The 2026 Crypto Crash

The start of 2026 has been a trial by fire for digital asset investors. While the year began with high hopes, a sudden deleveraging event saw the total cryptocurrency market capitalization plummet by more than 20% in less than a month. However, market-wide bloodbaths often reveal the "alpha"—projects with enough fundamental demand or narrative strength to decouple from Bitcoin's gravity.

Which coins are up in 2026?

Despite the $Bitcoin price struggling to maintain support, five specific tokens have remained profitable since January 1st, 2026. These assets have defied the downward trend, in some cases posting double-digit gains while the rest of the crypto news cycle remains bearish.

Crypto Market is Decoupling

In cryptocurrency trading, decoupling occurs when the price action of a specific altcoin stops following the price movements of Bitcoin or the Total Market Cap. This usually happens due to project-specific catalysts such as high protocol revenue, a major technological upgrade, or a shift in investor sentiment toward a specific niche (like Perp DEXs or Layer 1 innovations).

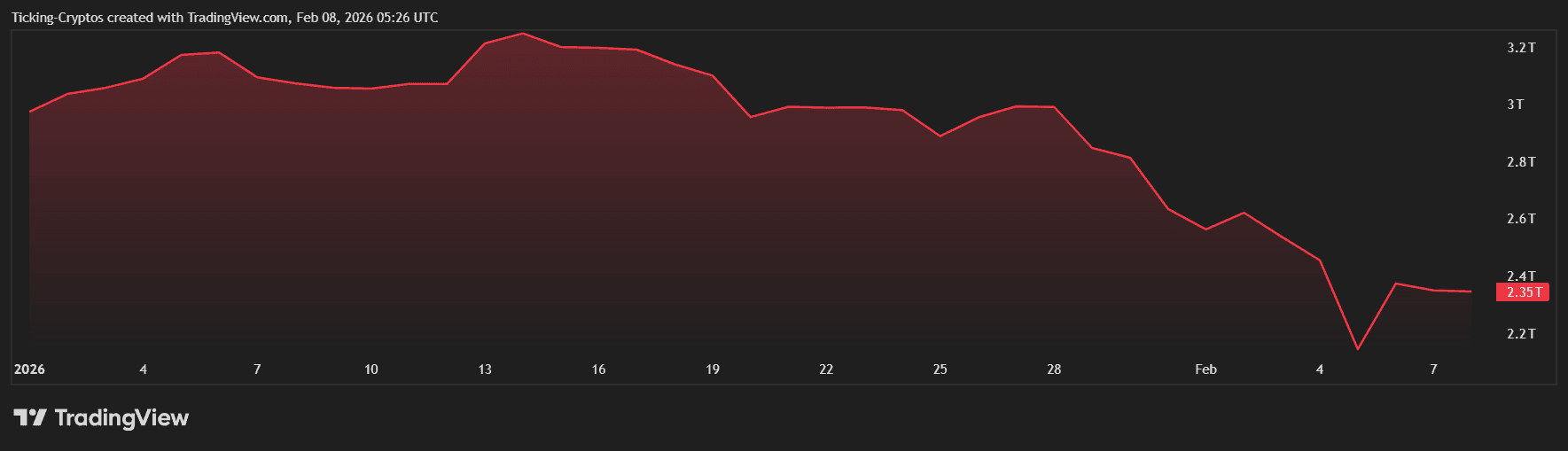

Analyzing the 2026 Total Market Cap Crash

Based on the current market data, the total crypto market cap recently shed over $1 trillion in value. This move, characterized by a sharp downward slope on the daily charts, was triggered by institutional outflows and a "negative Coinbase premium."

When the market enters a "risk-off" environment, liquidity usually dries up. However, the tokens listed below have maintained high liquidity and buying pressure.

1. Hyperliquid ($HYPE): The Volatility Winner

Hyperliquid has been the standout performer of 2026. As a decentralized perpetual exchange, its native token $$HYPE jumped 71% to reach $35.

- The Logic: Traders use Hyperliquid to hedge their portfolios during crashes. More liquidations mean more fees, which are partially used for token buybacks.

- Performance: Up significantly YTD while major L1s are down 30%.

2. MemeCore (M): The Cultural Infrastructure

MemeCore ($M) represents a new breed of Layer 1. Since its 2026 debut, it has maintained a 2,950% increase from its launch price.

- The Logic: By providing a dedicated chain for "Meme 2.0" projects, it has captured the retail interest that usually flees during a "serious" financial crash.

- Performance: Held its $1.9 billion market cap floor despite the January liquidations.

3. Decred (DCR): The Governance Safe Haven

$Decred saw a massive 28.5% surge in a single day during the February dip.

- The Logic: Investors often rotate into older, "hard money" projects with proven governance when newer DeFi protocols face smart contract risks or liquidity crunches.

- Performance: One of the few "old guard" coins trading above its January 1st open.

4. $MYX Finance ($MYX): Institutional Grade DEX

Similar to Hyperliquid, $MYX Finance has benefited from the shift toward on-chain trading.

- The Logic: With backing from major entities like Sequoia, $MYX is seen as a "flight to quality" within the decentralized trading space.

- Performance: Currently showing a green YTD candle, outperforming most cryptos

5. LayerZero ($ZRO): Interoperability Resilience

$LayerZero has maintained a steady trajectory, gaining roughly 15% when the market bottomed out in late January.

- The Logic: As users move assets between chains to find yield or safety during a crash, LayerZero’s cross-chain infrastructure sees record utilization.

- Performance: Strong support at $1.90, showing high "information density" in its price floor.

Why Are These 5 Coins UP?

The common thread among these winners is utility during distress. Whether it is hedging ($HYPE/$MYX), cross-chain movement ($ZRO), or narrative shifts (MemeCore), these coins provide services that are more necessary when the market is volatile. For those looking to protect their capital, using hardware wallets remains the gold standard while navigating these volatile outliers.

According to reports from major authorities like CoinDesk and Bloomberg Crypto, this rotation suggests that the 2026 market is becoming more sophisticated, rewarding revenue-generating apps over pure speculation.

cryptoticker.io

cryptoticker.io