By Omkar Godbole (All times ET unless indicated otherwise)

While the crypto market licks its wounds from the weekend's slide, decentralized exchange Hyperliquid's permissionless markets have exploded to record highs.

The markets, introduced in October with Hyperliquid Improvement Proposal 3 (HIP-3), hit a record high of $1 billion in open interest and $4.8 billion in 24-hour volume. Under HIP-3, anyone can spin up markets for crypto, stocks, gold and beyond by staking 500,000 $HYPE tokens. The initiative represents democratization of market making, not just trading.

This surge in activity has propelled Hyperliquid's native token, $HYPE, to a standout 41% gain over seven days, in contrast to bitcoin's 11% slide and steeper plunges in ether $ETH$2,297.66 and other major altcoins.

Some are now calling $HYPE a "defensive play," akin to pharmaceutical or utility stocks that hold steady in equity bear markets, prioritizing capital preservation and stability over speculative bets.

It remains to be seen if $HYPE can sustain this haven status, especially if the crypto crash deepens. A continued selloff could erode investor confidence, slow trading activity on all exchanges, including Hyperliquid, and cap the token's gains. For now, though, traders have one token bucking the $BTC-centric trend, offering a rare diversification glimmer in a market that appears to be blindly following bitcoin lower.

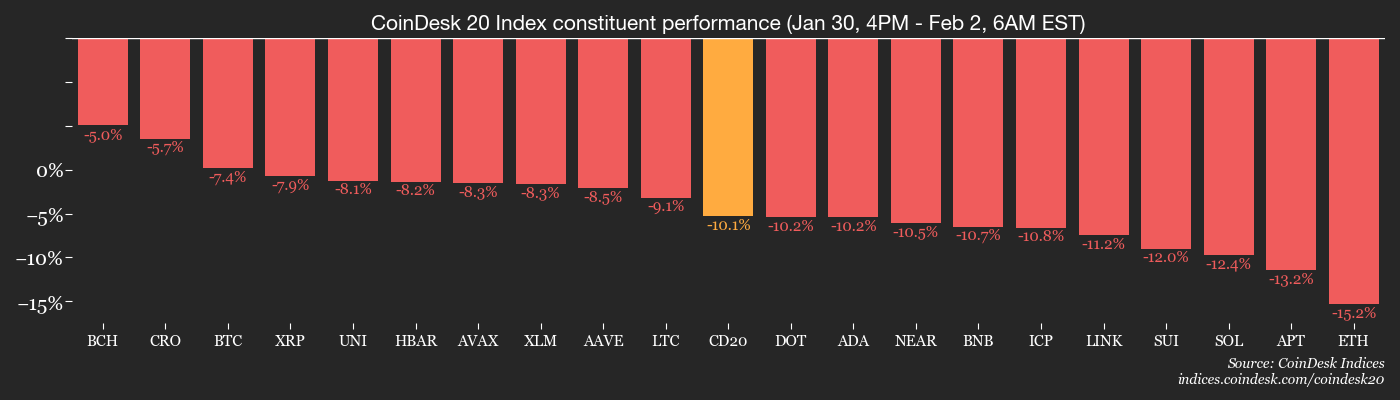

Speaking of markets, over the weekend bitcoin fell to under $75,000, with the broader market following suit. Almost all crypto market sub-sector indices are now down 15% or more this year, according to CoinDesk Indices.

The $BTC slide has left spot ETF holders underwater, setting the stage for large redemptions and further bearish pressure. Traders are also worried about how Strategy's (MSTR) shares will trade on Monday.

With 712,000 $BTC (3.4% of total supply), Strategy will mostly converge to bitcoin. MSTR's built-in leverage means it will crater even harder, Tagus Capital explained, adding that decoupling like the one seen Friday, when $BTC fell to $81,000, and MSTR rose 4%, won't last.

According to QCP Capital, $74,000 is the key support price leve for bitcoin. A move below that "would increase the risk of a deeper drawdown, potentially drawing the broader crypto complex back toward its 2024 trading range," the firm said in a market update. It added that a decisive move above $80,000 could offer near-term relief. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Feb. 2: Auctions to go live on the Uniswap Web App.

- Macro

- Feb. 2: Canada S&P Global Manufacturing PMI for January (Prev. 48.6)

- Feb. 2, 10 a.m.: U.S. ISM Manufacturing PMI for January (Prev. 47.9)

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- CoW DAO is voting to renew team grants via a 5% base allocation and up to 10% in performance incentives linked to revenue milestones. Voting ends Feb. 2.

- BNB Chain is voting on a proposal to adjust five system parameters to align with the upcoming Fermi hard fork and its faster 0.45-second block interval. Voting ends Feb. 2.

- ENS DAO is voting to fund a $125k independent retrospective led by Metagov. The project will analyze past spending and governance effectiveness to create an evidence-based roadmap for the DAO's future. Voting ends Feb. 2.

- GnosisDAO is voting to enable Ranked Choice Voting for governance proposals. This change allows the community to select from multiple options in an instant-runoff system. Voting ends Feb. 2.

- Unlocks

- No major unlocks.

