly in price may depend on whether open interest starts to increase again.

thecryptobasic.com

thecryptobasic.com