$MYX Finance has entered a critical phase after weeks of intense selling pressure. The token has suffered a steep decline amid broader bearish crypto market conditions.

Heavy profit-taking and forced exits accelerated the fall. $MYX has now become a focal point of concern among traders

$MYX Finance Token Forms History

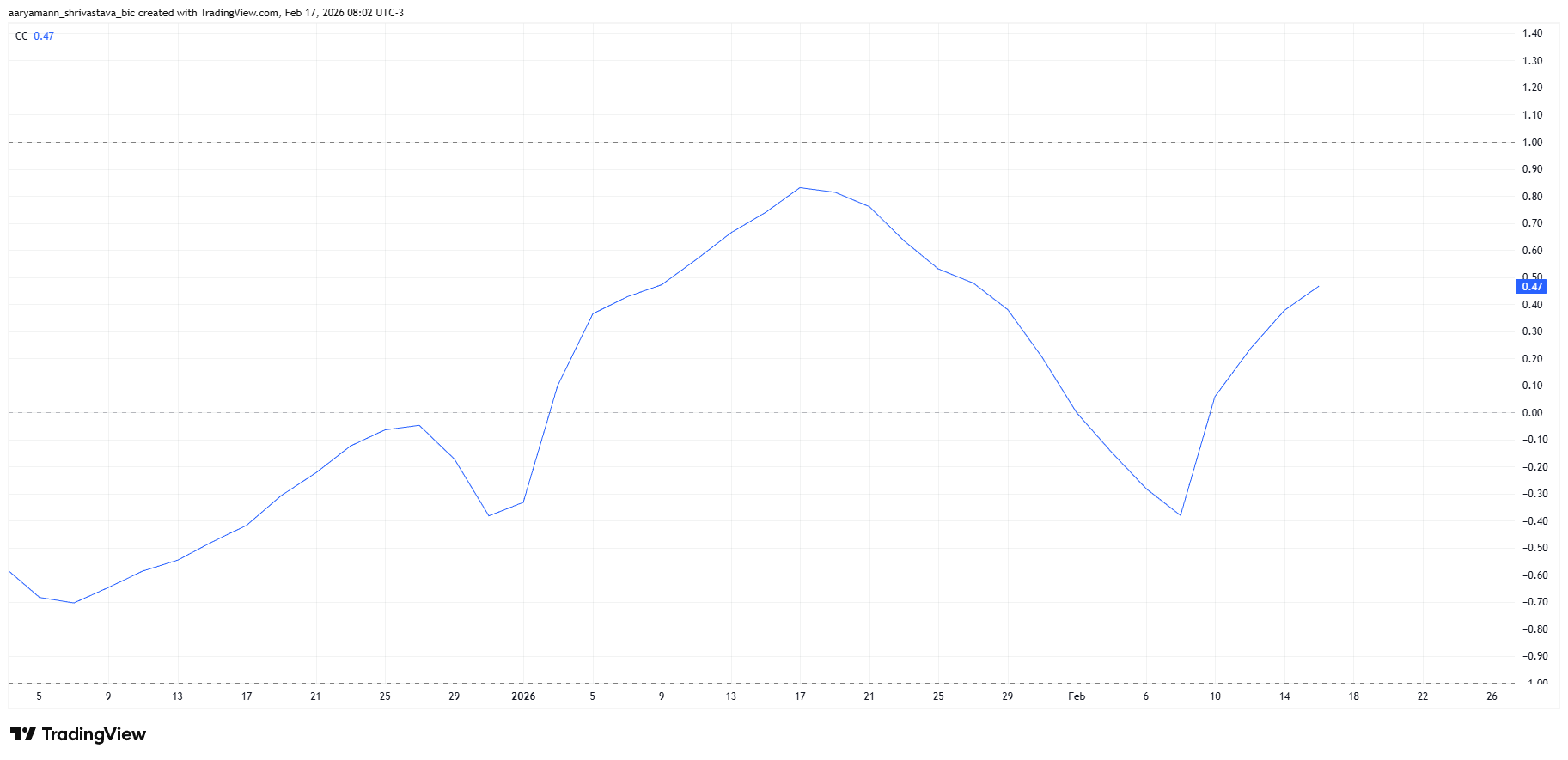

$MYX’s correlation with Bitcoin has shifted sharply since February 8. The coefficient improved from negative 0.42 to positive 0.47. This change indicates that $MYX is increasingly tracking Bitcoin’s price movements.

