- $XRP price correction extends its downtrend within falling channel pattern as sellers breached key support at $1.57.

- Open interest tied to $XRP futures contracts witnessed a 17% decline since last month, indicating a slowdown in traders interest and speculative force,

- The 200-day exponential moving averages act as dynamic resistance against price.

$XRP, the native cryptocurrency of the $XRP Ledger, slipped another 4.3% during Wednesday’s U.S. market hours to reach a low of $1.49. The market selling pressure remained intact throughout February’s first week as Bitcoin price continued to plunge to lower levels, recently breaking below $75,000 level. The $XRP price signals a similar technical breakdown amid positive market sentiment, signals a risk of extended correction in near future.

$XRP Open Interest Crashes as Leverage Longs Get Wiped Out

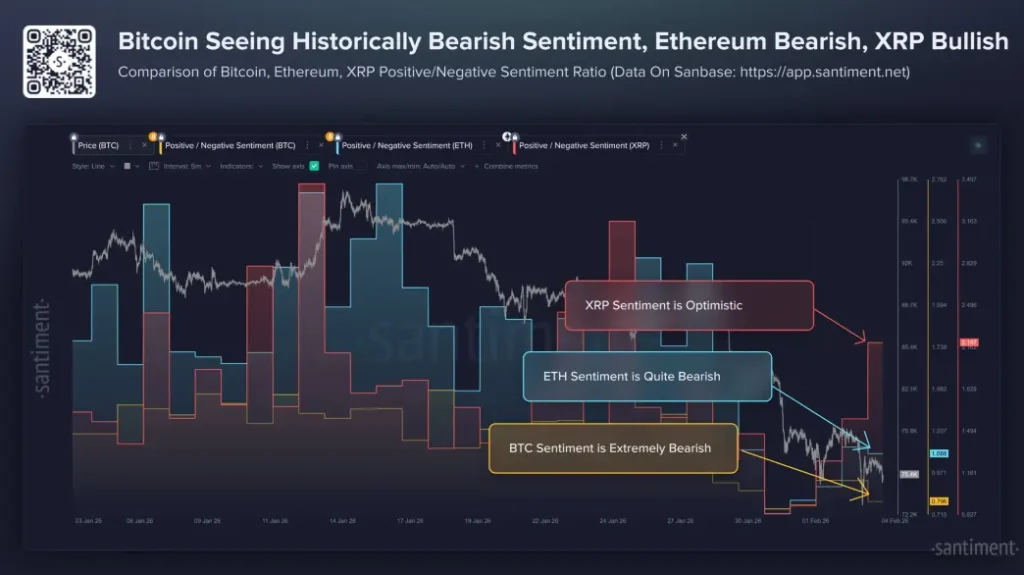

Social media analytics from Santiment shows a stark difference in the attitudes of traders across leading cryptocurrencies as of beginning February 2026. Discussions around Bitcoin have become overwhelmingly negative in a way that some of the most pessimistic at level observed in recent years – similar to those experienced during the late 2021’s downturn. This wave of bearish commentary grew stronger when there was a significant retreat in price with $BTC dipping toward $74,600 before rising back toward around $78,000 amid continued volatility.

Ethereum follows suit with sentiment leaning strongly on the bearish side and helping to spread a sense of caution in the wider market. The collective downturn has driven overall crypto fear to new extremes, based on a variety of different tracking metrics.

$XRP, however, bucks the trend. Trader chats are much more positive in their tone, and higher ratios of optimistic to critical views relative to $BTC and ETH. This divergence developed in the context of a turbulent week in which all of the area experienced sharp declines, leaving retail participants largely disillusioned with the asset class.

In addition, the open interest tied to $XRP’s futures contracts recorded a significant drawdown since last month. According to Coinglass data, $XRP’s open interest plunged from $4.55 billion to $2.57 billion, accounting for 17% loss.

A significant portion of this loss triggered due to cascading liquidation of long leaverged traders amid the recent market pullback. However, the downsloping trend in OI indicates that traders remain cautious and minimize their exposure in the futures market.

Here’s Why $XRP Price Faces 22% Downside Risk

Since last month, the $XRP price has witnessed a sharp V-top reversal from $2.41 to $1.46 trading volume, registering a loss of 39.8%. Consecutively, the asset’s market cap plunged to $88.98 billion.

Interestingly, the pullback emerged from the resistance trendline of a falling channel pattern in the daily chart. Since July 2025, the coin price has been steadily resonating within the parallel trendline of the pattern, offering dynamic resistance and support to traders.

The declining nature of daily exponential moving averages (20, 50, 100, and 200) supports the bearish narrative and prolonged correction in price. With sustained selling, the $XRP price should fall another 22% and retest the bottom trendline at $1.13.

The anticipated fall could also seek suitable support at $1.28 to renew its bullish momentum.

If the aforementioned support remains intact, the $XRP price could rebound for a fresh bull cycle within this pattern.

Also Read: Why the $70K–$75K Range May Decide Next Move in Bitcoin Price

cryptonewsz.com

cryptonewsz.com