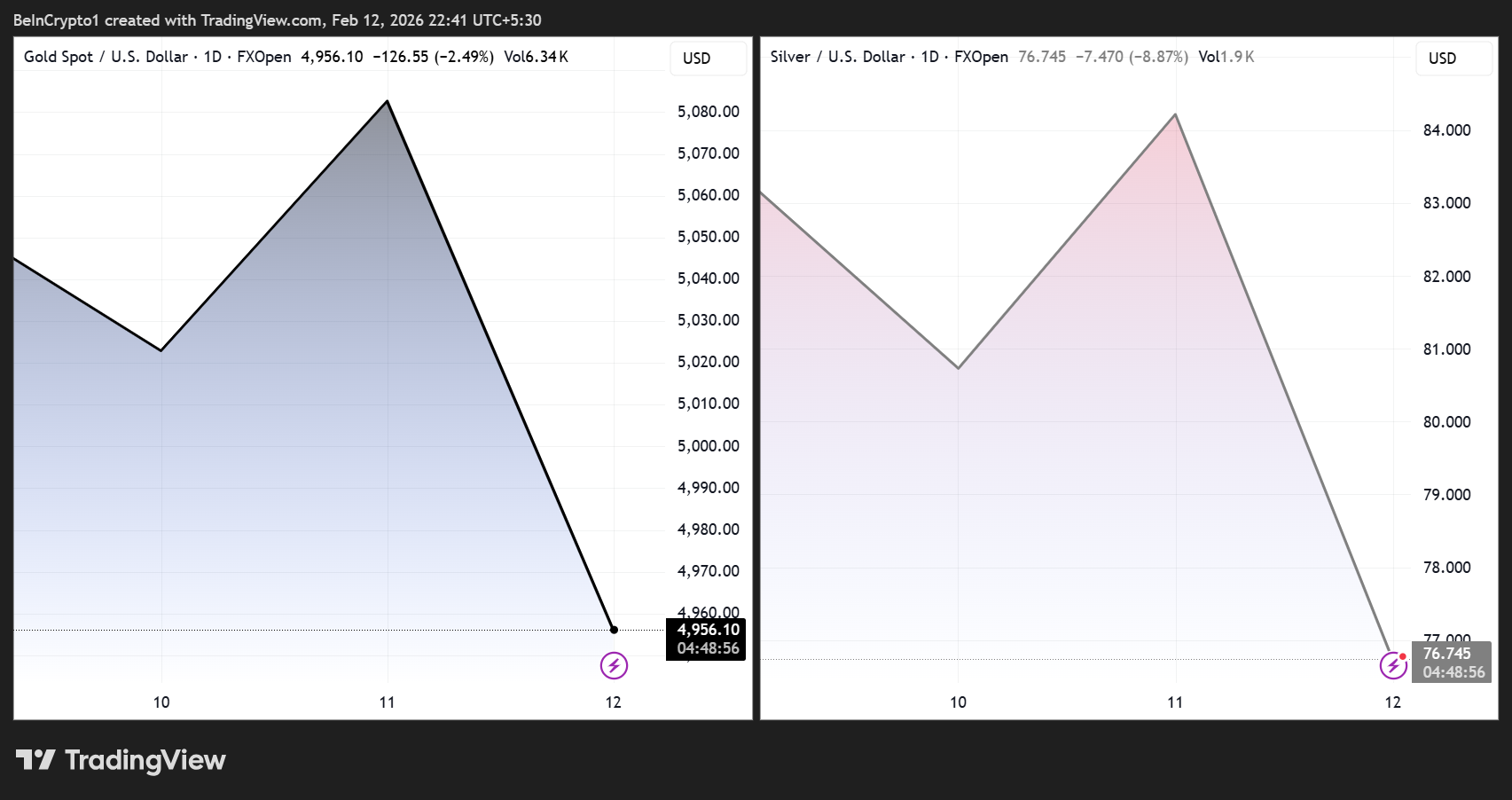

Gold and silver tumbled sharply on Thursday, rattling markets already on edge amid surging US financial stress.

Spot gold dropped by more than 3% while silver plunged by more than 10%, reversing a portion of their recent rally.

Bad News for Gold and Silver Amid Record US Debt and Rising Bankruptcies

As of this writing, gold was trading for $4,956, down 3.97% while silver exchanged hands for $76.74 after losing 10.65% in the last 24 hours.

The sudden sell-off has prompted analysts and investors to question whether a broader repricing of hard assets is unfolding.

The metals’ retreat comes amid intensifying economic stress. Over the past three weeks, 18 US companies with liabilities exceeding $50 million have filed for bankruptcy.

BREAKING: 9 large companies filed for bankruptcy in the US last week.

— The Kobeissi Letter (@KobeissiLetter) February 11, 2026

This brings the 3-week average to 6, the highest rate since the 2020 pandemic.

This means at least 18 companies with liabilities at or above $50 million have gone bankrupt over the last 3 weeks.

In the past,… pic.twitter.com/8XJB4BExGl

Notably, this is the fastest pace since the pandemic and approaches levels last seen during the 2009 financial crisis.

