Analyzing the 2026 Market Correction: Is it Different This Time?

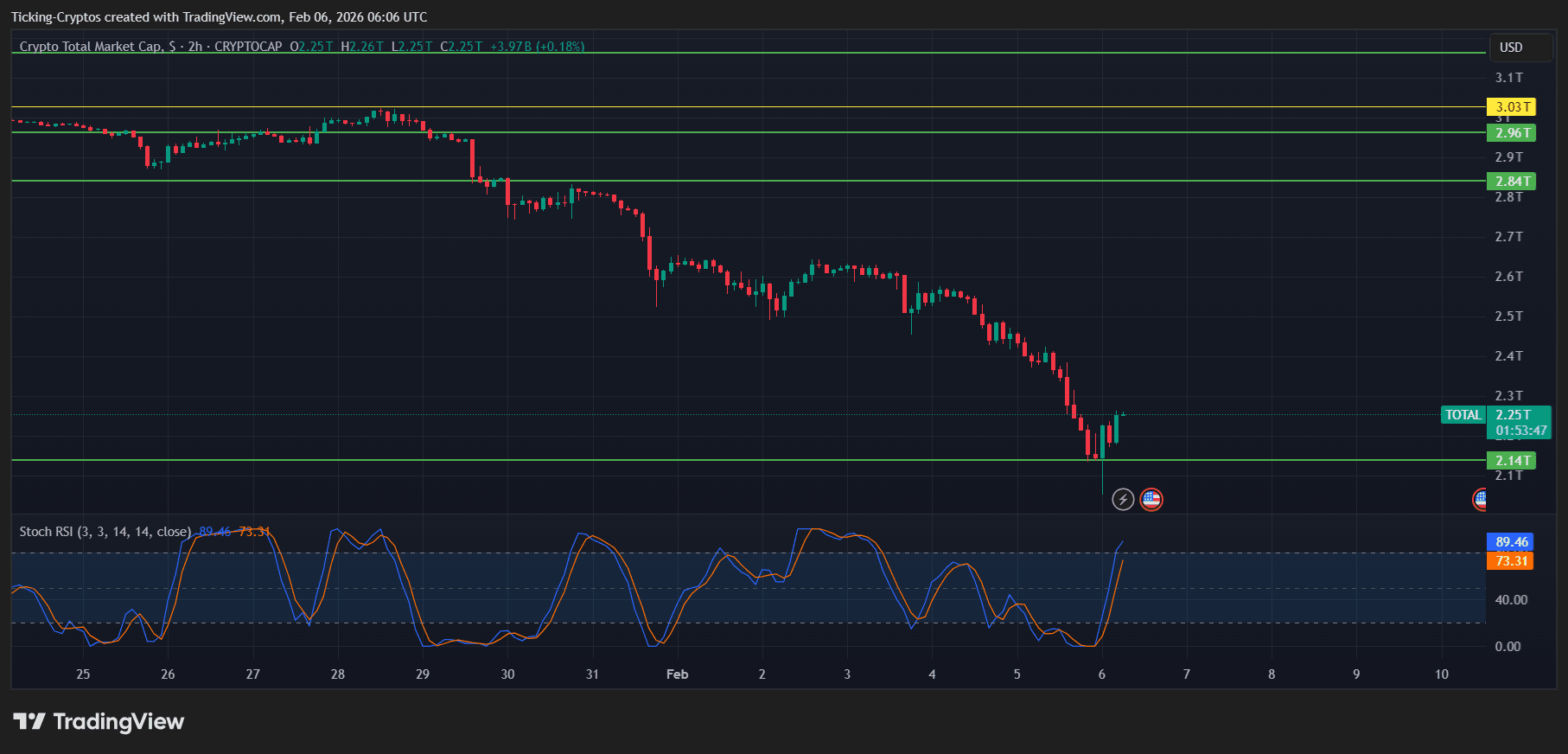

The start of 2026 has been a wake-up call for many digital asset investors. After the euphoria of late 2025, several major cryptocurrencies have crashed more than 20% Year-To-Date (YTD). The total crypto market cap has seen a dramatic drawdown, falling from its October 2025 peak of $4.38 trillion to approximately $2.42 trillion in early February 2026.

An analysis of the TOTAL market chart reveals that we are currently testing critical support levels. The sharp decline to around $60,000 for $Bitcoin triggered a cascade of over $2 billion in liquidations, primarily affecting over-leveraged long positions. However, historical data suggests that these "leverage flushes" are often the precursor to a healthier, more sustainable uptrend.

While the "Fear & Greed Index" has plunged into "Extreme Fear" (hitting levels as low as 5), seasoned traders view this as a period of re-accumulation. Here are five definitive reasons why this crypto crash is temporary.

1. Institutional "Diamond Hands" are Holding Steady

Unlike the retail-driven crashes of 2017 or 2021, the 2026 landscape is dominated by institutional players. Despite the price volatility, spot Bitcoin ETF flows have shown resilience. While short-term "tactical" capital has exited, the long-term holdings of giants like BlackRock and Fidelity remain largely intact. According to recent data from Bloomberg, ETF trading volumes hit record highs during the dip, suggesting that while some are selling, large-scale buyers are using the liquidity to enter at a discount.

2. The "Warsh Shock" is a Macro Re-Pricing, Not a Crypto Failure

A significant catalyst for the current dip was the nomination of Kevin Warsh as Federal Reserve Chairman. His hawkish reputation caused a global re-pricing of risk assets as markets adjusted to expectations of higher interest rates. This is a "macro" event affecting tech stocks and gold alike, not a fundamental flaw in blockchain technology. As the market absorbs this new monetary reality, the decoupling of crypto from traditional equities typically follows, allowing for a localized recovery.

3. On-Chain Fundamentals Remain Record-Breaking

While the $BTC price may look grim on a daily chart, on-chain metrics tell a different story. Stablecoin supply has only decreased by 2%, and active users on networks like Ethereum and Solana continue to hit all-time highs. Tether (USDT) recently reported record user growth, adding 35 million new users in the last quarter. This indicates that the "plumbing" of the crypto economy is more active than ever, even if the "storefront" prices are currently discounted.

4. The Leverage Flush is a Market Necessity

Market cycles require "cleansing" events. The run-up to $120,000 was fueled by massive leverage, with some traders using 50x to 100x. This crash has effectively wiped out $817 million in long positions in a single day. By removing this "froth," the market establishes a solid floor. Historical "capitulation" phases like this are almost always followed by a period of consolidation before the next leg up. You can compare different platforms for safer trading in our exchange comparison.

5. Growing Scarcity and the Post-Halving Supply Shock

We are still within the post-halving window where supply scarcity begins to bite. With daily production of Bitcoin significantly reduced and institutional demand persisting via ETFs, the "supply-demand" mismatch remains skewed toward the upside in the long run. As sell pressure from liquidated miners and forced sellers exhausts itself, the natural scarcity of assets like $BTC and $ETH will likely drive the next recovery phase.

Conclusion: A Buying Opportunity in Disguise?

The current market sentiment is undoubtedly bearish, but the structural thesis for crypto hasn't changed. We are seeing a "risk-off" rotation triggered by political and macro shifts, exacerbated by a technical liquidation event. For those with a long-term horizon, this may be one of the best entry points of the year. If you are holding through this volatility, ensure your assets are safe by checking out our hardware wallet comparison.

cryptoticker.io

cryptoticker.io