While downside pressure dominates the market amid price weakness, several factors point to a near-term recovery course for Shiba Inu.

Indeed, Shiba Inu looks fragile as the broader market continues to consolidate. The meme coin is down across all timeframes, as its price gravitates towards lower price levels.

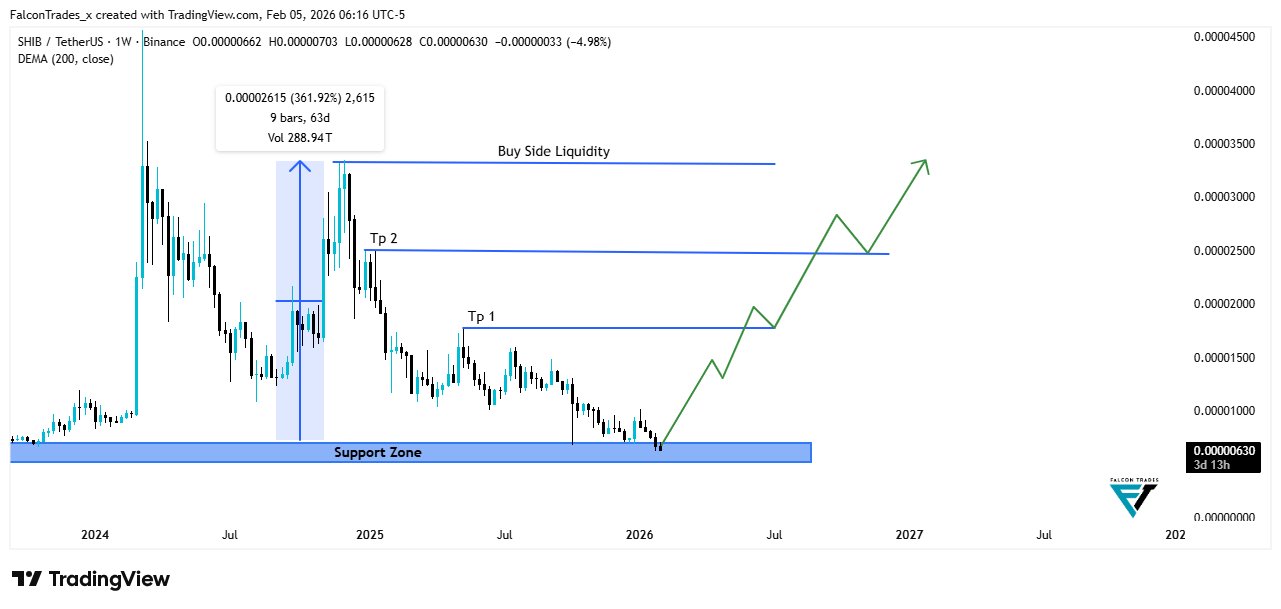

Yet all hope is not lost, as Shiba Inu might recover higher. Its strong support and the buy-side liquidity above suggest the token could be set on a rebound course to greater heights.

Key Points

- While downside pressure dominates amid price weakness, several factors point to a near-term recovery course for Shiba Inu.

- Support around $0.0000060 to $0.0000056 is crucial for $SHIB, as it has never broken below it since its market debut over four years ago.

