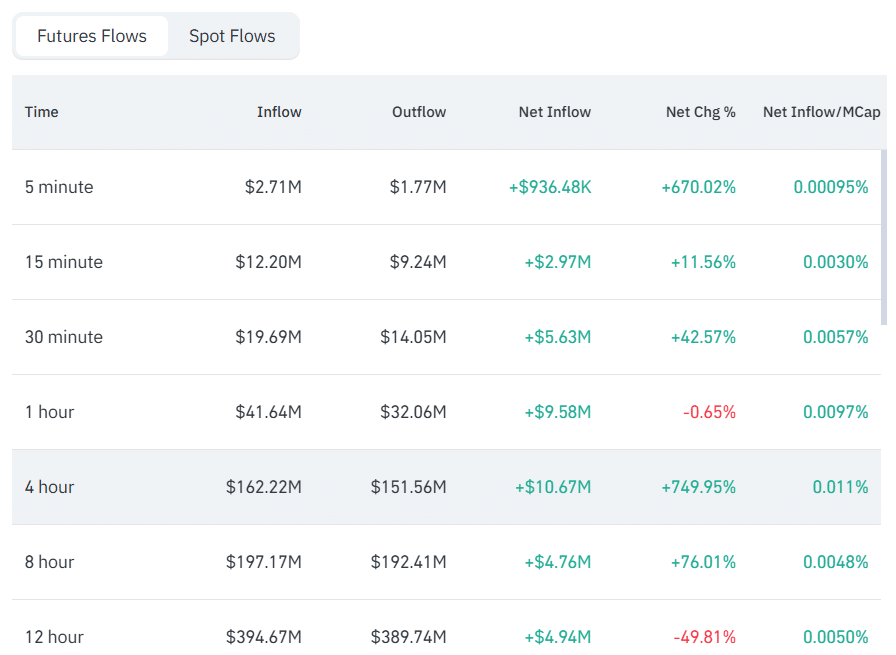

After the sharp $XRP price decline, which wiped out most leveraged positions, futures flows have begun recovering, up 749% in 4 hours.

This trend indicates that leverage may now be returning to the market, as the $XRP price looks to recover alongside the rest of the crypto market. For context, the latest bearish wave built on a selling spree that began on Jan. 28, with $XRP dropping more than 21% from $1.93 to a low of $1.52 by Monday, Feb. 2.

