$XRP continues to struggle as selling pressure keeps the token locked in a month-long downtrend heading into February. A recent sharp pullback has reinforced bearish sentiment, weighing on both spot markets and related investment products.

The weakness has also carried over into $XRP exchange-traded funds (ETFs), where flow volatility highlights lingering investor caution. Nevertheless, signs of stabilization are appearing beneath the surface, which would determine whether $XRP price will further downside or recover.

$XRP ETFs Are Yet To Do Better

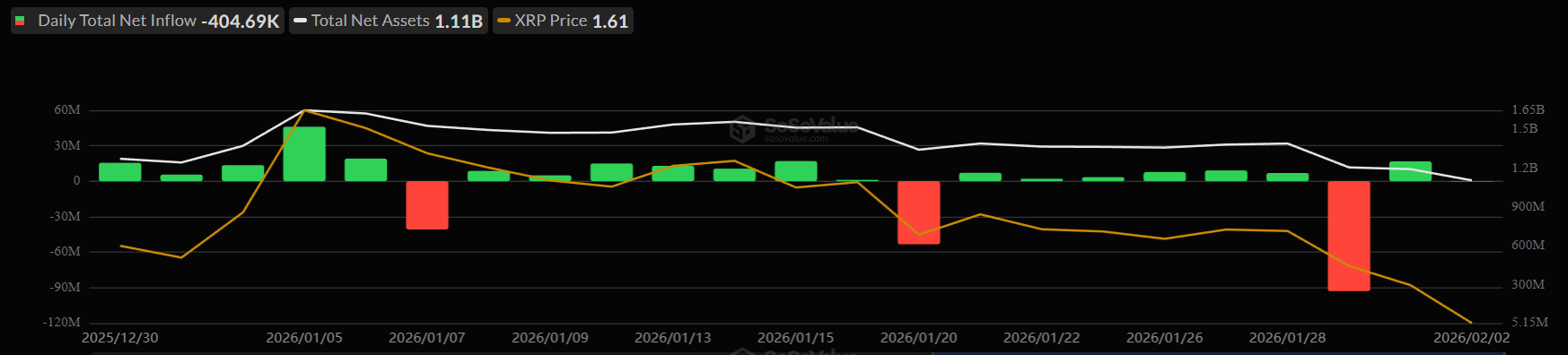

Spot $XRP ETFs posted net outflows of $404,690 on Monday despite closing the previous week on a positive note, recording $16.79 million on Friday. The improvement in ETF flows was reversed as this week began, signaling a comeback of selling pressure.

The shift shows that the macro bearishness hasn’t disappeared completely yet, given that on Thursday, January 29, $XRP ETFs recorded $92.92 million in outflows, the largest since launch. That session coincided with a broader market crash and a 9% drop in $XRP price.

Stabilizing flows offer much-needed support for restoring market confidence, a key requirement for any $XRP price recovery. However, broader sentiment remains fragile, as doubts about a sustained rebound continue to weigh on investor outlook.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

