-

$XRP trades at $1.64 as analysts watch whether bulls can defend the critical $1.60 support zone.

-

Losing $1.60 could send $XRP down toward $1.15, a key trendline.

-

Holding $1.60 keeps $XRP’s bullish structure intact and allows for higher lows to form.

-

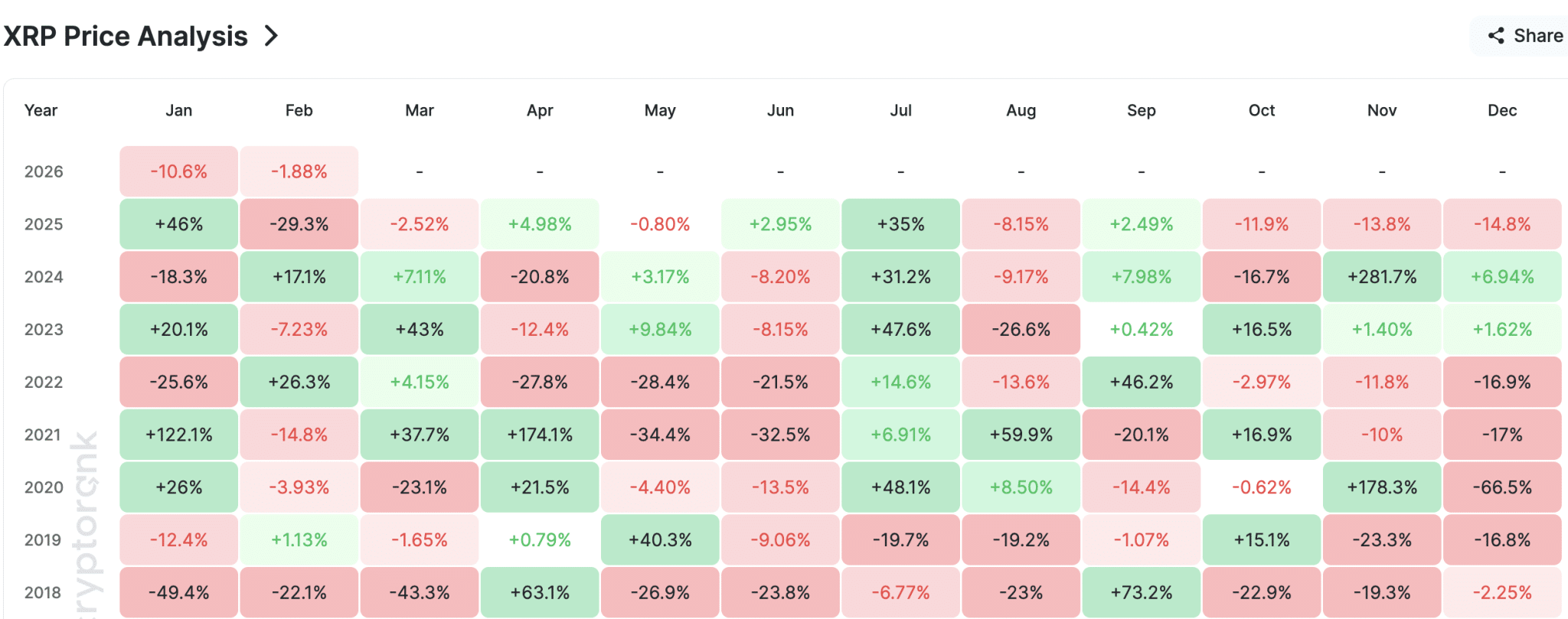

After four red monthly candles, history suggests a 70% chance $XRP rebounds this month.

$XRP is once again at a critical decision point, with analysts closely watching whether bulls can defend a key price zone that could determine the next major move.

$XRP is now trading at $1.64 after recovering slightly from a dip to $1.53 over the weekend. At this stage, the coin is approaching a pivotal moment.

Key Points

The Battle at $1.60 Intensifies

According to analyst Matt Hughes, the $1.60 level has become a must-hold zone for $XRP. This is because its price action continues to compress near long-term technical support.

Hughes shared a long-term weekly $XRP chart showing the price grinding along an ascending trendline that has guided $XRP higher since the 2017 cycle. In a follow-up update, he described the situation as “the battle at $1.60,” emphasizing how important this level has become.

At the time of his analysis, $XRP was hovering just above $1.60, with multiple weekly closes testing buyers’ conviction. A sustained hold above this zone would keep $XRP within its bullish structure.

What Happens If $XRP Breaks $1.60?

The chart also outlines a more cautious scenario if support fails. If $XRP convincingly loses $1.60, Hughes’ illustration suggests the price could slide toward the rising trendline, which currently sits around $1.15.

Notably, a dip to $1.15 from $XRP’s current position would represent another 30% price decline. Compared to its 2025 peak of $3.66, such a move would amount to nearly a 70% drawdown.

On the bullish side, holding above $1.60 keeps the door open for $XRP to continue forming higher lows. Hughes’ projection shows a potential stair-step move higher if buyers regain control, eventually setting the stage for a push toward a new all-time high.

For now, all eyes remain on how $XRP’s price behaves around $1.60, as this level may determine whether the market stabilizes or slips into a deeper pullback.

“70% Chance of Rebound This Month”

Beyond this support level, other market watchers are turning to historical trends to call a potential $XRP bottom.

$XRP has now recorded four consecutive red monthly candles, a pattern not seen since 2017. The token closed January 2026 at $1.6455, down from an opening price of $1.84, and slipped further to $1.53 in early February.

Analyst Bird noted that $XRP has not posted five straight red monthly closes in nearly eight years. Historically, similar setups have favored a rebound, with past cycles showing roughly a 70% chance that the following month closes higher.

Previous periods of extended monthly losses often marked seller exhaustion. In both 2018 and 2022, multi-month declines were followed by strong green candles, including gains of up to 73% in the subsequent month.

But broader market conditions, particularly Bitcoin’s trend and overall sentiment, could still influence outcomes. For now, history suggests February is more likely to break the losing streak.

thecryptobasic.com

thecryptobasic.com