The cryptocurrency market is showing signs of life this Saturday, February 7, 2026, as major assets record a 5% recovery within the last 24 hours. After a brutal week that saw billions in liquidations, the "digital gold" and its altcoin peers have finally tapped into historical demand zones. While the green candles are a welcome sight for weary traders, the question remains: is this the start of a new bull run or merely a "dead cat bounce" before further consolidation?

Bitcoin and Ethereum Bounce Off Critical Support

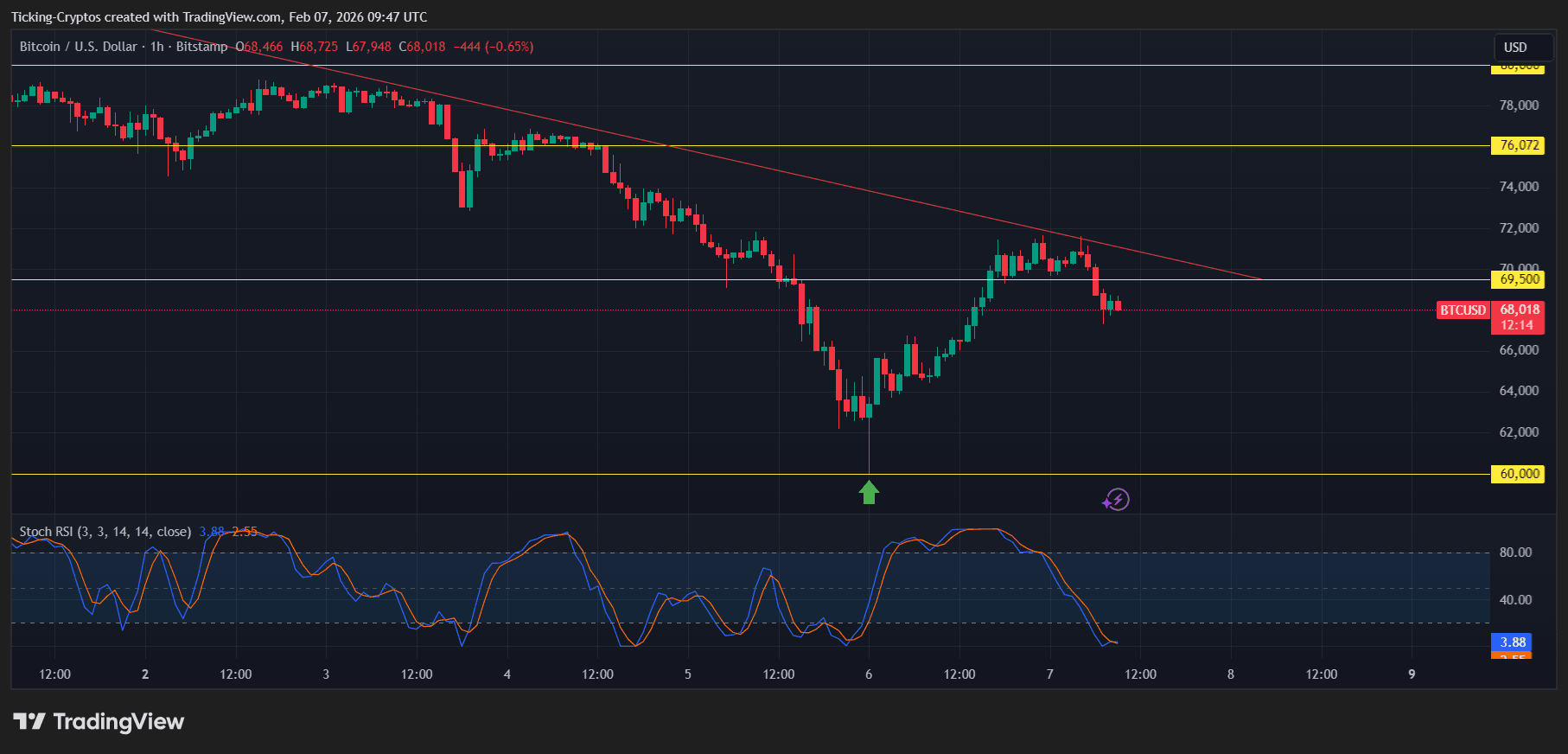

After plummeting from its 2025 highs near $126,000, the $Bitcoin price found significant footing around the $60,000 level. This psychological and technical support zone has triggered a wave of "buy the dip" activity. For many institutional investors, purchasing $BTC at $60,000 represents a much more attractive entry point compared to the $120,000 peak seen just months ago.

