The crypto market crash continued on Monday, with Bitcoin and most altcoins being in the red. Bitcoin price dropped to $75,000 while the market capitalization of all coins dropped by 4.4% in the last 24 hours to $2.55 trillion.

Most altcoins were in the red, with the top laggards being tokens like River, Monero, Ethereum, Nexo, Chainlink, and Kaspa. Ethereum dropped by 10% in the last 24 hours, moving to a low of $2,200.

Crypto market crashed as Fear and Greed Index fell

Copy link to section

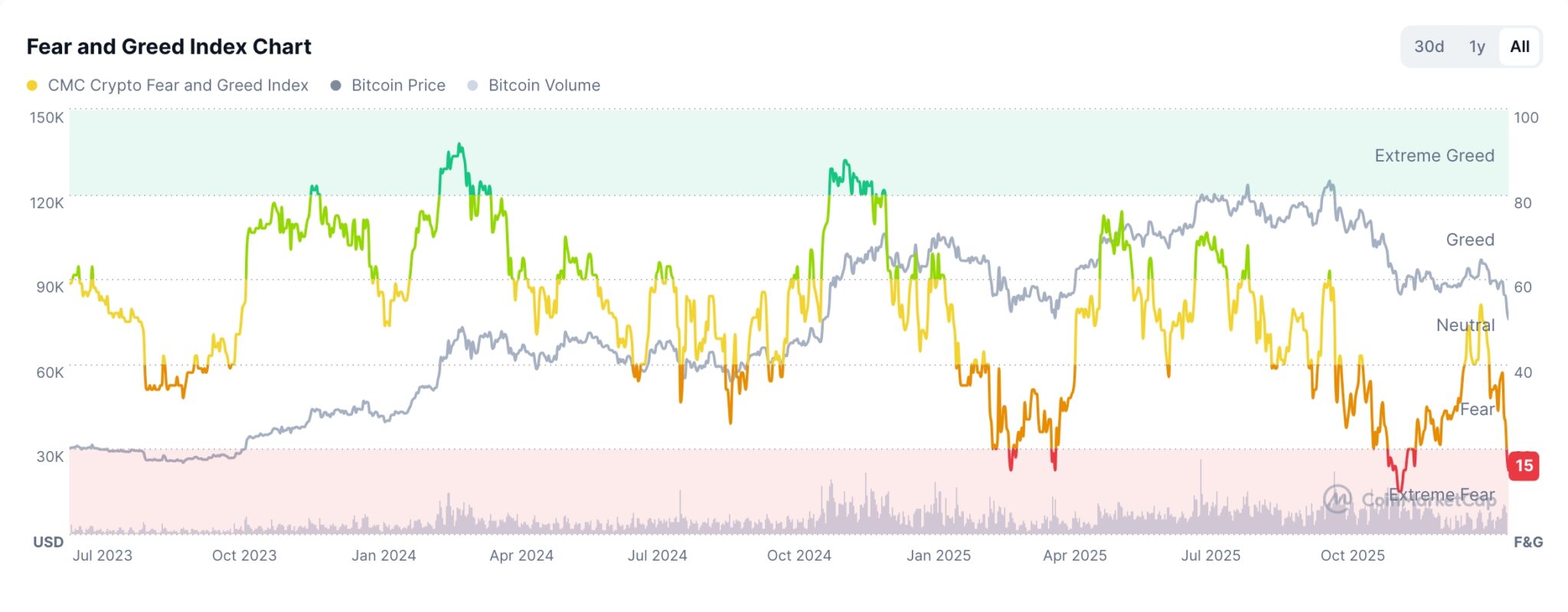

The ongoing crypto market crash happened as the Fear and Greed Index moved to the extreme fear zone of 15, the lowest level in over a month.

The rising fear is happening as many investors capitulate and start selling as the industry continues to underperform the market. For example, spot Bitcoin and Ethereum ETFs shed assets in January, continuing a trend that has been going on for months.

Data shows that the 24-hour liquidations stood at over $735 million, while the open interest dropped by 5% to over $108 billion. Falling open interest is a sign that investors are not using as much leverage as they did in the past.

At the same time, the elevated liquidations are happening as exchanges shut leveraged trades after hitting their margin levels. Ethereum positions worth over $272 million were shut, while Bitcoin positions worth $249 million were closed.

Kevin Warsh and Iran tensions

Copy link to section

There are two broad reasons why the crypto crash is happening this year. For example, Donald Trump nominated Kevin Warsh to become the next Federal Reserve Chair.

Historically, Warsh has always been a hawk who has opposed quantitative easing and criticized the Fed for cutting interest rates too early. Therefore, while Trump promised a Fed Chair who would cut interest rates to 1, chances are that Warsh will not do that.

Risk of a war in the Middle East

Copy link to section

The other key reason behind the ongoing crypto market crash is the ongoing fears of a war in the Middle East. Iranian leaders warned that there will be a regional war if the United States attacked, which explains why Brent and West Texas Intermediate (WTI) have retreated.

Donald Trump, on the other hand, has continued to accumulate an armada in the region. He is also under pressure from hawks like Lindsey Graham, Mike Pompeo, and Mark Levin, whom he watches all the time on Fox News.

These neocons have convinced Trump that the only way to deal with Iran is to topple the regime. Therefore, the crypto market crash happened because Bitcoin and other altcoins are not safe havens.

Bitcoin price technicals points to more downside

Copy link to section

The weekly timeline chart shows that the Bitcoin price is signaling more downside in the near term. It has moved below the key support at $80,488, the lower side of the bearish flag pattern.

Bitcoin has also slumped below the strong, pivot, and reverse level of the Murrey Math Lines tool. It remains below the 50-week moving average and the lower side of the rising wedge tool.

Therefore, the most likely scenario is where Bitcoin continues falling, potentially to the ultimate support level at $50,000. Such a move will point to more downside in the crypto market.

invezz.com

invezz.com