$XRP has faced a sharp downturn, falling 24% over the past week as selling pressure intensified across the market. The decline pushed the altcoin into a vulnerable position, breaking a pattern of past recoveries.

This sustained weakness suggests the current correction may reshape $XRP’s historical price behavior if demand fails to return.

$XRP’s Past Says Recovery Ahead

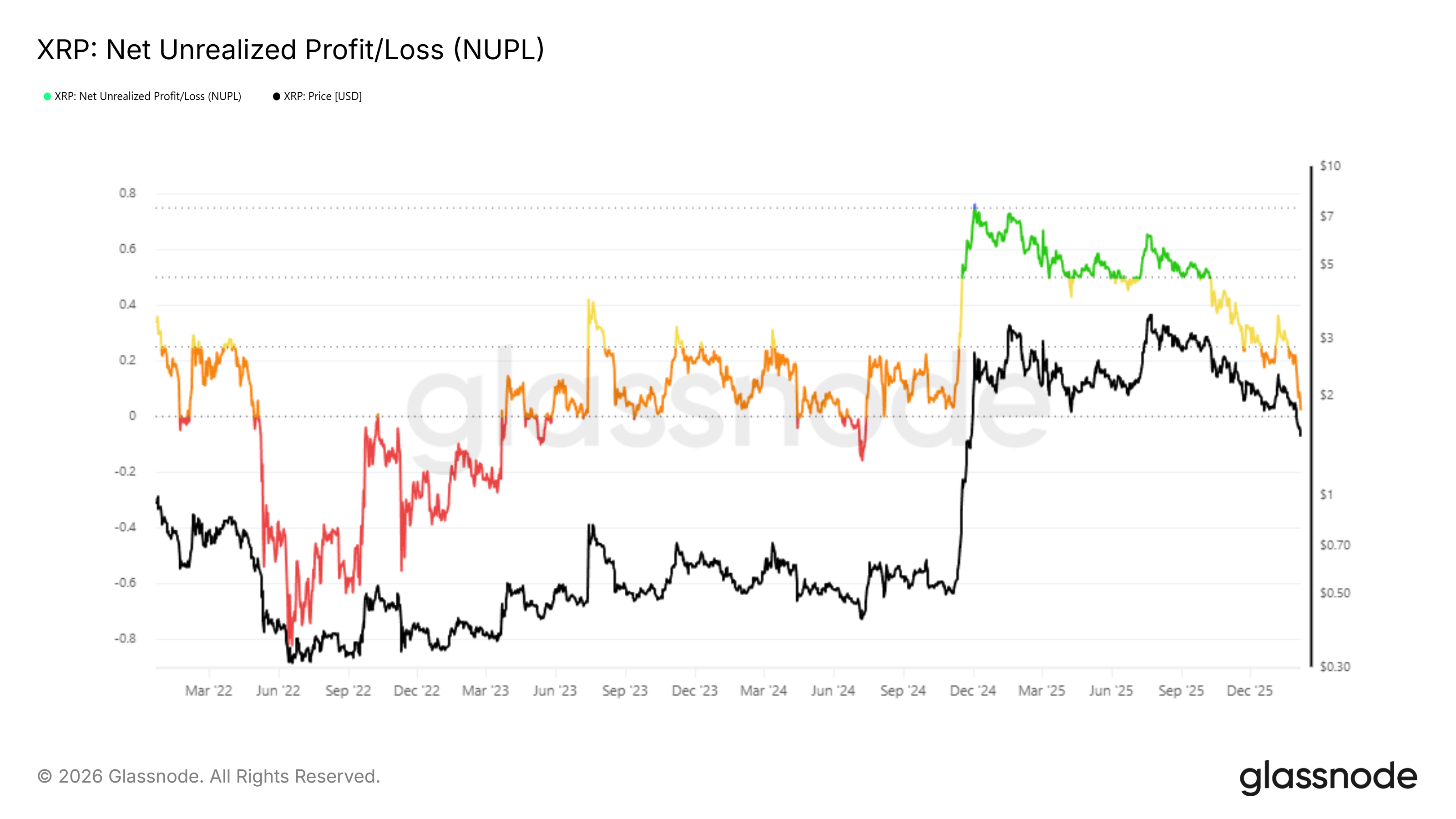

$XRP’s Net Unrealized Profit and Loss is approaching the capitulation zone. At this stage, unrealized losses outweigh minor gains across the circulating supply. Historically, such conditions reduce selling incentives.

Investors often pause distribution and begin accumulating at discounted levels, which can support price stabilization.

