$XRP could be on the verge of a major trend reversal that may eventually push the token toward the $7 mark, according to cryptocurrency market analyst DavidTheBuilder.

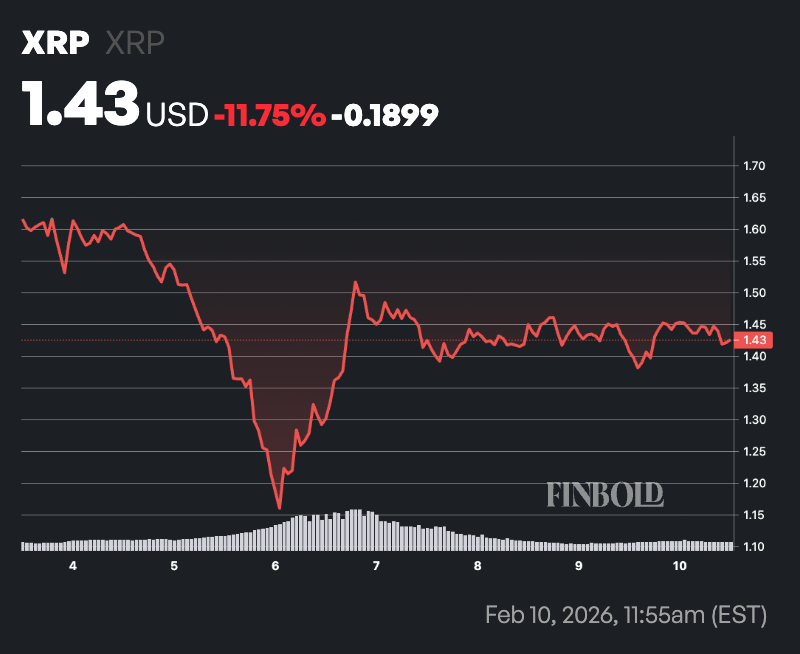

This outlook comes as $XRP attempts to mount a recovery following a recent crash that saw the asset drop below the $1 level. At press time, the token was trading at $1.43, up a modest 1% over the past 24 hours. On a weekly basis, however, $XRP remains down more than 11%.

Despite these near-term headwinds, DavidTheBuilder identified the $2.70–$3 range as a decisive level that could change $XRP’s outlook, he said in a CoinMarketCap post on February 9.

According to the analyst, a clean and sustained breakout above this zone would signal a structural shift in momentum, likely attracting technical buyers and sidelined capital.

Such a move could accelerate price action toward the $5 level, with $7 emerging as a realistic upside target if bullish conditions persist.

However, the analyst emphasized that technical breakouts alone may not be enough to support a long-term rally. The durability of any upside move would depend heavily on fundamental developments, particularly increased real-world usage of $XRP.

$XRP fundamentals

It is worth noting that $XRP has largely traded in line with broader market sentiment, closely aligning with Bitcoin (BTC), as there has been no Ripple-specific news impacting price action.

As a result, growth in cross-border payment adoption, increased institutional participation through exchange-traded funds (ETFs), and higher on-chain transaction volumes would be required to translate short-term momentum into sustained demand.

As things stand, $XRP remains locked in a prolonged downtrend that has been in place since late 2025, characterized by a series of lower highs and lower lows. Price action is still well below key moving averages, reinforcing the prevailing bearish structure.

Overall, $XRP remains in a bearish state, trading below both its 50-day ($1.89) and 200-day ($2.40) moving averages, signaling weakness in the medium- to long-term trend.

Meanwhile, the 14-day RSI at 37.8 sits in neutral territory, suggesting selling pressure is easing but not yet indicating a strong reversal.

Featured image via Shutterstock

finbold.com

finbold.com