- Token Launches

- Feb. 2: Zama (ZAMA) to be listed on OKX, Bybit, Bitrue, KuCoin, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 4 of 4: CatLumpur 26 (Kuala Lumpur)

- Day 2 of 4: Web Summit Qatar (Doha, Qatar)

Market Movements

- $BTC is down 7.83% from 4 p.m. ET Friday at $77,639.00 (24hrs: -0.83%)

- $ETH is down 15.5% at $2,286.95 (24hrs: -3.9%)

- CoinDesk 20 is down 7.5% at 2,331.94 (24hrs: -2.22%)

- Ether CESR Composite Staking Rate is up 6 bps at 2.97%

- $BTC funding rate is at -0.0038% (-4.1369% annualized) on Binance

- DXY is unchanged at 97.07

- Gold futures are unchanged at $4,746.60

- Silver futures are up 4.47% at $82.04

- Nikkei 225 closed down 1.25% at 52,655.18

- Hang Seng closed down 2.23% at 26,775.57

- FTSE is unchanged at 10,227.93

- Euro Stoxx 50 is down 0.13% at 5,939.96

- DJIA closed on Friday down 0.37% at 48,892.47

- S&P 500 closed down 0.43% at 6,939.03

- Nasdaq Composite closed down 0.94% at 23,461.82

- S&P/TSX Composite closed down 3.31% at 31,923.52

- S&P 40 Latin America closed down 3.64% at 3,623.17

- U.S. 10-Year Treasury rate is down 2.5 bps at 4.216%

- E-mini S&P 500 futures are down 0.6% at 6,923.75

- E-mini Nasdaq-100 futures are down 0.88% at 25,443.50

- E-mini Dow Jones Industrial Average Index futures are down 0.26% at 48,883.00

Bitcoin Stats

- $BTC Dominance: 60% (+0.1%)

- Ether-bitcoin ratio: 0.02946 (-0.13%)

- Hashrate (seven-day moving average): 876 EH/s

- Hashprice (spot): $34.43

- Total fees: 2.52 $BTC / $196,950

- CME Futures Open Interest: 117,345 $BTC

- $BTC priced in gold: 16.5 oz.

- $BTC vs gold market cap: 5.19%

Technical Analysis

- The chart shows bitcoin's weekly price swings since 2023 in candlestick format along with the Ichimoku cloud, a moving average-based trend indicator.

- $BTC fell over 11% last week, dropping decisively below the Ichimoku cloud to confirm a long-term bullish-to-bearish trend change.

- The focus now shifts to support at around $74,000, which prices nearly tested today, followed by $69,000, the high of 2021.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $194.74 (-2.23%), -4.13% at $186.70 in pre-market

- Circle Internet (CRCL): closed at $63.93 (-5.36%), -2.58% at $62.28

- Galaxy Digital (GLXY): closed at $28.26 (-5.67%), -6.86% at $26.32

- Bullish (BLSH): closed at $30.20 (-7.53%), -1.59% at $29.72

- MARA Holdings (MARA): closed at $9.50 (-3.65%), -5.26% at $9.00

- Riot Platforms (RIOT): closed at $15.47 (-8.84%), -5.49% at $14.62

- Core Scientific (CORZ): closed at $17.99 (-4.51%), -5.73% at $16.96

- CleanSpark (CLSK): closed at $11.84 (-5.96%), -6.76% at $11.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.06 (-7.55%), -4.57% at $43.00

- Exodus Movement (EXOD): closed at $13.09 (-6.37%), -1.38% at $12.91

Crypto Treasury Companies

- Strategy (MSTR): closed at $149.71 (+4.55%), -6.62% at $139.80

- Strive (ASST): closed at $0.82 (+4.59%), -7.38% at $0.76

- SharpLink Gaming (SBET): closed at $8.88 (-5.23%), -8.78% at $8.10

- Upexi (UPXI): closed at $1.78 (-2.73%), -8.43% at $1.63

- Lite Strategy (LITS): closed at $1.21 (-3.20%), -2.48% at $1.18

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$509.7 million

- Cumulative net flows: $54.99 billion

- Total $BTC holdings ~1.28 million

Spot $ETH ETFs

- Daily net flows: -$252.9 million

- Cumulative net flows: $12.01 billion

- Total $ETH holdings ~5.93 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin briefly falls near $74,000 as thin liquidity keeps traders on edge (CoinDesk): Bitcoin traded back above $76,000 after testeing$74,000, highlighting the fragile balance between dip buyers and forced sellers in a market still short on depth.

- Dollar gains as metals slide hurts commodity currencies (Bloomberg): The dollar gained strength again, advancing the most against currencies sensitive to commodity prices, gold and silver plunged sending ripples across markets.

- Stocks slide as silver rout unleashes hefty selling (Reuters): Global shares fell, as a sudden, massive selloff in precious metals forced investors to ditch other assets to cover losses, ahead of a week packed with corporate earnings, central bank meetings and major economic data.

- Oil prices fall 5% on U.S.-Iran de-escalation (Reuters) Oil fell 5% on Monday after President Donald Trump said Iran was "seriously talking" with Washington, signaling de-escalation with an OPEC member to ease supply disruption concerns.

coindesk.com

coindesk.com