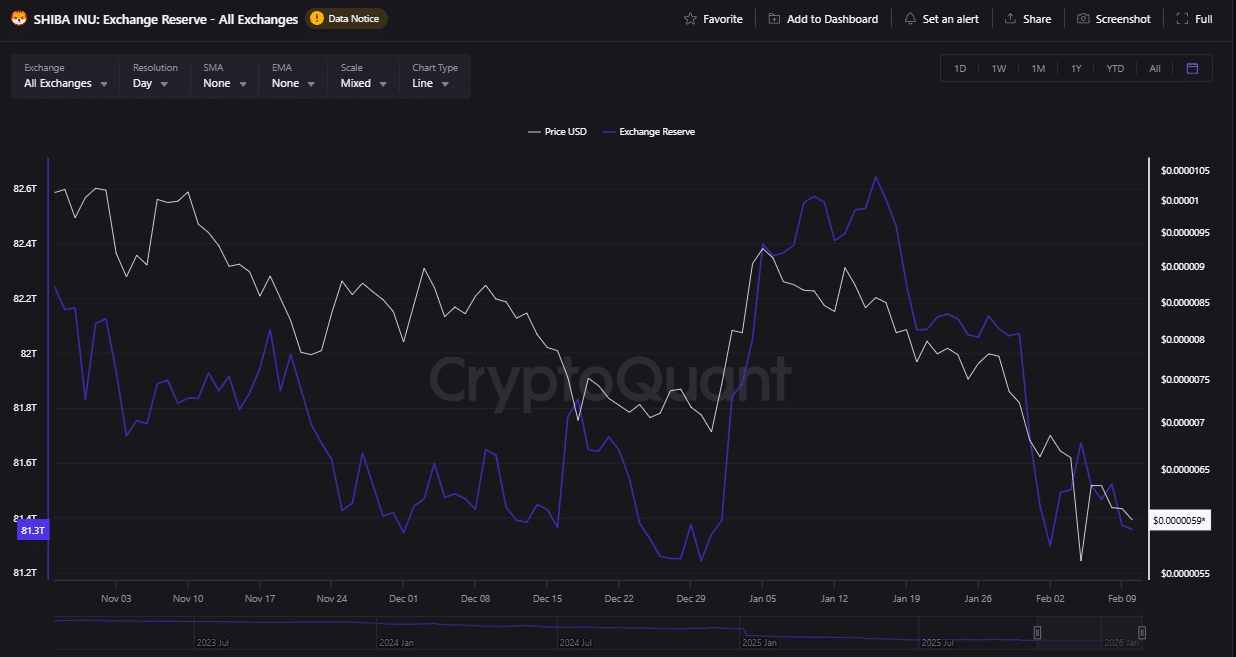

- Data shows that the exchange reserve has dropped over 316 billion $SHIB in the past five days to 81.3 trillion tokens, as holders move their stash away from exchanges.

- Another factor that could drive $SHIB higher is the buy-side liquidity at higher prices.

Weekly Support Holds Strong

Shiba Inu currently trades within a weekly support zone. Notably, this area, around $0.0000060 to $0.0000056, is crucial for $SHIB, as it has never broken below it since its market debut over four years ago.

Notably, it has maintained a price above this level so far, rebounding considerably from a drop to $0.00000507 last week. As long as Shiba Inu holds above this support level, it could rebound to higher prices.

Interestingly, on-chain metrics add to the optimistic view. CryptoQuant data shows that the exchange reserve has dropped over 316 billion $SHIB in the past five days to 81.3 trillion tokens, as holders move their stash away from exchanges. The move suggests that buying pressure is slowly returning as holders accumulate rather than sell their tokens on exchanges.

Buy-Side Liquidity

Another factor that could drive $SHIB higher is the buy-side liquidity at higher prices. For the uninitiated, this refers to a level with large volumes of unfiled buy orders. Typically, these are price magnets, and an asset tends toward them to grab liquidity.

Derivatives data from Coinglass show that massive liquidity is concentrated around the $0.000010 level, with $591,630 in liquidation leverage at risk of a wipeout if the price reclaims this psychological level. Before that, there are also lower-liquidity blocks. The chart shows that liquidity is greater on the upside than on the downside, as traders are heavily skewed toward further price corrections.

Buy-side liquidity also lies around $0.0000350, and a steady recovery could ensure that Shiba Inu reaches the multi-year high. On the way to this price, potential profit targets are $0.0000150 and $0.000025, where significant resistance levels exist.

thecryptobasic.com

thecryptobasic.com