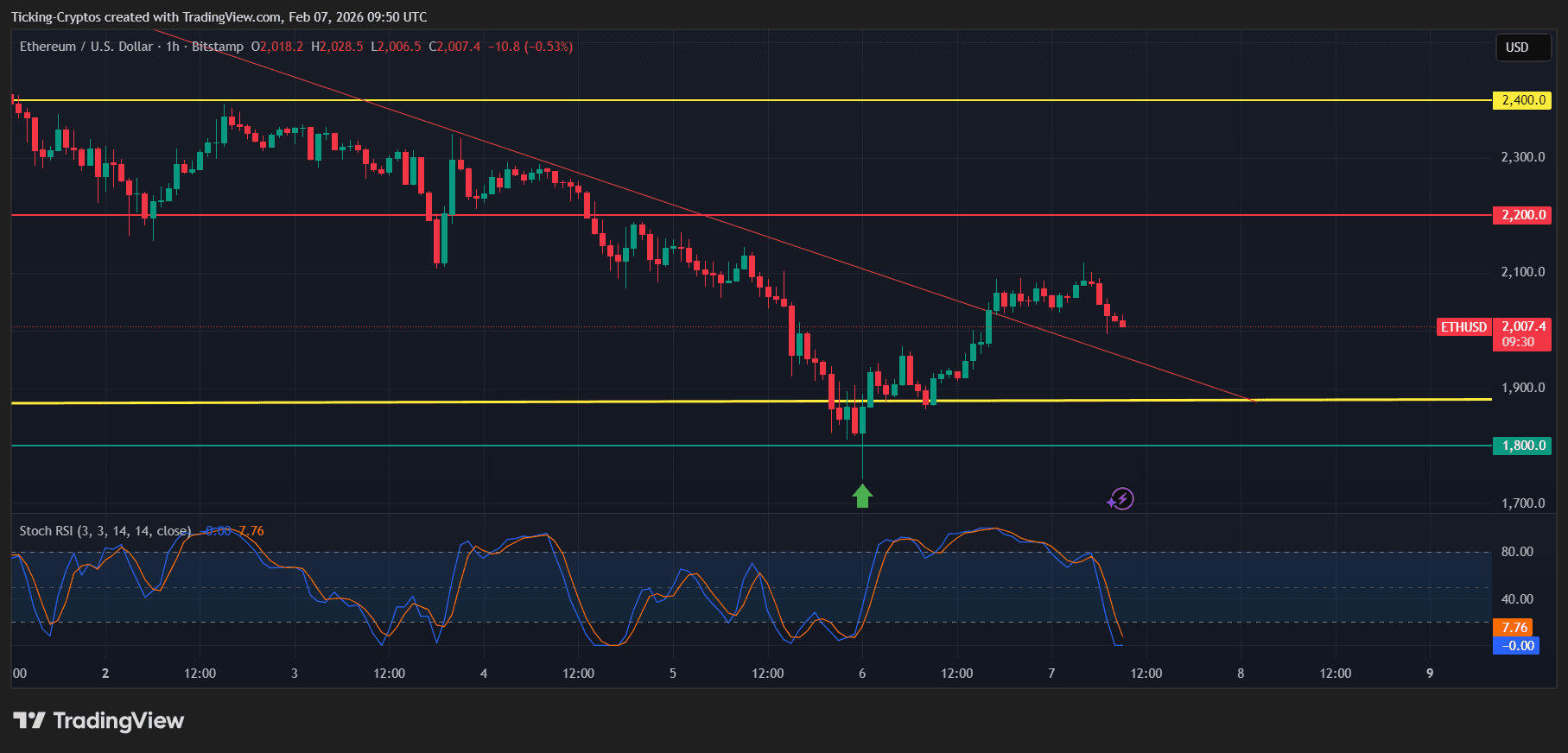

Similarly, the $Ethereum price has staged a comeback after testing the $1,800 - $2,000 range. With $ETH previously trading near $5,000 during the height of the 2025 surge, the current levels are being viewed by long-term holders as a potential "generational buy zone." According to data from CoinMarketCap, the global crypto market cap is attempting to stabilize around $2.7 trillion.

Is Now the Time to Buy for the Long Term?

For investors with a medium-to-long-term horizon, these discounted prices offer a stark contrast to the FOMO-driven peaks of last year.

- Bitcoin ($BTC): Buying at $60,000 vs. $120,000 offers a 50% discount on the leading asset.

- Ethereum ($ETH): Entering at $2,000 rather than $4,000+ significantly lowers the cost basis for DeFi and NFT enthusiasts.

- $XRP: Currently hovering around $1.35, far below its recent volatility peaks of $2.20, making it a point of interest for those following the Ripple ecosystem developments.

Warning: The Shadow of 2018 Consolidation

While the 5% jump is promising, veteran traders warn that the market might not be out of the woods yet. Macroeconomic pressures and recent outflows from Spot ETFs suggest that we could be entering a period of extended consolidation.

History often rhymes in crypto. After the 2017-2018 crash, prices didn't just V-shape back to highs; they spent months, and in some cases years, grinding sideways. There is a distinct possibility that the market will move into a "boring" phase where prices fluctuate within a tight range as leverage is fully flushed out.

"We might see a bounce toward $74,000 for Bitcoin, but unless we reclaim that level, the risk of a secondary drop to $45,000 remains on the table," notes one market analyst.

cryptoticker.io

cryptoticker.io