However, this alignment presents risk. Since February 8, Bitcoin has remained in consolidation without meaningful recovery. A stronger positive correlation suggests $MYX may continue mirroring Bitcoin’s weakness. Without a BTC breakout, bearish conditions could persist for $MYX.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

$MYX Correlation To Bitcoin">

$MYX Correlation To Bitcoin">

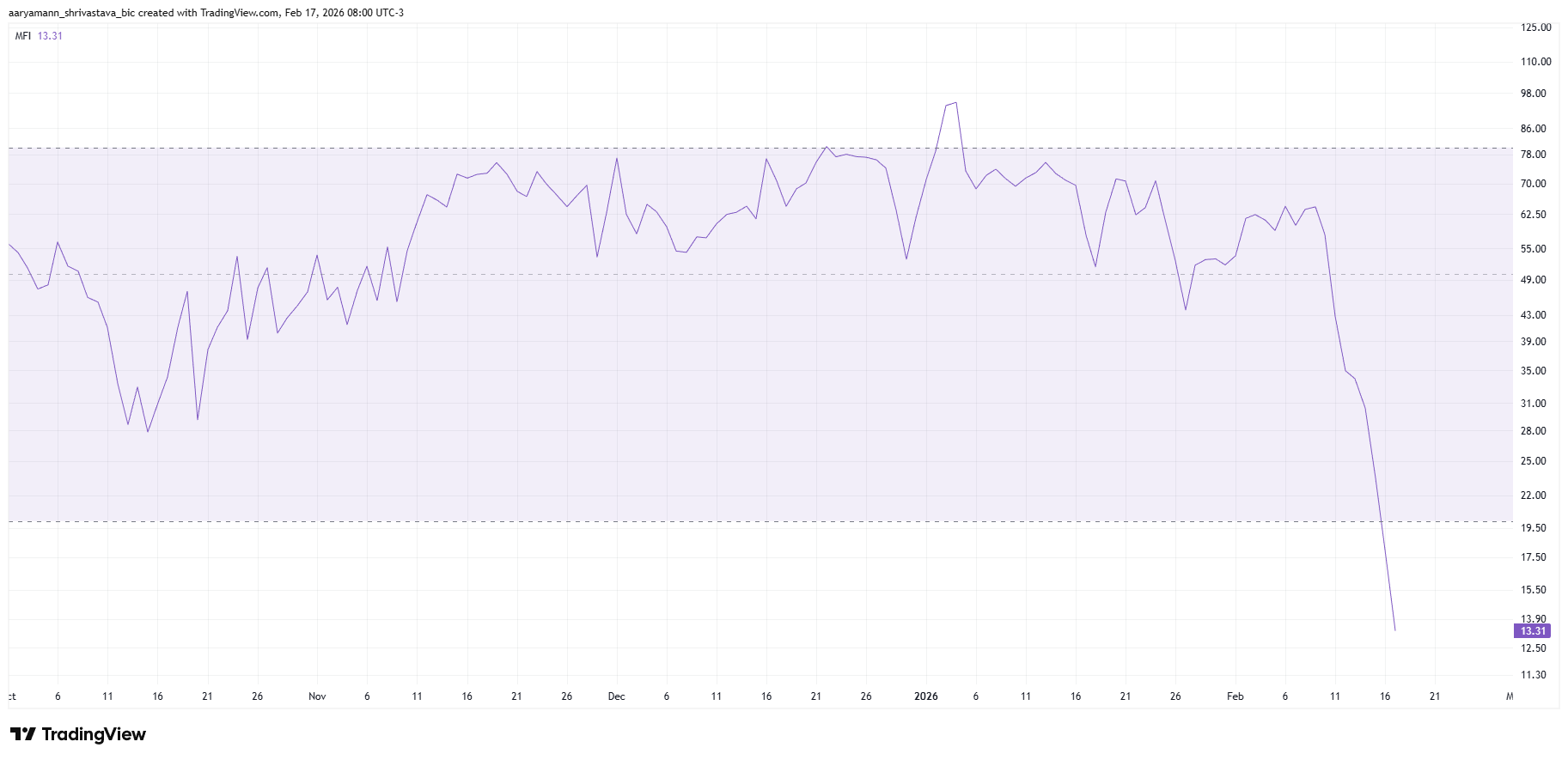

The Money Flow Index highlights the intensity of recent selling. The indicator shows severe capital outflows as investors rushed to exit positions. Panic selling, combined with leveraged liquidations, intensified downward pressure.

This wave of capitulation has pushed $MYX into oversold territory for the first time in its trading history. Typically, oversold conditions suggest selling may slow as value-focused buyers step in. In many cases, such readings precede short-term relief rallies.

$MYX MFI">

$MYX MFI">

However, context matters. Oversold signals alone do not guarantee immediate recovery. Broader market weakness and fragile sentiment could delay accumulation. If Bitcoin fails to stabilize, $MYX may struggle to attract fresh capital despite extreme technical readings.

$MYX Price Bounce Back Unlikely

$MYX price is down nearly 30% in the past 24 hours. The token trades at $1.50 at the time of writing. This sharp drop compounds a 70% decline recorded since February 8, reinforcing the scale of the correction.

Current technical and macro signals suggest further downside risk. Continued correlation with Bitcoin and persistent outflows could pressure $MYX lower. A retest of the $1.22 level appears plausible before oversold conditions trigger meaningful stabilization.

$MYX Price Analysis. ">

$MYX Price Analysis. ">

Conversely, investor behavior could shift sooner than expected. If holders halt selling and begin accumulating at discounted levels, momentum may change. Reclaiming the $1.68 support level would mark an early recovery signal. A confirmed bounce could open $MYX price’s path toward $2.01 and potentially higher, invalidating the prevailing bearish outlook.

The post $MYX Finance Is Oversold For The First Time Ever, Yet No Relief In Sight appeared first on BeInCrypto.

beincrypto.com

beincrypto.com