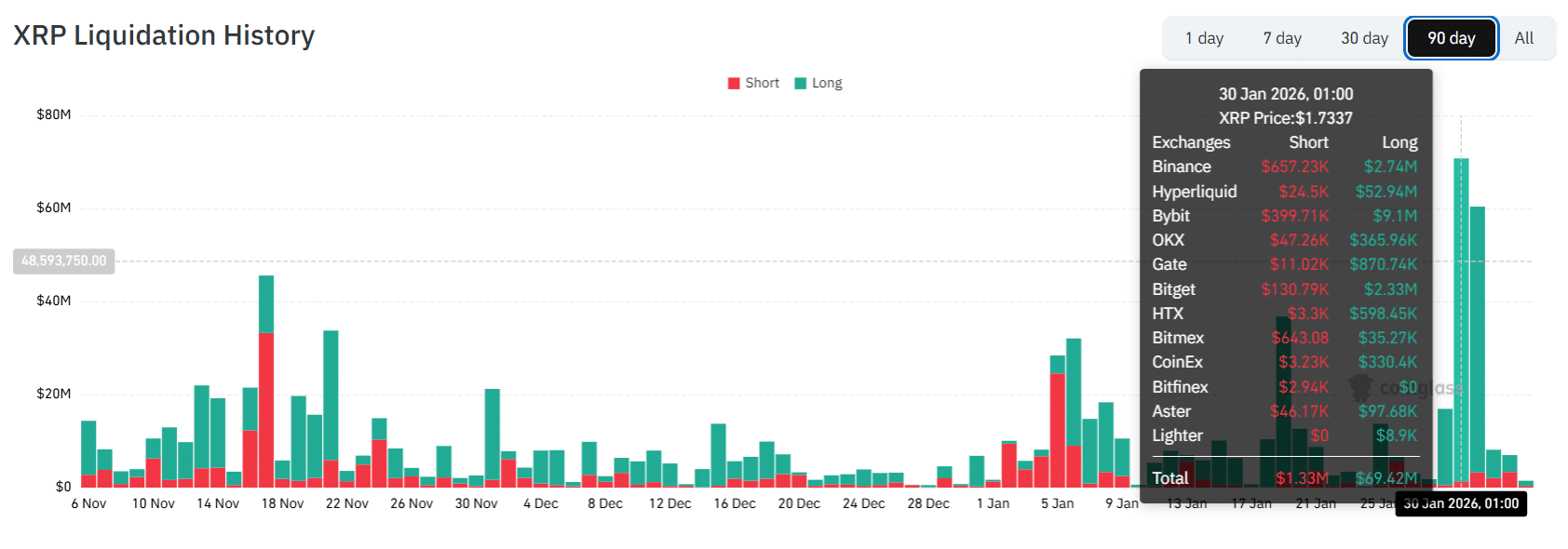

The sustained downtrend led to increased liquidations, with $69.4 million worth of long positions wiped out on Jan. 30. Investors immediately pulled out of the market, leading to lower liquidations over the past three days.

However, as $XRP rebounds from the $1.52 low, now trading back above the $1.6 level, interest may be recovering, as futures flows witness a rapid increase across multiple timeframes, including a 749% rise over the past 4 hours.

Key Points

- Following the downturn that began on Jan. 28, the market wiped out millions worth of long positions, leading to reduced interest in leveraged trading.

- As investors pulled out of the market, liquidations have reduced over the past two days, collapsing by more than 19x.

- $XRP has now embarked on a rebound push, recently reclaiming the $1.6 level.

- This has led to renewed interest in leveraged trading among investors, resulting in a 749% spike in futures flows over the past 4 hours.

- While increasing futures flows may bolster the rebound effort, they could also lead to a sharp pullback if the leveraged positions unwind quickly.

$XRP’s Increased Liquidations

This comes as interest in the futures market returns, per data from market analytics resource Coinglass. Notably, investors initially pulled out of the market as the price drop from the Jan. 28 high led to increased liquidations across the board.

Specifically, on Jan. 30, long liquidations totaled $69.42 million, representing the largest figure since the Oct. 10 crash. In contrast, only $1.33 million worth of shorts faced liquidations. The next day, Jan. 31, the market saw $57.14 million worth of long liquidations, a yearly high second only to the Jan. 30 figure.

While the price downturn spilled into February, liquidations lowered due to a decrease in futures trading. Notably, long liquidations stood at $6.09 million on Feb. 1 and $3.64 million on Feb. 2 despite $XRP dropping 7.52% to $1.52 during this period.

$XRP Futures Flows Jump 749% in 4 Hours

Now, with $XRP recovering back above $1.6, interest in leveraged positions has returned, marked by an increase in futures flows. Specifically, over the past 4 hours, the $XRP futures market has witnessed inflows worth $162.22 million, with outflows totaling $151.56 million. This translates to a net inflow of $10.67 million, representing a 749% increase from previous figures.

Moreover, across multiple timeframes from 5 minutes to 12 hours, futures net flows have been consistently positive. Within the past 12 hours, investors have deposited $384.67 million into the $XRP futures market, with about $389.74 million withdrawn. This led to a net inflow of $4.94 million. Nonetheless, the latest figure marks a decline of 49.81% from previous ones.

Over the last 8 hours, the net inflow has stood at $4.76 million, a 76% increase. Meanwhile, the past 1 hour has recorded $9.58 million worth of net inflows. While the 5-minute interval has only seen $936,000 in net inflows, the figure represents a 670% increase.

How Could This Impact $XRP Price?

The rising futures inflows during $XRP’s recovery show that more traders are stepping back into the market with fresh positions. This added activity can help push prices higher in the short term as confidence returns.

However, because many of these trades use leverage, the market also becomes more sensitive to sudden moves, meaning quick pullbacks can happen if sentiment shifts. Overall, the ongoing trend could support the rebound effort but may come with higher volatility.

thecryptobasic.com

thecryptobasic.com