However, $XRP has not yet shown clear signs of this shift. Selling pressure remains dominant, preventing NUPL from triggering a meaningful reversal. Without accumulation replacing fear-driven exits, $XRP struggles to benefit from its typical recovery cues, keeping sentiment tilted firmly toward caution.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

$XRP NUPL">

$XRP NUPL">

$XRP Investors Opt to Panic For Now

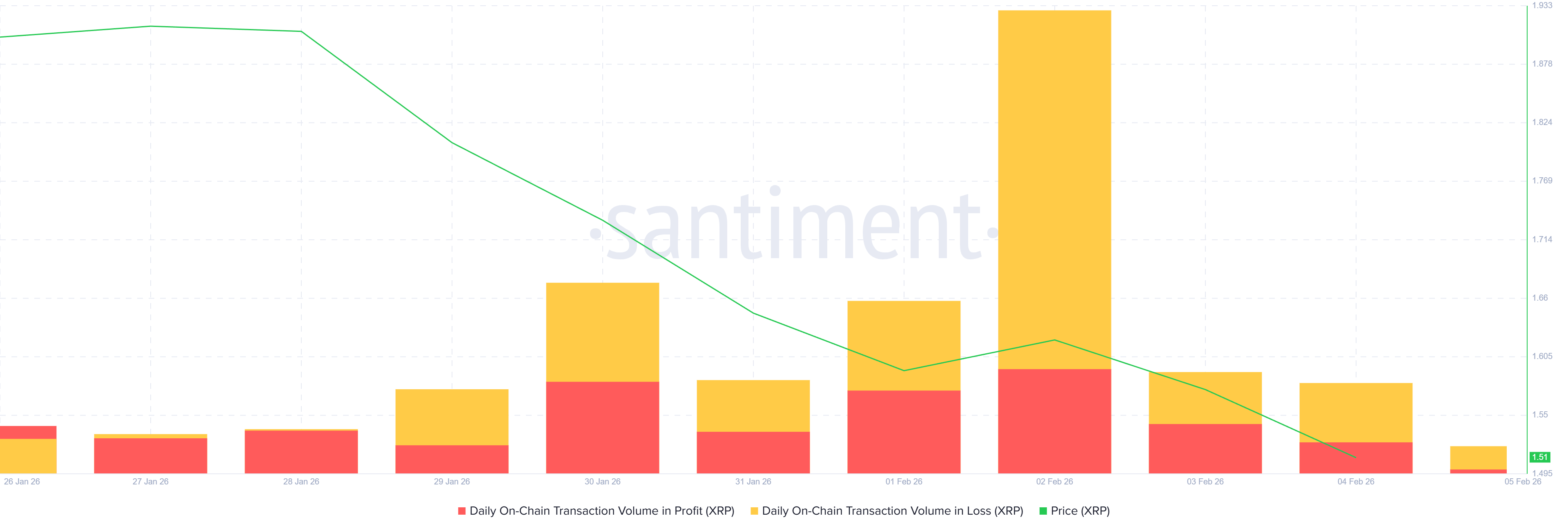

On-chain transaction data reflects sustained panic selling. Over the past week, $XRP transactions executed at a loss have consistently exceeded profitable transfers.

Transaction volume on February 2 registered $2.51 billion in losses, against $567 million in profit. This imbalance highlights deteriorating confidence as holders prioritize capital preservation amid falling prices and broader market weakness.

Loss-dominated transaction volume often signals late-stage fear. While such phases can precede recovery, they also deepen drawdowns when unchecked. $XRP’s inability to stabilize transaction behavior suggests momentum remains fragile, leaving the asset exposed to further downside unless sentiment improves quickly.

