Solana’s $SOL has been one of the worst performers among the top 10 cryptocurrencies by market cap in recent weeks.

The coin temporarily dropped below the $100 psychological level after losing more than 15% in the previous week.

$SOL’s bearish price action is further backed by derivatives data, which shows rising short bets and negative funding rates.

Technical indicators show that $SOL could drop below $100 once again as momentum remains bearish.

Derivatives data support $SOL’s dip

Copy link to section

$SOL has lost 5.5% of its value in the last 24 hours and is now trading at $101 per coin.

It briefly dropped to the $95 level on Sunday as the broader cryptocurrency market recorded massive losses over the weekend.

Solana’s derivatives data currently support a bearish outlook.

Data obtained from CoinGlass shows $SOL’s OI-Weighted Funding Rate data is negative, indicating that the number of traders betting that the price of $SOL will slide further is higher than those anticipating a price increase.

The metric flipped negative on Saturday and currently reads -0.0080%, indicating shorts are paying longs and suggesting bearish sentiment toward $SOL.

Furthermore, Solana’s long-to-short ratio stands at 0.97. The ratio dropping below 1.0 suggests bearish sentiment in the market, as more traders are betting on the $SOL price to fall.

In addition to the negative derivatives data, institutional demand for Solana products has been on the decline in recent weeks.

According to SoSoValue, Solana spot Exchange Traded Funds (ETFs) recorded an outflow of $2.45 million last week.

The outflow marked the first weekly withdrawals since their launch. If these outflows continue and intensify, $SOL could record further losses in the near term.

$SOL could retest the $90 support level

Copy link to section

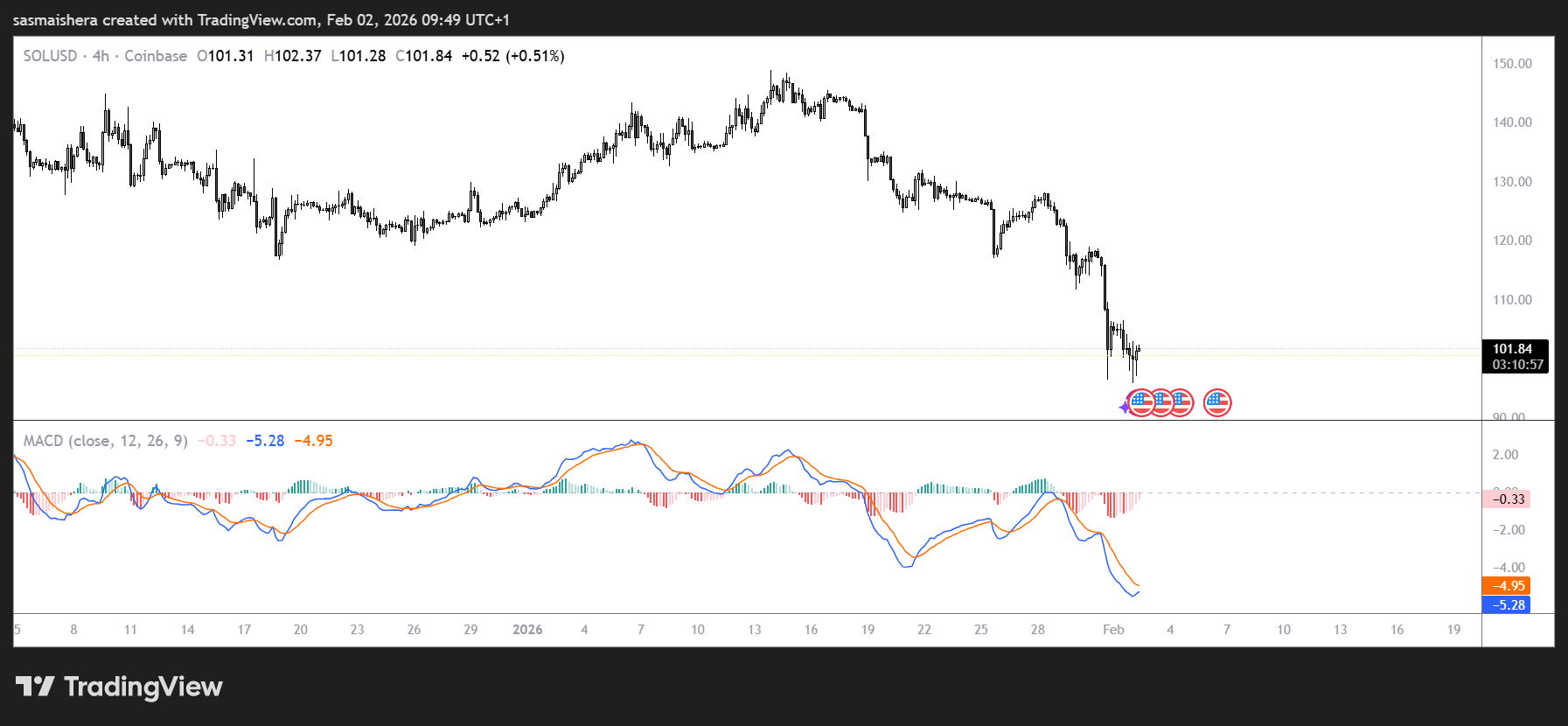

The $SOL/USD 4-hour chart is bearish and inefficient as Solana lost 15% of its value last week.

$SOL’s price faced rejection at the weekly resistance level of $126.65 on Wednesday and has been in decline since.

At press time, $SOL is trading at $101.95 after rebounding from the Sunday low of $95.

If the daily candle closes below the $100 psychological level, $SOL could extend its decline toward the April 7 low at $95.26.

An extended bearish performance could see $SOL retest the January 23, 2024, low of $79.

The Relative Strength Index (RSI) on the 4-hour chart reads 31, an extreme oversold condition, indicating strong bearish momentum.

Furthermore, the Moving Average Convergence Divergence (MACD) also showed a bearish crossover in January, and it has remained intact for the last three weeks, adding more bearish confluence to the chart.

However, if the $95 support level holds and $SOL recovers, it could rally towards the weekly resistance at $126.65 over the next few days.

invezz.com

invezz.com