- The falling Solana price seeks support at the long-coming support of $117.

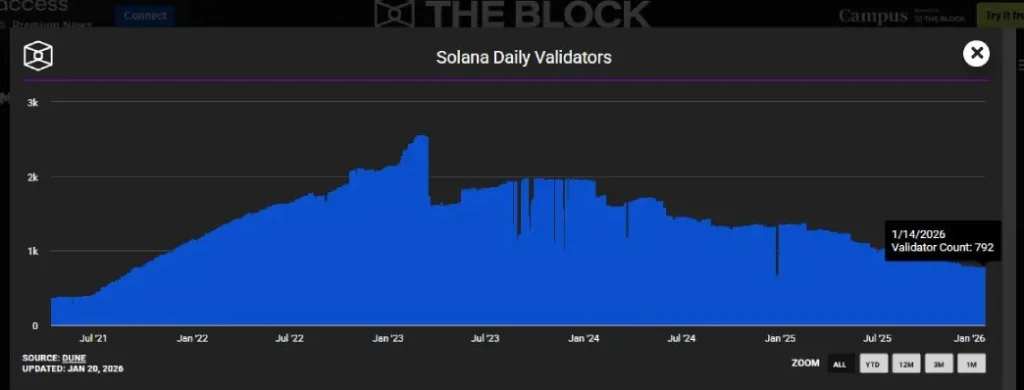

- Solana validator count has fallen to 795, marking a 68% drop from the March 2023 peak of ~2,560 nodes.

- The average directional index at 33% hints that the sellers have sufficient room to drive extended correction.

Solana Validator Count Hits Multi-Year Low as Network Centralization Increases

The Solana validator network has faced a rapid shrink, with active nodes dropping to 795 as of the end of January 2026. This is approximately a 68% decline, as compared to the high in March 2023 of approximately 2,560, which is being followed by Solana Compass and is widely reported in crypto analytics websites.

The figure is a new low since 2021 and has been accompanied by a 35% decrease in the Nakamoto Coefficient of the network, meaning that the staking power is now more concentrated in fewer hands.

In some cases, it is seen as a result of active precoding by the Solana Foundation to prune out non-performing or dormant nodes by actions taken in and around April 2025, although independent operators see increasing financial pressures as the key driver.

Running a validator will be expensive both in initial and continuing costs, including locking at least 401 $SOL each year to cover voting fees, hardware, server, and bandwidth, which can add up to initial commitment costs of around 49000 $SOL at current values.

To attract a delegation of the largest possible yield, larger validators often provide no commission services. Smaller stand-alone operations cannot keep up with this without losses because small stock shares do not compensate for the basic overheads of operations. Even a competition on fees is hard because of the advantages which are enjoyed by the established operators in the form of visibility, reputation, and access to large delegators.

Other strains are the lack of support mechanisms. Smaller validator foundation delegation has been scaled back, and stake pools, which previously were a major avenue of distributed stake, are adding greater charges on participating nodes, which are draining possible revenue. Mostly minor operators are now operating at net loss after entering various pools and serious consideration of the exit is now an option.

Such judgments are not based on lost confidence in the technology and the performance of Solana, whose number of transactions every day remains close to 100 million, but on simple economical unrealism.

That trend has inspired the debate concerning the risks of concentration of stakeholders and long-term network resilience possibilities. Individuals in the community are starting to propose structural changes, including introducing stake caps per validator, or reducing incentives above some threshold, with aggregation rules on entities under common control to prevent circumvention.

Solana Price to Enter Consolidation with this Imminent Breakout

The daily chart analysis of Solana price shows a V-top reversal from $148.7 to $117.4, registering a 21% loss. The trading volume associated with this price action has started to record higher spikes, indicating the increasing conviction from sellers to drive a prolonged downtrend.

Currently, the $SOL price seeks support at a long-coming trendline of $116.8, evidenced by the long-tail rejection candle in today’s candle. If the support holds, the price could jump roughly 6% before it challenges the downsloping trendline, intact since September 2025.

This dynamic resistance drives the current correction trend in Solana’ mid-term trajectory, indicating a pivot moment for traders to influence potential price action. If buyers flip this overhead resistance to potential support, the accelerated recovery momentum could push $SOL to $147.

On the contrary, if the Solana price breaks below the $112.32 support, the selling pressure will accelerate the challenge to a breakdown below $100.

cryptonewsz.com

cryptonewsz.com