$XRP Transactions in Profit/Loss">

$XRP Transactions in Profit/Loss">

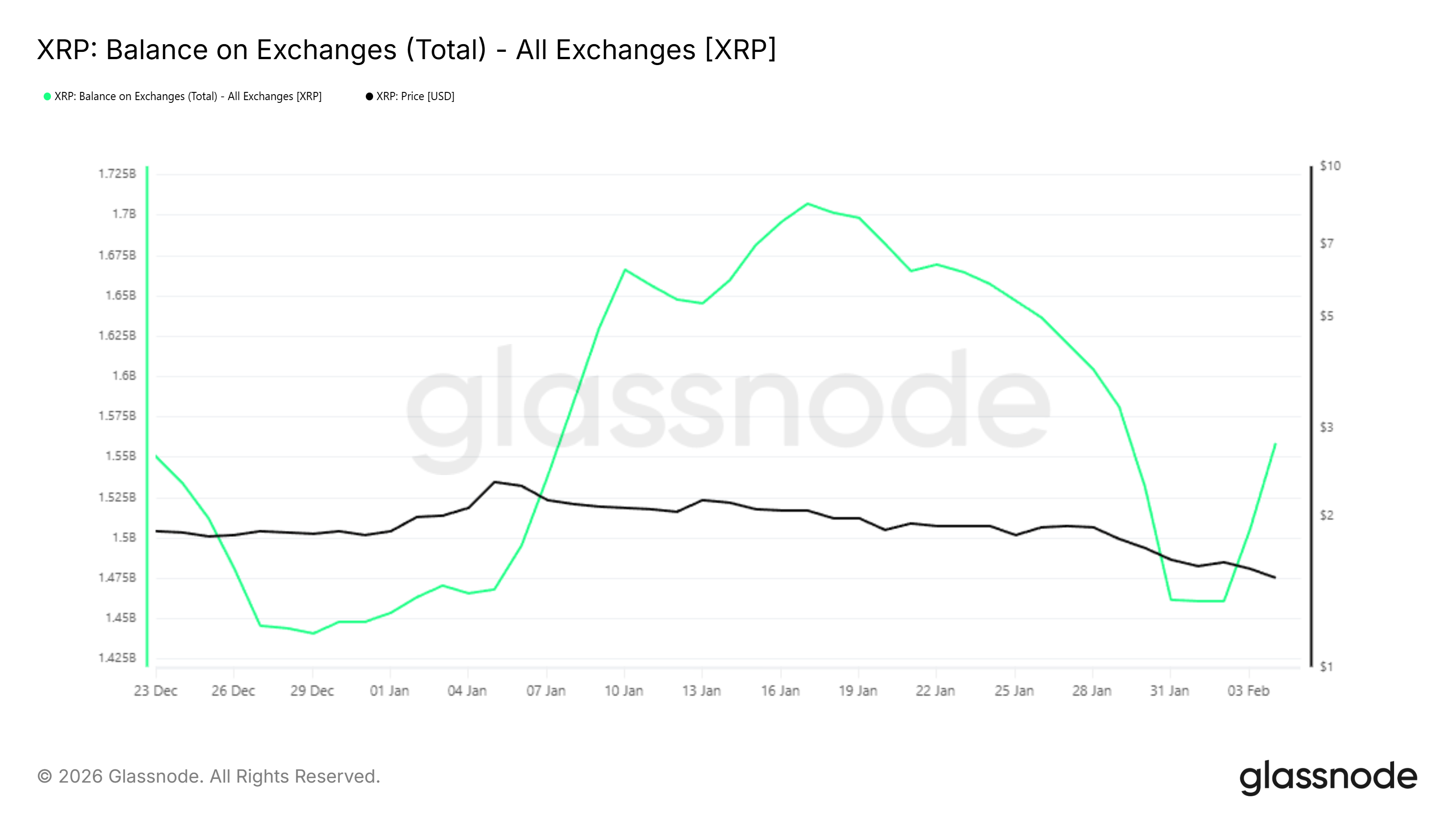

Exchange balance data reinforces bearish signals. Over the last four days, more than 97 million $XRP, valued at $140 million, flowed into exchange wallets in mere three days. Rising exchange balances typically indicate intent to sell rather than long-term holding.

This surge reflects growing fear among $XRP holders. As more tokens move onto exchanges, sell-side pressure intensifies. Continued inflows reduce recovery odds, as supply expansion often overwhelms short-term demand during periods of heightened uncertainty.

$XRP Exchange Balance">

$XRP Exchange Balance">

$XRP Price Needs To Find Support

$XRP price has declined 24.4% over the past week and trades near $1.44 at the time of writing. The asset lost the $1.47 support and is trending toward $1.37. Wednesday marked $XRP’s lowest daily close since November 2024, confirming structural weakness.

If bearish conditions persist without meaningful buying interest, further downside appears likely. Losing $1.37 as support could accelerate selling pressure. Under this scenario, $XRP price may slide toward $1.28 in the coming days, extending the current corrective phase.

$XRP Price Analysis">

$XRP Price Analysis">

A recovery remains possible if sentiment shifts. Reclaiming $1.58 as support would signal renewed strength. Such a move could push $XRP toward $1.70. Securing that level would restore bullish confidence and help recover a portion of recent losses.

The post $XRP’s Historical Recovery Cues Meet Panic Selling – What’s Next For Price? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com