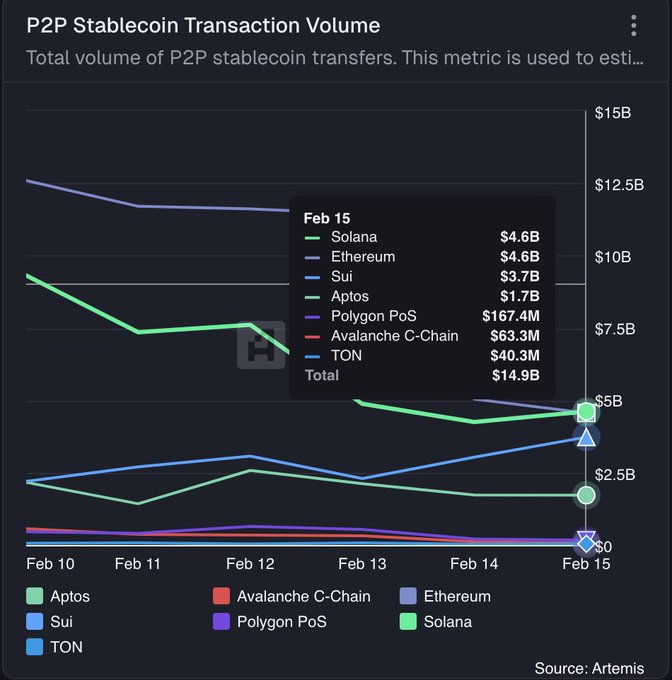

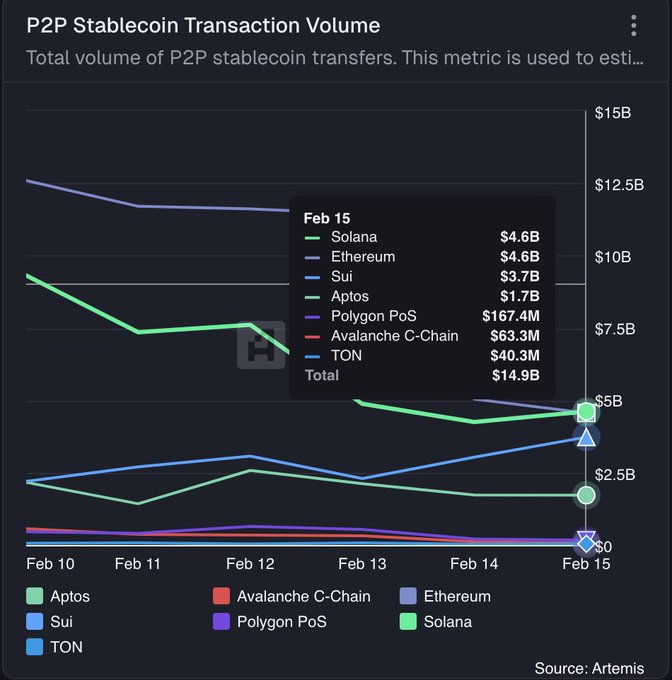

$SUI ranks 3rd on 7D P2P stablecoin transactions at $3.7B just after eth.

invezz.com

2 h

invezz.com

2 h

Sui trades around $0.96, just below the dollar mark, as it continues to grapple with bearish pressure that has seen most cryptocurrencies hover below recent highs.

Yet despite the current weakness, analysts continue to eye a return toward the $2 level.

The outlook remains positive despite market sentiment continuing to fluctuate between risk-off conditions and potential technical recoveries.

$SUI has experienced consistent downward pressure since peaking around May and again in September/October 2025.

The token has mirrored the broader market downturn since Bitcoin hit a peak above $126,000, ahead of the bloodbath on October 10, 2025.

As the bellwether crypto asset plunged to lows of $60k, $SUI followed suit.

In the past three to four months, the altcoin fell below key support levels at $3 and $2.

The latest leg of the downside action sees the token struggle with resistance around the psychological $1 mark.

Prices may yet drop to new multi-year lows.

However, analysts point to the technical outlook as one that portends a potential bullish reversal in the coming weeks.

Oversold conditions in momentum indicators support this.

The Relative Strength Index (RSI) is moving off the oversold line, and the Moving Average Convergence Divergence (MACD) has formed a bullish crossover on the daily chart.

Movement in recent sessions has also indicated an upward trend as the prices respect the support of the Bollinger Bands and the key downtrend line.

As the chart above shows, $SUI at current prices hovers within a potential bounce zone - despite prevailing market conditions.

The technical picture for Sui highlights a possible bounce.

However, whether $SUI can reclaim key levels above $2 and sustain a move higher depends on a number of factors.

Beyond chart patterns, the next move for bulls hinges on what happens across the ecosystem.

Stablecoin adoption amid fresh traction across real-world assets and tokenization paints a scenario where network growth sparks $SUI price movement toward its peak of $5 and beyond.

$SUI ranks 3rd on 7D P2P stablecoin transactions at $3.7B just after eth.

Meanwhile, initiatives such as partnering with Coinbase to bring the Sui token standard to institutions, builders, and everyday users highlight long-term potential.

Cryptocurrencies currently mirror broader risk assets and so remain sensitive to macroeconomic and geopolitical trends.

Risk appetite across the digital asset sector has resulted in Bitcoin and Ethereum prices being constrained at around $70,000 and $2,000.

Solana and XRP also show similar price trajectories, with analysts at Standard Chartered slashing 2026 price targets amid macro headwinds and ETF outflows.

Strength in the wider market often ripples through to mid- and small-cap tokens, offering a tailwind for recovery.

Conversely, a protracted downturn or liquidity crunch could complicate efforts to hold higher price levels.