Is Cardano nearing a short-term flush, or is this just another leg lower in a broader downtrend?

Notably, Cardano ($ADA) is changing hands at $0.2551 as intraday bears accelerated activity into the session’s close. On the day, $ADA has moved within a tight lower band, recently sliding toward the $0.255 area after earlier attempts to stabilize above $0.263.

Market structure across higher timeframes reinforces the bearish tone. $ADA is down 12.07% over 7 days, 34.47% in the last 30 days, and a steep 53.11% over the past 90 days. Year-to-date performance stands at -23.18%, highlighting sustained structural pressure.

From a derivatives perspective, futures volume over 24 hours reached $709.16 million, compared to $66.34 million in spot volume, indicating elevated speculative activity relative to cash trading. Open interest sits near $408.24 million, suggesting positioning remains active despite declining price.

Will heavy long positioning fuel a short squeeze bounce, or is $ADA setting up for another downside flush before true stabilization begins?

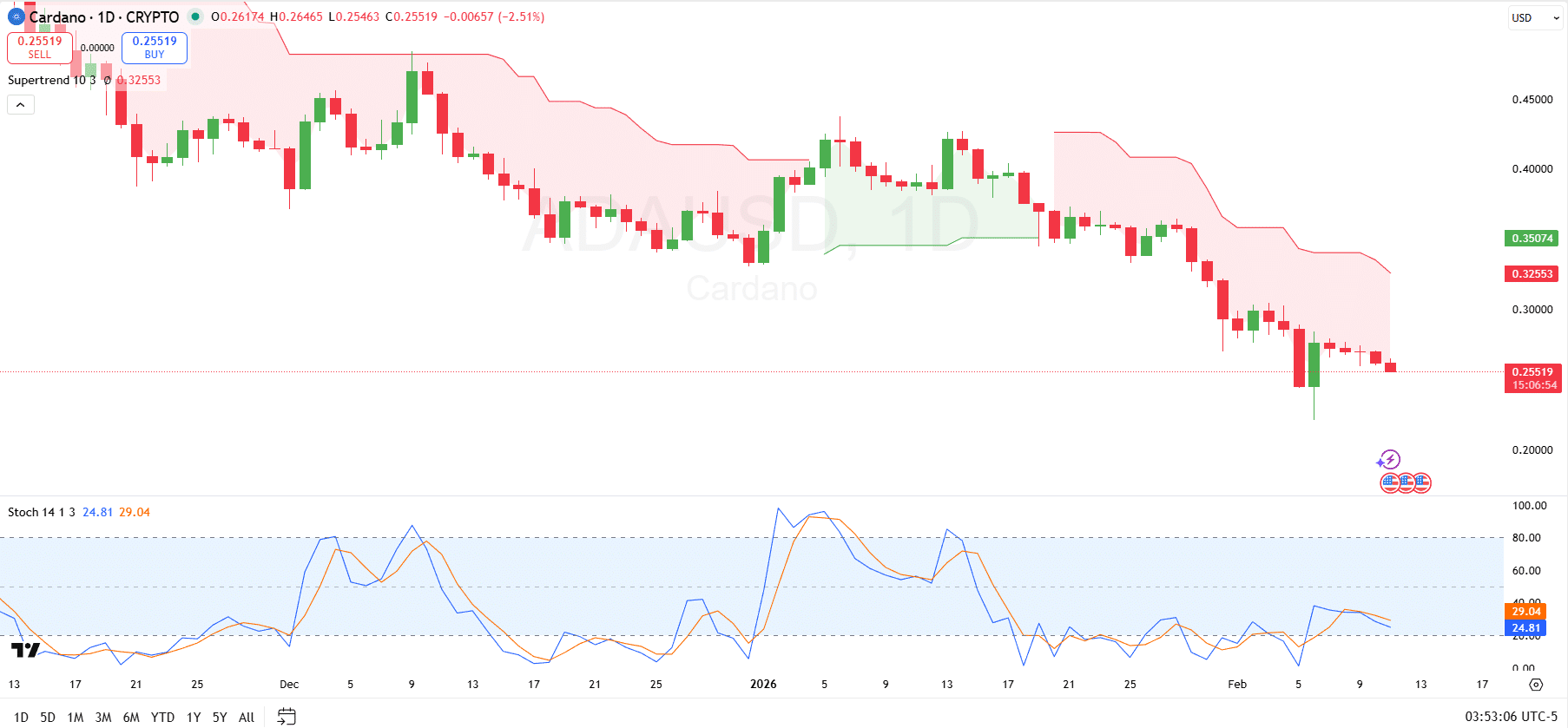

Cardano Price Analysis

Cardano is currently hovering around the recent swing low around the $0.255 area. This zone now acts as immediate short-term support after the sharp breakdown that followed rejection near the $0.27 region.

A daily close below $0.25 would cause a short-term flush or even expose $ADA to a deeper retracement toward the $0.22–$0.23 region. For now, buyers are attempting to stabilize prices above this psychological level, but the lack of strong bullish candles suggests support remains fragile rather than firmly defended.

