$XRP is rebounding sharply as crypto risk appetite returns, according to a new analysis highlighting heavy whale accumulation and surging network activity that signal renewed momentum after a steep sell-off, positioning the token as a market standout.

$XRP Rebound Gains Strength as Whales and Network Activity Surge

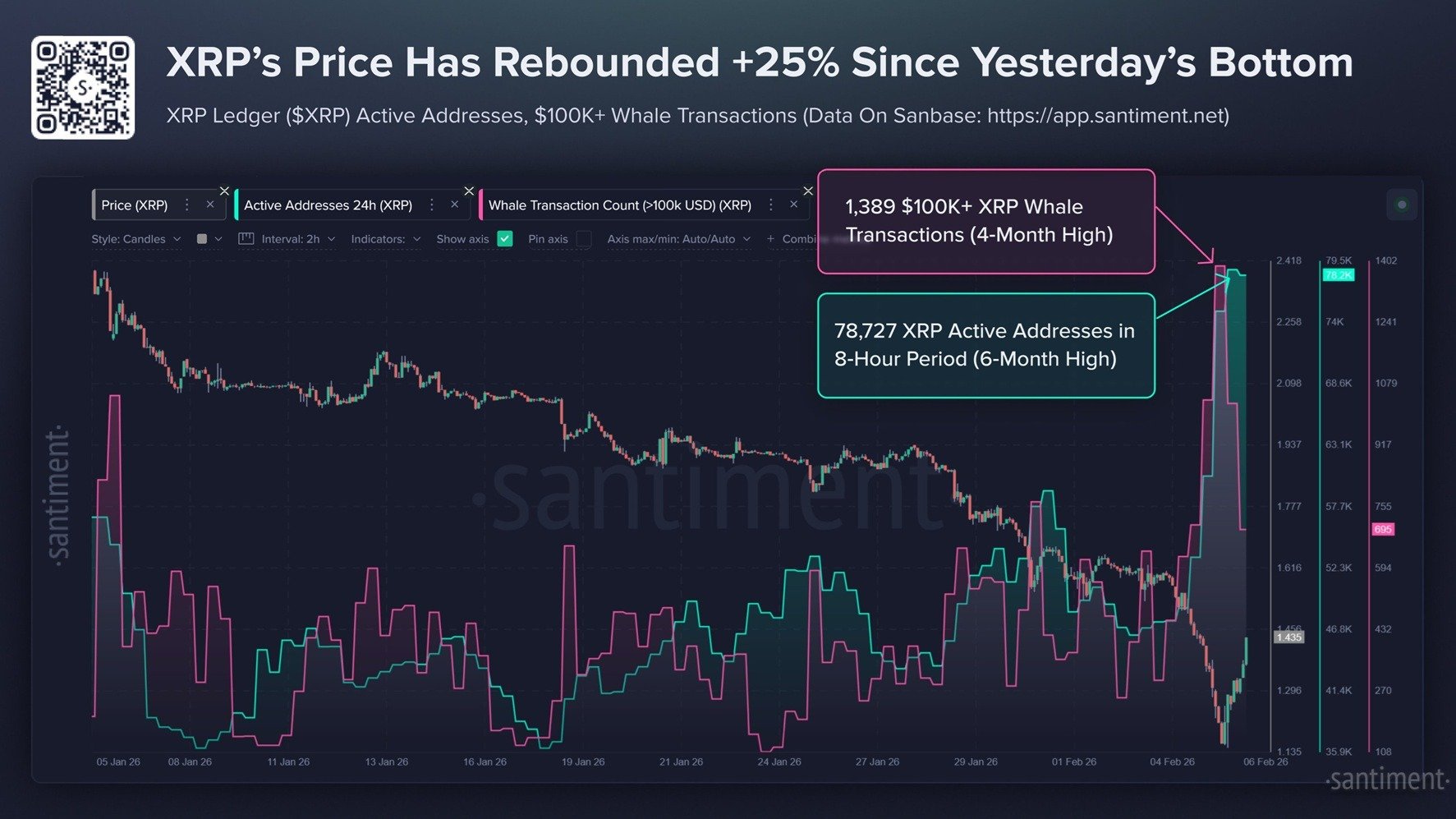

At 4:12 p.m. on Feb. 6, $XRP is trading near $1.50, posting a sharp rebound after an aggressive sell-off earlier in the session. Price has lifted decisively off the intraday low near $1.12 and is now stabilizing just below the $1.46 area, reflecting a strong reaction from buyers after downside momentum peaked. Blockchain analytics firm Santiment shared on social media platform X on Feb. 6 that $XRP rebounded sharply from recent lows, supported by heavy whale accumulation and a surge in $XRP Ledger activity. The firm stated:

“Since bottoming out below $1.15 just under 18 hours ago, the #4 market cap has now recovered to back above $1.50.”

Santiment described heightened engagement during the sell-off: “Panic sellers should have stopped to notice the massive activity on the $XRP Ledger as speculators were discussing whether the coin would fall below $1.00.”

As of writing, $XRP is staging a notable rebound, climbing more than 14% to trade between $1.46 and $1.53. The recovery follows a sharp multi-day decline that pushed the token to a low of $1.13 on Feb. 6, completing a weekly drawdown of roughly 20%. That move was exacerbated by approximately $46 million in liquidations after prices broke below the $1.40 support level. The rebound is being fueled by technical bargain buying after relative strength index readings reached deeply oversold conditions, while improving sentiment ahead of $XRP Community Day on Feb. 11 has also contributed to renewed interest.

The analysis by Santiment was shared alongside a chart that emphasized specific on-chain metrics rather than sentiment alone. Santiment explained: “Obvious whale accumulation occurred during this dip, with 1,389 separate $100K+ whale transactions (the highest in 4 months).” The chart also showed a sharp expansion in network participation, with the firm detailing:

“The amount of unique addresses on the ledger suddenly ballooned to 78,727 in just one 8-hour candle (the highest in 6 months).”

Santiment characterized the combination of these signals as historically meaningful, stating:

“These are both major signals of a price reversal for any asset.”

Read more: ‘I’ll Keep Buying’: Dave Portnoy Doubles Down on $XRP as Price Falls

Elevated whale transaction counts typically reflect confidence among large holders, while rapid growth in unique addresses suggests expanding participation and liquidity. Together, these indicators often point to strengthening demand rather than a temporary relief bounce. While broader market conditions continue to influence short-term volatility, sustained growth in both high-value transfers and active addresses positions $XRP as one of the digital assets currently exhibiting clear on-chain momentum.

FAQ ⏰

-

Why is $XRP rebounding sharply according to Santiment?

$XRP is rebounding as whale accumulation and $XRP Ledger activity surged during the recent dip. -

What does whale accumulation signal for $XRP price action?

Elevated $100K+ transactions suggest large holders are positioning for a sustained $XRP price reversal. -

How important is $XRP Ledger address growth in this rally?

A rapid increase in unique $XRP Ledger addresses indicates expanding participation and liquidity. -

Are on-chain metrics supporting $XRP’s recent recovery?

Santiment data shows transaction spikes and address growth aligning with structurally supported price gains.

news.bitcoin.com

news.bitcoin.com