The long-term perspective for Cardano is now in focus, as the price is sitting at a historical demand zone with bullish implications.

This long-term base price level has cushioned weak momentum, serving as a catalyst for a price recovery in the past. As a result, holding it is promising for $ADA. As long as this scenario continues, analysts expect an impressive rebound in the future.

Key Points

- The long-term perspective for Cardano is now in focus, as the price is sitting at a historical demand zone with bullish implications.

- This long-term base price level has cushioned weak price momentum and served as a catalyst for a price recovery in the past.

- Cardano bounced from this support in June 2023, rallying over 6x to the cycle’s high of $1.32 in December 2024.

- $ADA could see a long-term gain of 200% if it revisits the previous resistance level around $0.7914.

- The projected rebound hinges on several conditions, one of which is a broader market cycle recovery.

Cardano Nears Historical Demand Zone

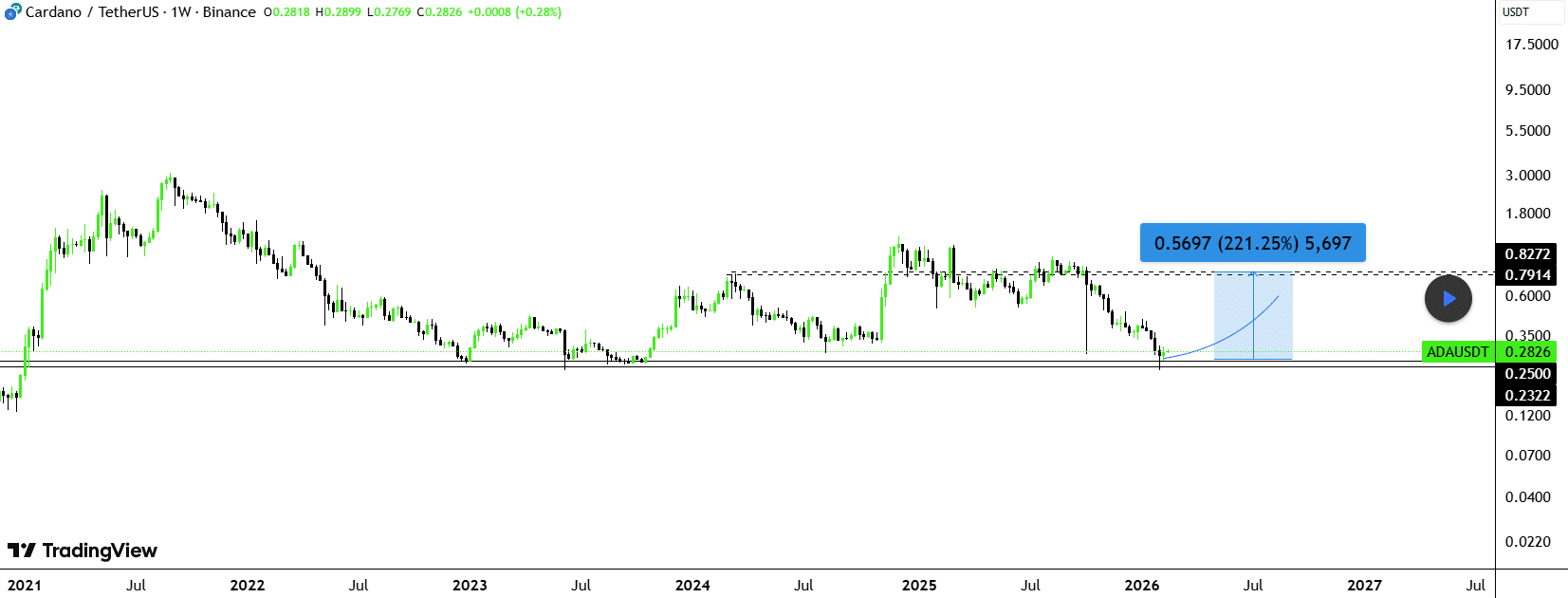

A TradingView outlook from a pseudonymous yet prominent analyst indicates that $ADA is consolidating around a historical demand zone. An accompanying chart shows the coin trading at $0.2826, near a key support level at $0.250.

The demand zone holds significant importance for Cardano, as it has served as a bedrock for major price recoveries in the past. Notably, this level is near its previous bear-market lows, cushioning prices when sentiment was very sour.

In the past, Cardano bounced from this level, rallying over 6x to the cycle’s high of $1.32 in December 2024. The chart shows that before the final bounce in June 2023, the coin first touched this support in December 2022 and also recovered considerably.

Long-Term Scenarios

The Tuesday analysis is also expecting Cardano to follow this pattern in the long term. The analyst sees the current level as a base from which it will rally when market conditions turn favorable.

Specifically, she projects an over 200% long-term return if $ADA revisits the previous resistance level around $0.7914. The price zone closely aligns with the March 2024 highs of $0.798 and $0.810.

Requirements for Rally

Furthermore, the pseudonymous analyst noted that the projected rebound hinges on several conditions, one of which is a broader market cycle recovery.

Despite being one of the major assets in the crypto market, $ADA still has a small market share, with Bitcoin and Ethereum dominating the scene. As a result, Cardano would need these two assets to spearhead a recovery attempt before mirroring their price action.

Another requirement is that Cardano holds above the historical demand zone. The coin briefly fell below it on February 6 to reach $0.2205 before rebounding considerably. If it does not close below this support on significant timeframes, then this move to $0.7914 remains possible.

Further, the analysis also indicated a risk-on market condition as a catalyst. If macroeconomic factors look favorable, investors could increase exposure to risk assets like Cardano, which may bring fresh liquidity.

thecryptobasic.com

thecryptobasic.com