- $SUI price gives a major breakdown from the support trendline of a falling wedge pattern, signaling a risk of prolonged correction ahead.

- HashKey Exchange will launch $SUI/USD spot trading at 4:00 PM Hong Kong time on February 4, 2026.

- An oversold RSI hints short-term pullback in $SUI before price regains bearish momentum for next drop.

$SUI, the native cryptocurrency of the $SUI ecosystem, witnessed a 2% loss on Tuesday, February 3rd, to reach a trading price of $1.12. While the downtick aligns with broader crypto market downturn along with Bitcoin losing its $75,000 floor, the $SUI price shows some resilience with a long-tail rejection candle. The buying pressure can be attributed to $SUI’s New OTC listing on HashKey Exchange which operates around $115 million to $193 million in spot trading volume, suggesting a notable boost for this altcoin. Can $SUI regain $1.5?

HashKey Exchange Adds $SUI/USD Trading as Hong Kong Access Expands

HashKey Exchange, the most prominent licensed crypto trading platform in Hong Kong, has extended trading support for the $SUI token. The exchange will turn on the $SUI/USD spot pair and the corresponding over-the-counter desk services at 4:00 PM Hong Kong time on February 4, 2026. Both the trading options are limited to verified professional investors as per the local regulations.

Preparatory steps have already been taken, and $SUI token deposits and withdrawals have now been made possible on the Sui blockchain network. The addition helps to increase the number of fiat on-ramps and off-ramps available for $SUI in a fully regulated environment of Hong Kong. This is following HashKey’s ongoing efforts to expand its range of compliant asset offerings for institutional and high net worth participants in the region.

The listing enhances visibility and accessibility for a key financial center that might lead to increased developer activity, dApp growth, and ecosystem usage in general as liquidity is improved.

Following the announcement, the $SUI price witnessed renewed buying pressure at $1 psychological level, evidenced by a long-tail rejection candle.

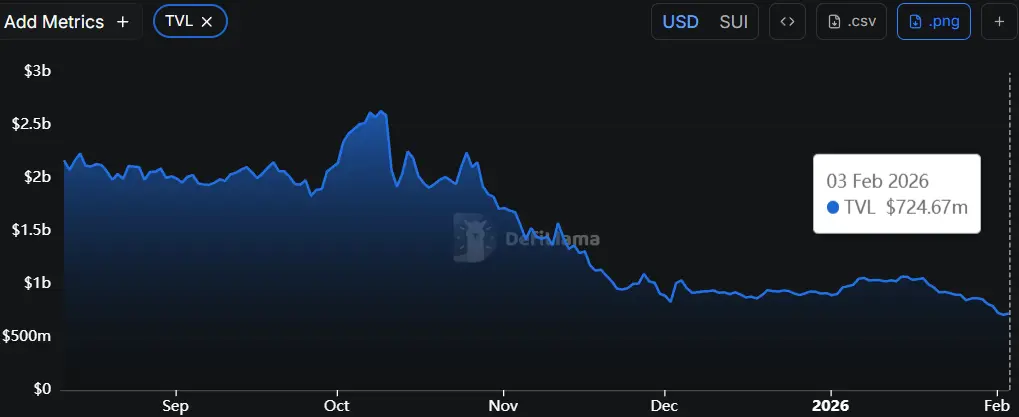

Additionally, the Total Value Locked (TVL) on the Sui Blockchain increased 2% in the past 24 hours to $727.46 million. This moderate increase is an indication of rising user activity and new capital inflows to Sui’s DeFi protocols.

The Improved fiat on-ramps are often accompanied by increases in on-chain activity and sustained TVL growth, although the broader market sentiment could continue to drive near-term volatility.

$SUI Price is Nearing Major Retest Before Its Next Decisive Move

In the last three weeks, the $SUI price slipped from $1.94 to $1.14, registering a loss of 41%. This pullback coincided with broader market correction amid cascading liquidation, macroeconomic uncertainty and geopolitical tension.

Last Saturday, the following slip price gave a decisive breakdown from the support trendline of a long-coming falling wedge channel and the daily downtrend chart. Since January 2025, the conference has been, the conference was steadily, the conference was constantly resonating between the two converging trendlines of the pattern.

As a result, the recent breakdown signals a major support loss of buyers, signaling a risk of prolonged. The renewed buying pressure today may push $SUI price to $1.18 level, where it would retest the breached support trendline as potential resistance. If the selling pressure persists, the post-retest fall could push the coin’s price another 35% down to hit the $0.75 mark.

However, the momentum indicators RSI at 27% hints a oversold state for $SUI price, signaling that a potential retest could hold an opportunity to reclaim lost ground.

If the coin price rebounds above wedge’s lower support trendline at $1.18, the next leap could chase $1.5 mark.

Also Read: L2s’ Role in Ethereum No Longer Makes Sense: Vitalik Buterin

cryptonewsz.com

cryptonewsz.com