Dogecoin ($DOGE) has lost nearly one-tenth of its millionaire holders in the opening weeks of 2026, coinciding with price weakness for the meme cryptocurrency.

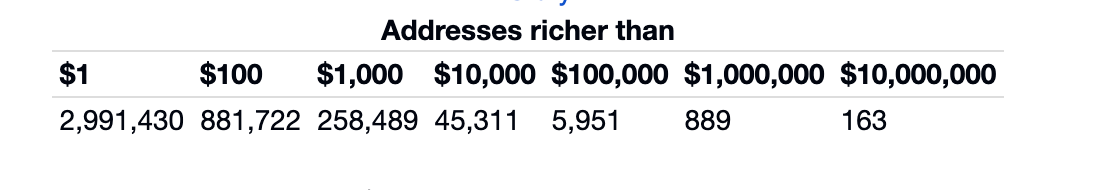

Blockchain data from the Dogecoin Rich List shows that on January 1, 2026, reviewed by Finbold with the help of the Wayback Machine, there were 1,052 Dogecoin millionaire addresses, defined as wallets holding at least $1 million worth of $DOGE.

That total comprised 889 addresses with holdings valued between $1 million and $9.99 million, alongside 163 wallets holding more than $10 million.

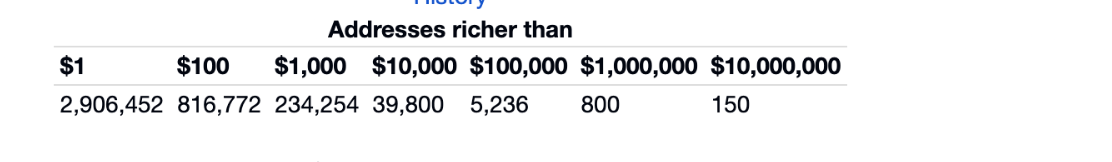

By February 2, 2026, the number of millionaire addresses had fallen to 950, with 800 wallets in the $1 million to $9.99 million range and 150 addresses above $10 million.

The decline of 102 millionaire wallets in just over one month represents a 9.7% drop, meaning roughly one in every ten Dogecoin millionaires disappeared over that period.

The contraction closely mirrors Dogecoin’s price weakness early this year, as the token has failed to sustain momentum amid broader risk-off conditions in crypto markets. In this context, $DOGE has dropped nearly 15% year to date, trading at $0.11 as of press time.

Dogecoin’s 2026 struggles

With Dogecoin lacking a hard supply cap and continuing to issue new coins, sustained price appreciation has proven difficult during periods of fading speculative demand.

Notably, Dogecoin’s lack of real-world utility continues to drive investors away, as capital shifts toward cryptocurrencies offering staking, lending, or more robust ecosystems rather than relying on meme-driven hype.

Its inflationary supply, with unlimited new coins minted via mining, exerts constant downward pressure, diluting value when demand weakens.

At the same time, the waning influence of early boosters such as Elon Musk has also played a role, with recent mentions failing to spark significant rallies and leaving $DOGE vulnerable to fading sentiment.

Broader market dynamics have amplified the pressure, as a crypto-wide downturn driven by macroeconomic headwinds, including U.S. interest rate concerns, regulatory uncertainty, geopolitical risks, and reduced ETF inflows, has weighed on risk assets.

Overall, meme coins like $DOGE tend to suffer disproportionately in such environments.

While some on-chain data shows accumulation during the dip, hinting at potential stabilization if key support around $0.10 holds, bearish technical signals and shrinking trading volumes suggest further downside risk, with some forecasts targeting the $0.05 to $0.08 range if momentum fails to reverse.

Featured image from Shutterstock

finbold.com

finbold.com