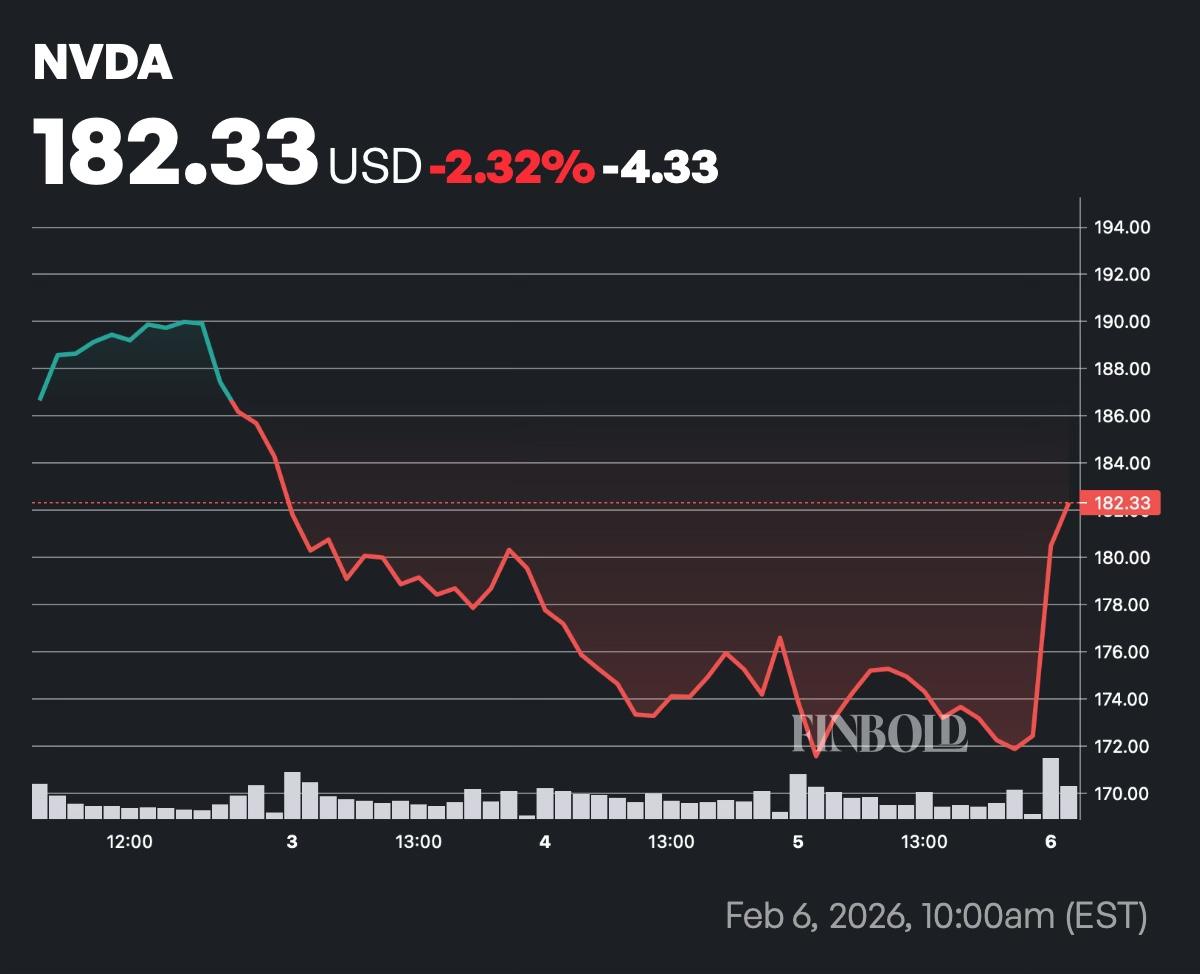

Nvidia (NASDAQ: NVDA) shares jumped 5% when the market opened on Friday, February 6, recovering some of the recent losses as the Nasdaq stabilized after a technology-led sell-off.

The uptick comes just 24 hours after Goldman Sachs reaffirmed its ‘Buy’ rating on the chipmaker, maintaining a $250 Nvidia share price target that implies a nearly 50% upside from Thursday’s closing price at $171.88.

According to analyst James Schneider, the bank expects Nvidia to deliver a positive quarter due to favorable supply-and-demand trends. Schneider likewise identified some potential growth catalysts in the first half of 2026, such as promising hyperscaler capital expenditure plans extending into 2027.

Is Nvidia a buy?

Goldman also pointed to strong results from new large language models trained on Nvidia’s Blackwell architecture, reinforcing the company’s technological leadership. At the same time, Nvidia and Deutsche Telekom AG have launched a €1 billion ($1.2 billion) data center in Munich, marking a major milestone for Nvidia in Europe and potentially representing another catalyst.

However, today’s rebound may ultimately prove fragile. Namely, with rising AI investment (hyperscalers are expected to invest more than $600 billion in the infrastructure this year), Nvidia shares could come under increased pressure if sentiment turns against large-scale spending.

Amazon (NASDAQ: AMZN), for example, has added a lot to the market jitters, telling Reuterson February 5 that its capital expenditures could reach $200 billion, more than 50% higher than last year. The announcement sent the e-commerce leader’s shares down 10% in premarket trading.

Nonetheless, Simon Lin, chairman of Nvidia supplier Wistron, told the same publication that the sector is not a bubble, predicting AI-related orders in 2026 would exceed last year’s growth. Meanwhile, Nvidia CEO Jensen Huang confirmed intention to participate in OpenAI’s next fundraising round and eventual initial public offering (IPO), dismissing reports of strain between the two companies.

Thus, the scale could tilt in either direction. On the bullish side, Nvidia remains deeply embedded in the global AI infrastructure narrative. However, it remains dependent on sustained, large-scale AI capital expenditure, meaning it could be vulnerable to drastic sentiment shifts when it comes to large spending discipline.

Nvidia stock outlook

With earnings scheduled for February 25, investors have roughly 20 days to position ahead of what could be the company’s make-or-break report this year.

For now, Wall Street remains in accordance with James Schneider. Indeed, the average Nvidia stock price target for 2026 sits at $260, implying over a 40% upside from NVDA’s current price, judging by the data available on TipRanks.

In addition to Goldman Sachs, Cantor Fitzgerald has also given Nvidia a ‘Buy’ rating this month, with an even bigger price target of $300. The highest forecast remains that of Evercore, who sees the price hitting $352.

Featured image via Shutterstock

finbold.com

finbold.com