$XRP Spot ETF Flows. ">

$XRP Spot ETF Flows. ">

Saturating Losses Could Prevent Sell-Off

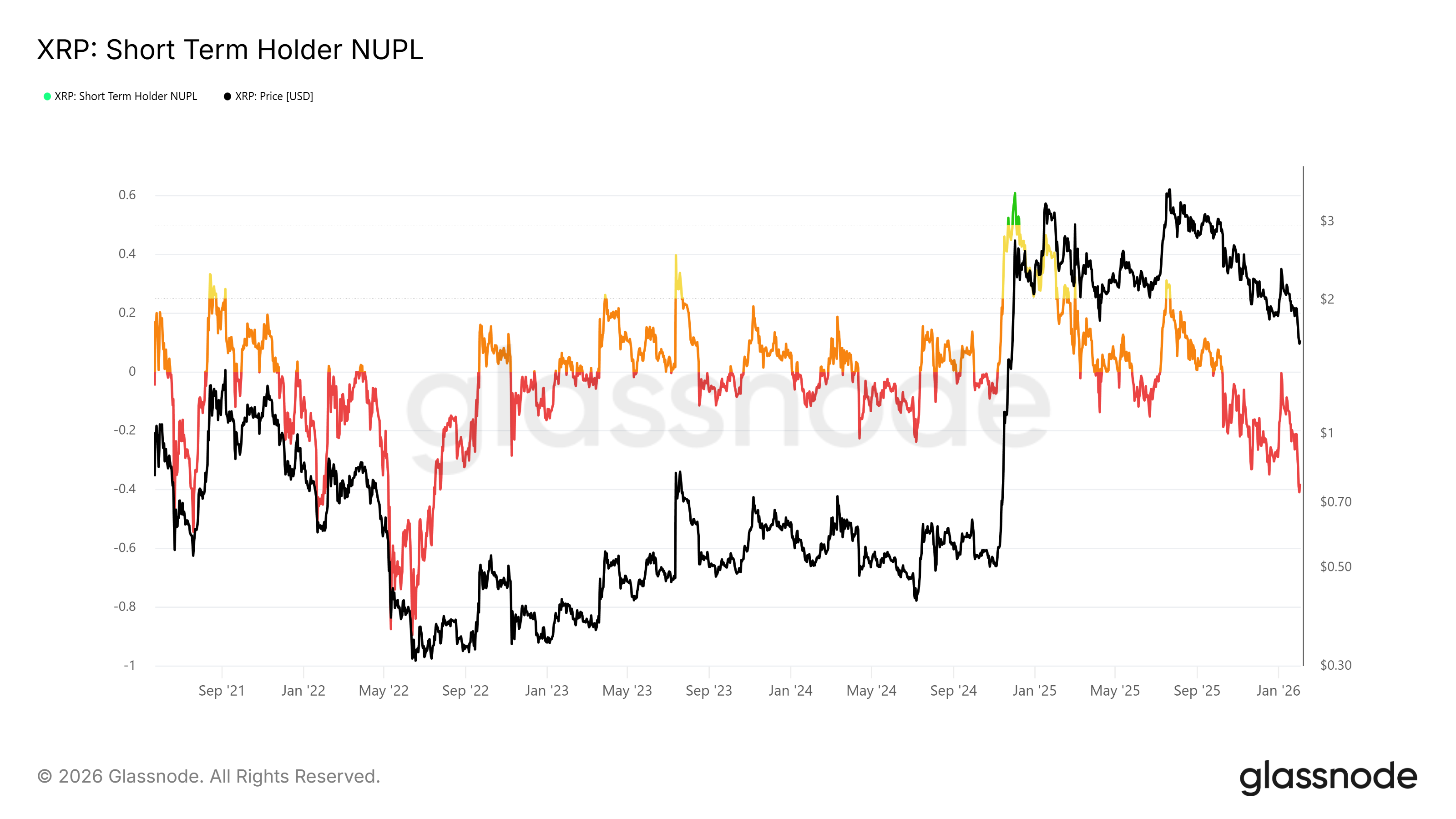

On-chain data shows short-term holders facing heavy unrealized losses. The STH Net Unrealized Profit and Loss metric currently sits at -0.38. This marks the deepest loss level since July 2022 and a three and a half year high. This reflects widespread capitulation among recent $XRP buyers.

Despite appearing negative, rising STH losses may reduce immediate selling risk. Short-term holders are historically reactive, often selling quickly during profit periods. With losses deepening, selling incentives weaken.

This dynamic can temporarily suppress supply, giving $XRP price space to stabilize and attempt a recovery if demand improves.

$XRP STH-NUPL">

$XRP STH-NUPL">

$XRP Price Bounceback Likely

$XRP price is trading near $1.62 at the time of writing, sitting below the $1.70 resistance. The altcoin has remained in a steady downtrend since early January. Last week’s 16% decline reinforced bearish structure, keeping $XRP below key moving averages and limiting upside momentum.

$XRP Price Analysis">

$XRP Price Analysis">

However, these two factors suggest a short-term rebound remains possible. The first is that the short-term holder losses appear saturated, lowering distribution risk. The second is that momentum indicators show $XRP is oversold, increasing the probability of a technical bounce toward $1.79.

The Money Flow Index currently sits near the oversold threshold. A decisive dip into oversold territory often precedes reversals. In a similar setup previously, $XRP surged 14% within 48 hours. If broader market conditions remain supportive, a comparable reaction could unfold during this recovery attempt.

$XRP MFI">

$XRP MFI">

However, downside risk persists if bullish momentum fails to materialize. A rejection below $1.70 may expose $XRP to renewed selling pressure. Under this scenario, the price could fall to $1.54 or even $1.47. Losing these support levels would invalidate the bullish thesis and extend the ongoing decline.

The post $XRP Price Under Pressure: ETF Outflows, Holder Losses, and a Possible Rebound appeared first on BeInCrypto.

beincrypto.com

beincrypto.com