Cardano has failed to reclaim higher resistance levels as weak momentum persists, potentially paving the way for further price declines.

Cardano trades within a descending channel and has repeatedly made lower highs and lower lows. After dropping to the structure’s lower support level following its February 6 crash to multi-year lows, the coin has yet to show recovery signs.

Key Points

- Cardano has failed to reclaim higher resistance levels as weak momentum persists, potentially paving the way for further price declines.

- Technical analysis points to repeated lower-high rejections for $ADA in the channel, dating back to the early November high of $0.6069.

- The momentum remains bearish after dropping to $0.22, as it has not shown the strength to even reclaim the descending resistance zone.

- Unless conditions change, $ADA might decline further to the $0.220 lows.

Cardano Looks Bearish

Technical analysis points to repeated lower-high rejections for $ADA in the channel, dating back to the early November high of $0.6069. The cryptocurrency has seen its price action contained within the channel as it slides consistently to lower prices.

Recently, Cardano dropped to the channel’s support at $0.220 last week before rebounding slightly. The momentum remains bearish, as it has not shown the strength to even reclaim the descending resistance zone.

Unless conditions change, $ADA might decline further. Analysis suggests that support at $0.22 remains a key level to watch if the coin slides further. The move would culminate in a 16% correction from the current price of $0.262.

However, if Cardano regains momentum from here, it could retest the channel’s upper resistance. A breakout makes things a bit more interesting and sets it on course to reclaim the $0.34 resistance level. Holding here invalidates bearish scenarios for $ADA.

Good Entry for Long Positions

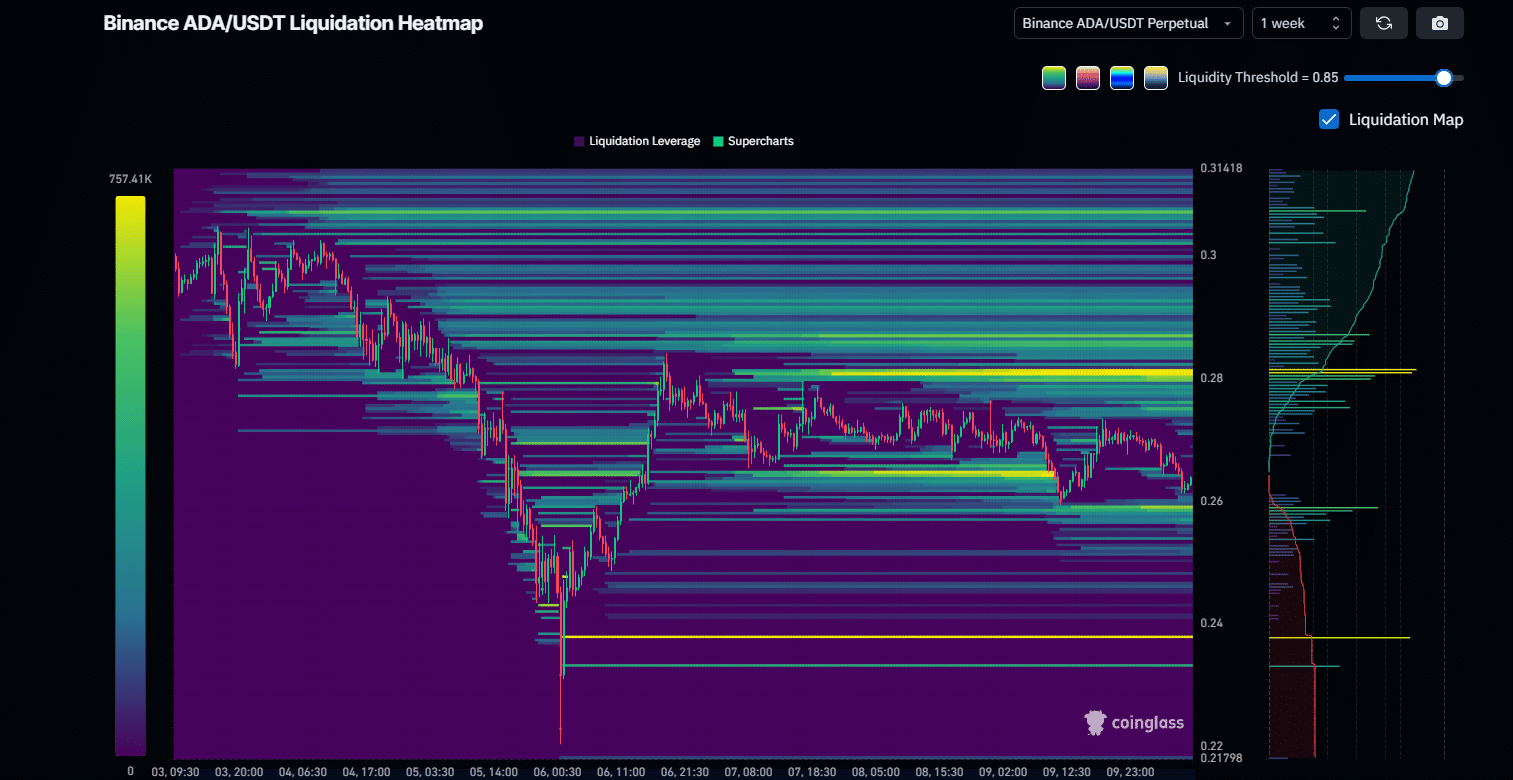

A separate analysis still aligns with a bearish bias for Cardano in its current state, but remains optimistic. Specifically, $ADA could drop below the $0.25 area to grab liquidity and could rebound if it shows a reaction from there.

Under these circumstances, $0.25 would be an optimal entry point for a long position, as $ADA would complete a double bottom if the rebound materializes. This could push the coin toward $0.30, above which there is more liquidity to capture.

Notably, data from Coinglass supports this. At $0.25, there would be a large-scale long liquidation on the $ADA/BTC chart on Binance, with up to $424,350 at risk of being wiped out. The next area on the chart with such dense leverage liquidation value is at $0.28, where $735,890 worth of shorts would be forced to exit the market.

thecryptobasic.com

thecryptobasic.com