Meanwhile, the New York Fed said in a press release that household debt has reached a record $18.8 trillion, with mortgages, auto loans, credit card balances, and student loan balances all at historic highs.

NEW IN: U.S household debt increased by $191 billion in Q4 2025.

— Polymarket Money (@PolymarketMoney) February 12, 2026

Reaching a new all time high $18.8 trillion. pic.twitter.com/FjMOCkYNWm

Serious credit card delinquencies climbed to 12.7% in Q4 2025, the highest since 2011, with younger households under particular strain.

Such conditions typically emerge late in the economic cycle, often preceding policy interventions like rate cuts or liquidity injections.

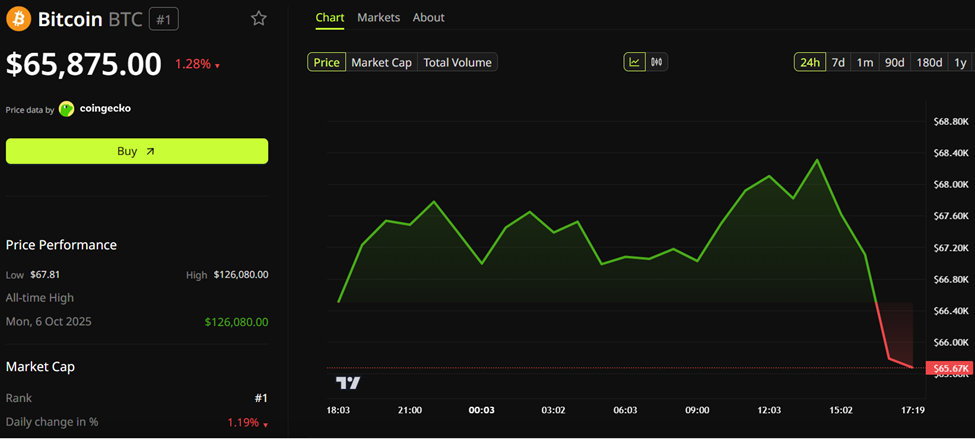

Bitcoin has also remained under pressure, falling to the $65,000 range as the pioneer crypto lags both equities and traditional safe-haven assets over the past few months.

$BTC) Price Performance">

$BTC) Price Performance">

While digital assets often present as a hedge against macroeconomic uncertainty, recent trends suggest they are not yet playing that role effectively in this cycle.

Analysts Split on Metals Sell-Off as Fed Watchers Eye Rate Cuts and Asset Repricing

Analysts are at a crossroads, offering differing interpretations of the metals’ pullback. Some argue it reflects short-term volatility within a broader trend of hard-asset repricing.

“Gold was repriced to $5,000 by the US, and markets caught up,” wrote macro analyst Marty Party, suggesting that authorities may be positioning precious metals to collateralize sovereign debt alongside digital assets like Bitcoin.

However, others caution that tight liquidity conditions remain dominant, and further weakness could emerge if financial stress continues to mount.

Policy watchers are closely monitoring the Federal Reserve’s potential response. Citi economists project softer job growth in spring and summer after January’s payrolls came in below expectations, which could create room for three rate cuts later in 2026.

U.S. JOB GROWTH TO SLOW, FED SEES RATE CUTS AHEAD

— *Walter Bloomberg (@DeItaone) February 12, 2026

Citi economists expect softer job growth in spring and summer after January’s 130,000 payroll gain, which beat consensus but fell short of Citi’s forecast. The weaker labor market should allow the Fed to resume rate cuts later… pic.twitter.com/tZQxrfIW4l

Historically, rising corporate bankruptcies and consumer delinquencies precede monetary easing. This suggests that official support could arrive once economic strain becomes more visible in the data.

The confluence of record household debt, accelerating bankruptcies, and declining hard-asset prices suggests a market at a critical inflection point.

“This economic decay, mirroring the indicators of 2008, is not an anomaly. It is the direct consequence of the current administration’s ideologically driven policies, prioritizing inflationary fiscal adventurism and social engineering over foundational economic stability and competitive market principles,” commented Jade Kotonono, a popular user on X.

Is the current precious metals crash a temporary correction or the early stages of a multi-year repricing? Some bullish analysts anticipate that once gold consolidates near $5,000, rotation back into digital assets could accelerate.

IMO: Gold was repriced to $5000 by the US and markets caught up. This supports my thesis that they will reprice hard assets to collateralize the soverign debt. This includes Bitcoin which will be accumulated, all unknown bad actors, overleveraged traders and OG sellers flushed… pic.twitter.com/CGUrxNaQ7b

— MartyParty (@martypartymusic) February 12, 2026

Notwithstanding, the current environment presents both opportunities and risks, and investors should conduct their own research.

With markets digesting unprecedented financial stress, gold, silver, and Bitcoin may fall further. Conversely, a stabilizing policy response could catalyze the next leg of the asset repricing cycle.

The post Gold and Silver Price Plunge as US Financial Crisis Signals Flash Red appeared first on BeInCrypto.

beincrypto.com

beincrypto.com