On the upside, resistance is clearly defined by the Supertrend indicator, which sits near $0.3255. $ADA remains below this level, keeping the broader trend firmly bearish on the daily timeframe. Until price closes decisively above the Supertrend and establishes acceptance above the $0.32 region, upside moves are likely to be capped.

Momentum signals show early but unconfirmed stabilization. The Stochastic RSI currently reads approximately 24.81 for %K and 29.04 for %D, placing $ADA near oversold territory. While this suggests downside pressure may be slowing, neither line has pushed convincingly above the 50 midline, which would be required to confirm a stronger momentum shift. A shift in momentum would also need the %K line to move above the %D line.

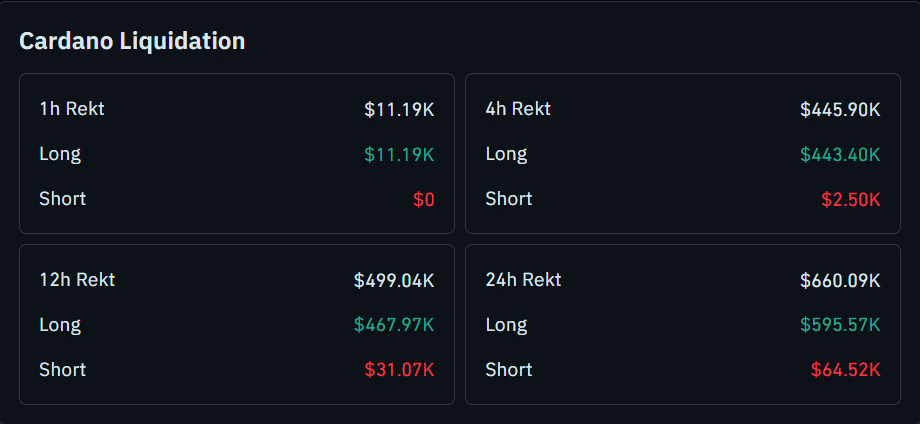

Over $660K Liquidated from $ADA Market

Meanwhile, liquidation data from Coinglass shows that recent downside pressure in Cardano has disproportionately impacted long traders. Over the past 24 hours, total liquidations reached $660.09K, with long positions accounting for $595.57K, compared to just $64.52K in short liquidations.

This imbalance suggests that bullish positioning was crowded heading into the latest decline, and the move lower forced leveraged longs out of the market.

Shorter timeframes reinforce this pattern. In the last 12 hours, liquidations totaled $499.04K, with $467.97K from longs and $ 31.07K from shorts. The 4-hour window shows a similar skew, with nearly the entire $445.90K wiped out coming from long positions, and shorts losing just $2.50K. Even in the most recent hour, all $11.19K in liquidations were long positions, with no shorts impacted.

thecryptobasic.com

thecryptobasic.com