Shiba Inu remains under intense bearish pressure, but fresh on-chain data shows exchange reserves have shrunk massively from 82 trillion last month.

The rapid decline in Shiba Inu’s exchange reserve has sparked debate over how the shift could influence $SHIB’s price action.

Key Points

- Shiba Inu remains under intense bearish pressure even as on-chain metrics are improving.

- The token’s exchange reserve has declined from above 82 trillion to roughly 81.35 trillion $SHIB in just weeks.

- If the reserve continues to shrink, reduced sell-side liquidity could support a potential trend reversal.

- $SHIB trades near the critical $0.0000056 support, where analysts anticipate a possible rebound. But broader market weakness could still drive prices lower.

Shiba Inu Exchange Reserve Loses 82T Threshold

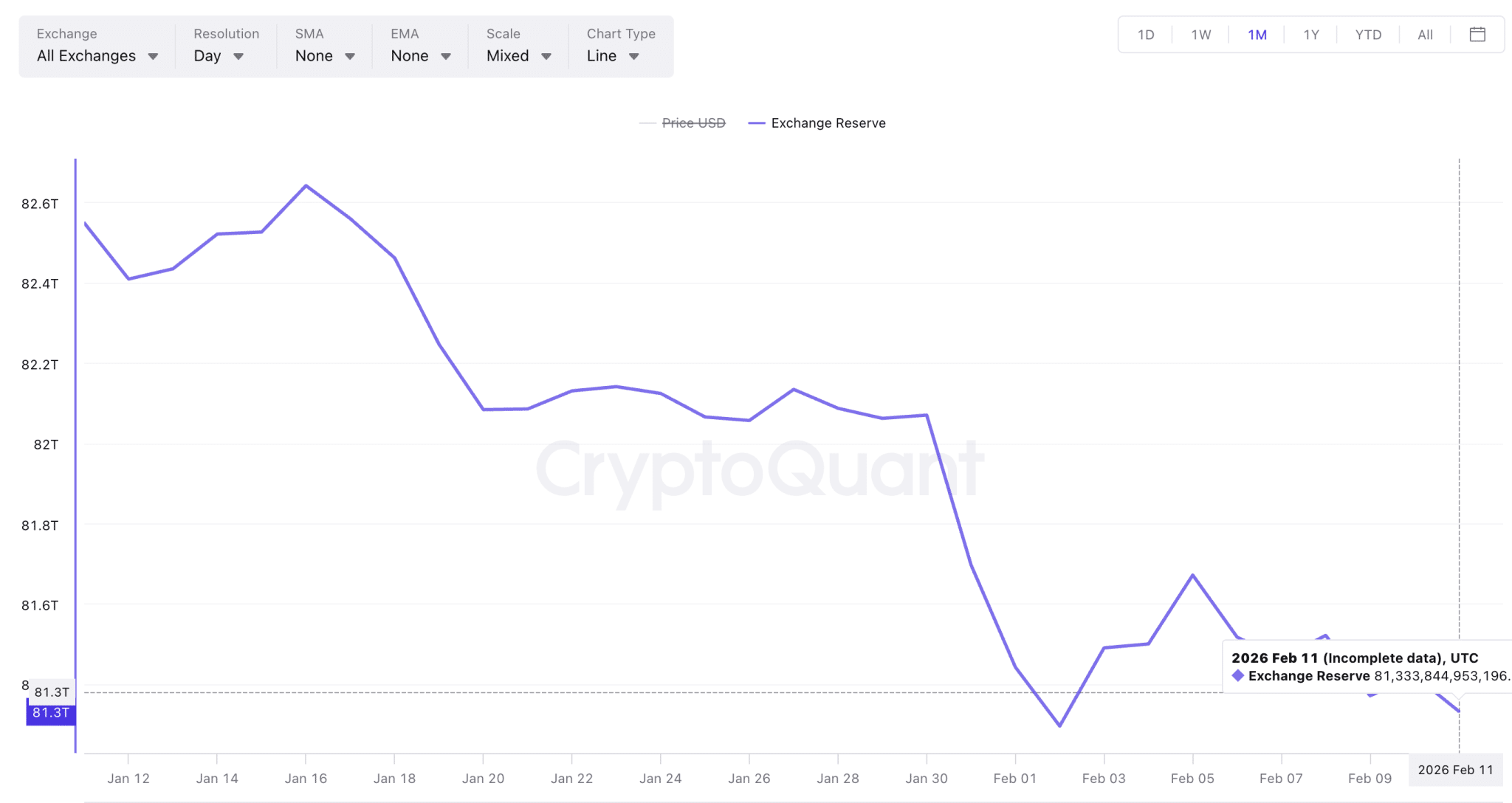

For months, centralized exchanges held about 82 trillion $SHIB, a level many analysts argued created persistent sell pressure, as the tokens were readily available for sale. As of January 26, centralized exchanges held roughly 82.066 trillion $SHIB.

However, recent CryptoQuant data shows that the reserve has fallen to 81.357 trillion $SHIB. This indicates that investors have withdrawn about 709 billion $SHIB from exchanges over the past two weeks. Notably, the metric declined by 0.01% in the past 24 hours, with 8.13 billion $SHIB leaving exchanges during that period.

Retail-Driven?

Following the sharp drop in exchange reserves, many market participants argue that retail investors are growing more bullish on $SHIB and withdrawing tokens for long-term holding. However, the situation remains more nuanced, as not all exchange outflows stem from retail activity.

Notably, whales and exchanges themselves can also influence the metric by transferring funds to cold storage.

Nonetheless, consistent outflows often reflect a stronger preference for holding rather than short-term trading. As a result, the reduced supply available for immediate sale could ease sell-side pressure and improve supply-demand balance.

If the trend continues, it could support price stabilization and trigger a bullish reversal. Yet, broader market sentiment and macroeconomic conditions will remain decisive in shaping $SHIB’s next move.

$SHIB Remains Under Bearish Pressure

In the meantime, Shiba Inu remains subjected to intense bearish pressure, alongside the broader crypto market. It has plunged below the $0.000006 mark and now trades at $0.000005851, reflecting a 24-hour decline of 2.33%.

Despite the recent pullback, Shiba Inu continues to trade above its key $0.0000056 support level. Notably, this zone has served as a strong foundation for $SHIB over the past few years, triggering multiple rebounds. As a result, many analysts expect a similar bounce from this level.

However, since $SHIB closely tracks the broader market’s performance, it could slide further if the market suffers another sharp downturn similar to the February 5 crash.

thecryptobasic.com

thecryptobasic.com